Despite her earlier arguments that it should be a law preventing members of the United States Congress from trading stocks while in office, Representative Marjorie Taylor Green has recently filed up to $340,000 worth of stock market trades – while being sworn in office.

Specifically, Taylor Greene has revealed purchases of Nestlé (OTCMKTS: NSRGY), NextEra Energy (NYSE: NEE), Crowdstrike (NASDAQ: CRWD), Costco (NASDAQ: COST), US Treasury Bills, ASML Holdings (NASDAQ: ASML), and Lululemon (NASDAQ: LULU).

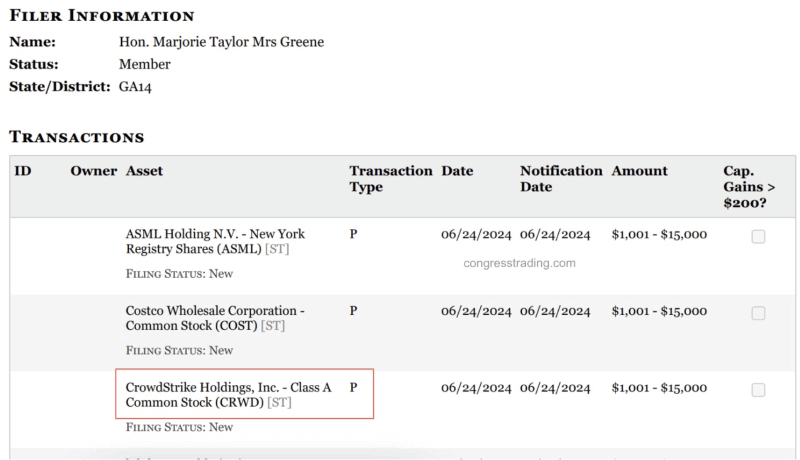

Among these sales, the Congresswoman has purchased up to $15,000 worth of ASML shares, up to $15,000 in COST stocks, and up to $15,000 in CRWD stock, according to information shared by two platforms monitoring politician and insider trades, Insider Tracker and congresstrading.com, in recent X posts.

As per Quiver Quantitative data, her other purchases include up to $250,000 in US Treasury bills, $15,000 in LULU, $15,000 in NEE, and $15,000 in NSRGY stocks, in addition to already holding a number of other, mostly technology-focused shares.

Marjorie Taylor Greene vs. Nancy Pelosi

Interestingly, one of the stocks bought by Taylor Greene, a Republican, specifically that of cybersecurity firm Crowdstrike, is also one of the major positions of Nancy Pelosi, a former House Speaker, leader of the House Democrats for 20 years, and a revered stock trader.

That said, Greene’s purchase of CRWD shares might be a conflict of interest, as she is a member of the Subcommittee on Cybersecurity, Information Technology, and Government Innovation under the House Committee on Oversight and Accountability, possibly giving her access to direct knowledge of the insider information.

Earlier in May 2024, Representative Taylor Greene had also submitted a regulatory filing that revealed purchases of Advanced Micro Devices (NASDAQ: AMD), Apple (NASDAQ: AAPL), Caterpillar (NYSE: CAT), Charles Schwab (NYSE: SCHW), Kinder Morgan (NYSE: KMI), and Southern Company (NYSE: SO).

On top of that, MTG owns some Goldman Sachs (NYSE: GS), Home Depot (NYSE: HD), The Hershey Company (HSY), Microsoft (NASDAQ: MSFT), Qualcomm (NASDAQ: QCOM), Intel (NASDAQ: INTC), Procter & Gamble (NYSE: PG), and others, purchased recently and in prior years, despite her original stance on stock trading in Congress.

When asked in early January about her stock trading activities revealed by the market analysis watchdog Unusual Whales, the Congresswoman said that she didn’t “even own any stocks, and I haven’t all of 2023,” adding that the reports could be referring to her son’s account.

Is it illegal for legislators to trade stocks?

As a reminder, it is technically illegal for legislators to buy and sell stocks based on nonpublic information, and in 2012, President Barack Obama signed the STOCK Act, banning members of Congress from trading based on details obtained through their work.

However, as long as they report a trade in 45 days, they can trade as much as they want, even if the bills they pass or reject could influence a company’s performance and, with it, the price of its shares, allowing the politicians to make a substantial profit.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.