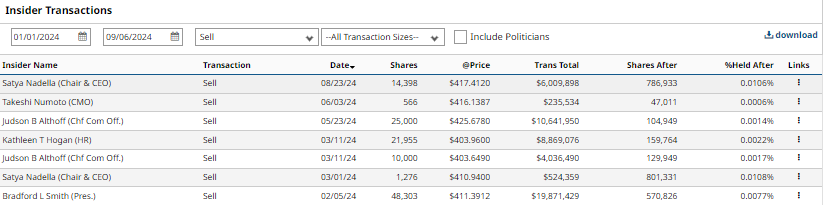

Although members of the “Magnificent Seven” and their stocks have experienced notable insider trading activity in 2024 due to a stock market rally, Microsoft (NASDAQ: MSFT) has been a notable exception, with only seven sales this year.

However, August 23 saw a deviation from this trend. Microsoft’s CEO, Satya Nadella, offloaded 14,398 MSFT shares at an average price of $417.41 per share for a total profit of just above $6 million.

This transaction marks only the second time Microsoft’s CEO has sold his company’s stock in 2024. A previous transaction was recorded on March 1, when he sold 1,276 shares for a $524,358 profit.

Several factors, including portfolio diversification, tax-related obligations, or a prearranged 10b5-1 trading plan could have influenced Nadella’s recent sale.

Traders will also be watching to see whether this signals his belief that Microsoft’s stock is nearing a short-term peak, given the current market conditions and the “September Effect.” While insider sales do not necessarily indicate a negative outlook, they can sometimes reflect executives’ perspectives on the stock’s near-term valuation.

Other insider sales of MSFT stock in 2024

In addition to Nadella, other higher executives have offloaded part of their holdings during 2024.

Recording the same number of transactions, software company’s Chief Commercial Officer (CCO) Judson Althoff sold his MSFT stock holdings on two separate occasions, with a transaction of 10,000 shares on March 11 and 25,000 shares on May 23, for a total profit of $14.6 million.

Microsoft’s most profitable insider sale occurred on February 5, at the start of the year, when Brad Smith, its President, offloaded 48,303 shares worth $19.8 million.

Other insider sales include Kathleen Hogan, Chief human resources officer of Microsoft, who sold 21,955 MSFT shares on March 11 for a profit of $8.8 million, and Chief Marketing Officer (CMO) Takeshi Numoto’s sale of 566 shares on July 3, for $235,534 profit.

The combined sales of all insiders at this blue-chip company amount to $50 million, which is considered small compared to other S&P 500 leaders, such as Nvidia (NASDAQ: NVDA), whose CEO Jensen Huang alone sold more than $500 million of NVDA shares since May.

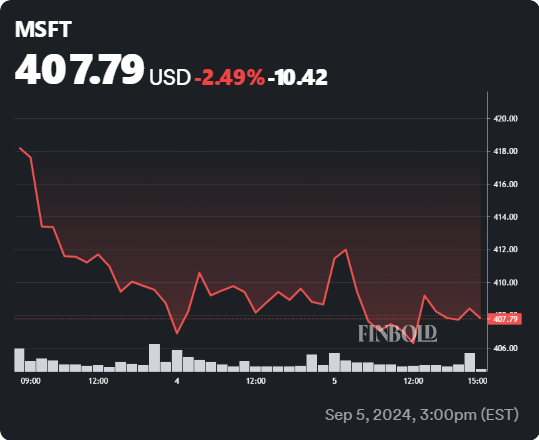

Microsoft stock price chart

During the past eight months, which saw rare insider trading activity, MSFT stock has recorded a 10.12% gain since January 1, trading above the $400 threshold for most of the time.

Latest trading sessions saw a 1.53% decrease, with the trend continuing in the September 5 trading, shedding 0.12% of MSFT share value and causing its price to close at $408.39.

Although insider sales can harm a specific stock’s price, the sales from Microsoft’s higher executives have been too small and far apart to significantly affect the MSFT share price.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.