Recent alterations in the stock portfolio of United States investor and hedge fund manager Michael Burry, who famously predicted the 2008 housing market collapse, could signal the next trajectory for the economy.

In an analysis shared by Game of Trades in a post on X on July 26, Burry has been offloading a significant share of his stake in big technology companies. Specifically, Burry has sold approximately $50 million worth of his stock portfolio in a significant shift.

In the first quarter of 2024, Burry offloaded substantial positions in major US tech companies, including Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOGL), and Oracle (NYSE: ORCL). These three stocks alone constituted around 15% of his portfolio in 2023. The selling spree suggests that Burry has a pessimistic outlook for the US economy, especially regarding high-valuation tech stocks.

“Michael Burry has gone on a Big Tech selling spree. This is a MAJOR warning signal for the economy. <…> In 2024, Burry has been on a selling spree, offloading some of his largest holdings,” the platform noted.

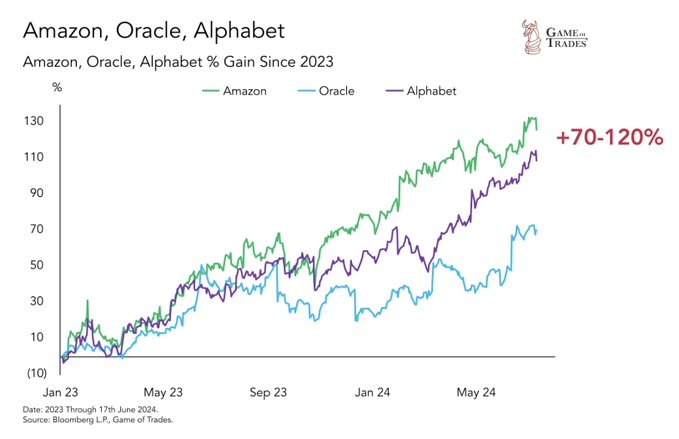

In the backdrop of this transaction, the US tech sector has experienced remarkable gains since the start of 2023, with some large-cap companies appreciating between 70% and 120%.

According to Game of Trades, tech stocks are trading at their highest valuations in over 20 years, reminiscent of the Dot-Com bubble in 2000. The price-to-earnings (PE) ratio for US tech stocks now stands at 30, meaning investors are paying $30 for each dollar these companies earn. The average PE ratio for US stocks today is around 15, making tech stocks twice as expensive as other businesses.

Burry’s sales of Amazon, Alphabet, and Oracle come amid significant valuation increases. Oracle’s PE ratio has risen from 25 to 38, and Alphabet’s from 19 to 28, making these stocks particularly expensive. This move suggests that while Burry may not be entirely bearish on US tech, he believes their current valuations are too high compared to other investment opportunities.

Betting on Chinese market

Interestingly, Burry has redirected his investments towards Chinese tech firms in a notable pivot. He has significantly increased his holdings in JD.com, Alibaba Group, and Baidu Inc., now owning about $23 million in these companies.

This shift appears to be driven by the relative cheapness of Chinese stocks compared to their US counterparts. Chinese stocks are currently at their lowest valuations relative to US stocks in over 15 years, reflecting significant pessimism around the Chinese market. Burry is betting on a potential turnaround, similar to trends seen in previous years.

Burry’s strategic shift highlights his keen eye for identifying key risks and opportunities from an investment and economic standpoint. His recent moves indicate a cautious approach towards the inflated valuations of US tech stocks while simultaneously betting on the undervalued Chinese market.

Notably, in recent months, US stocks have rallied significantly, led by the tech sector, which has dominated the S&P 500 index. Some analysts note this valuation could signal a possible collapse ahead, potentially leading to a recession.

Already, key sector leaders such as Nvidia (NASDAQ: NVDA) are battling bearish sentiments after months of dominance and record rallies.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.