Following a notably profitable month, Shiba Inu (SHIB) appears to be experiencing selling pressure, causing its price to decline and retreat to levels seen before its gains.

Despite approaching the key resistance zone of $0.000001, SHIB fell short and experienced a series of losses, pushing it further away from this mark.

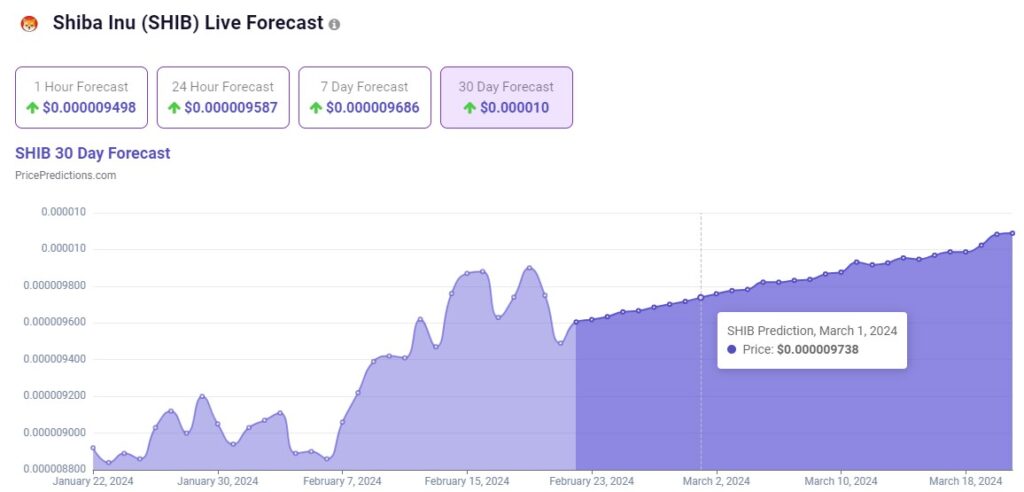

To assess the likelihood of overcoming this resistance zone in the coming days, Finbold utilized machine learning algorithms from PricePredictions to forecast the potential price of this cryptocurrency at the start of the following month.

Picks for you

SHIB price forecast

According to the algorithms, the projected price for SHIB is expected to increase to $0.000009738 by March 1, marking a gain of 2.86% from the current level of Shiba Inu price of $0.000009475 at the time of writing.

However, looking further into March, algorithms expect a $0.00001 threshold to be achieved on March 19, a level that hasn’t been achieved since the start of 2024.

A spike in SHIB transactions might indicate a price surge in Shiba Inu

Significant amounts of Shiba Inu tokens have been transferred by anonymous holders in the past few hours, according to data provided by on-chain data aggregator Arkham Intelligence. Arkham noted a collective movement of almost 20 billion SHIB.

This coincided with Shibarium hitting a new peak in daily transfers and experiencing fluctuations in SHIB’s price. The layer-2 blockchain has witnessed a remarkable surge in daily transaction volume, with today’s count surpassing four million and reaching 4.21 million transactions.

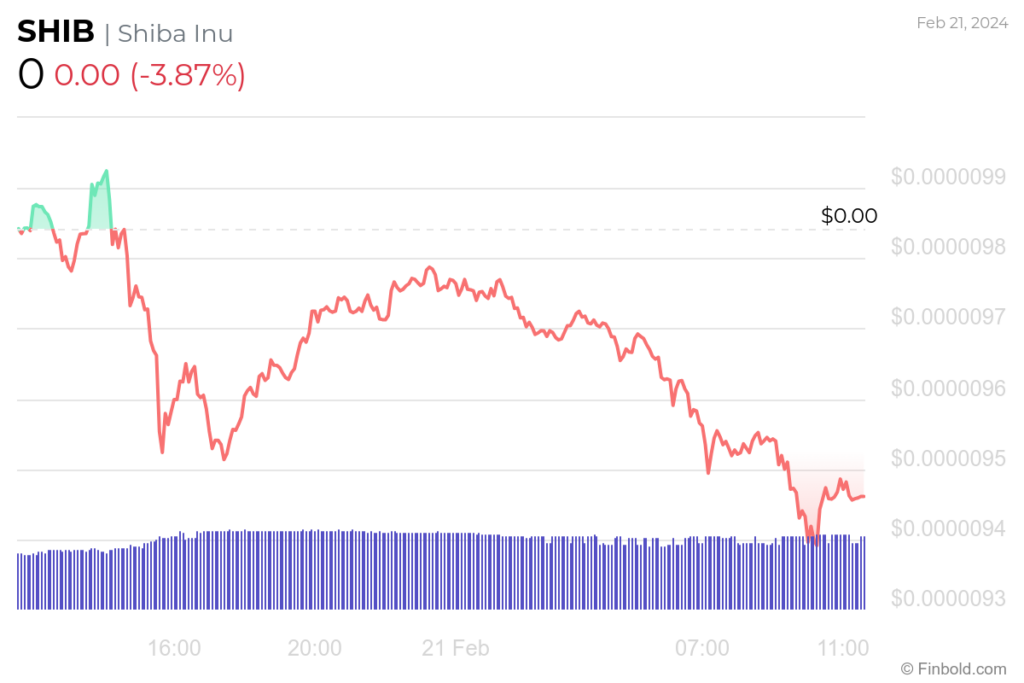

Shiba Inu price chart

At the time of press, the SHIB price today shows that the meme coin is trading at $0.000009462, reflecting a decrease of -3.87%. This follows a loss of -1.85% over the past week, in contrast to gains of 4.00% over the previous 30 days.

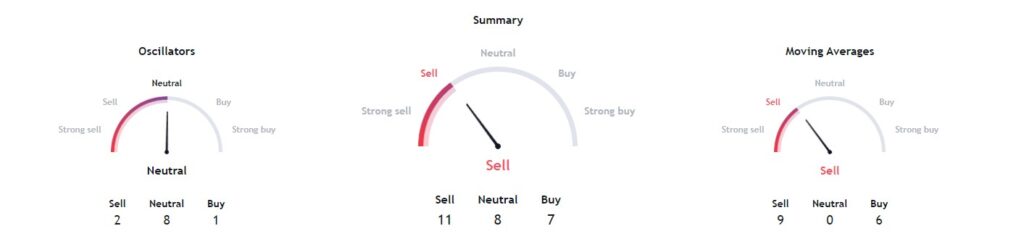

Despite a notable increase in daily transactions and deposits on major crypto exchanges, technical indicators for SHIB are leaning towards a ‘sell’ rating at 11 evaluations.

Moving averages from 9 indicators suggest a ‘sell,’ while oscillators indicate a ‘neutral’ rating in 8 cases.

Whether SHIB meets algorithmic predictions or succumbs to bearish technical indicators largely hinges on investor support during this period.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.