Solana (SOL) was one of the top-performing cryptocurrencies during this cycle, attracting retail and institutional interest due to its network scalability and transaction efficiency. Finbold selected two promising Solana competitors to consider for the second half of 2024.

Notably, SOL had an impressive 19,873% rally in 2021 and another remarkable recovery from the 2022 bottom. In the previous bull market, Solana went from $1 to $260 in less than 12 months. Later, it made from $8 to $204 in one and a half years, currently trading at $140 per token.

Solana positioned itself as a strong competitor to Ethereum (ETH), the leader in Web3 and decentralized finance (DeFi). In particular, the network offers a much higher throughput measured by transactions per second (TPS), faster confirmation, and cheaper fees.

Now, two Solana competitors have been silently building high-throughput networks to address a similar demand. From a technology perspective, these two cryptocurrencies thrive with a highly scalable, efficient, decentralized, and secure tech stack.

Promising Solana competitors: MultiversX (EGLD) and Radix (XRD) bet in a ‘sharding’ future

The two promising Solana competitors are MultiversX (EGLD) and Radix (XRD), focused on scaling through sharding. Interestingly, most of the largest systems in the world scale through a sharded database, a provably efficient way of handling high loads of data, now replicated to blockchain applications in decentralized and distributed ledgers.

In 2018, Ethereum’s creator, Vitalik Buterin, mentioned sharding and proof of stake as efficiency-driving attributes for “Blockchains of the future.”

“Blockchains of the future with proof of stake and sharding will be thousands of times more efficient, and so the efficiency sacrifices of putting things on a chain will become more and more acceptable.”

Vitalik Buterin

On that note, Radix creator Dan Hughes posted a long essay on X entitled “Why Sharding?” In summary, Hughes explained that his 12 years of experimenting and developing different blockchain architectures pointed out sharding.

Moreover, both MultiversX and Radix have developed an asset-oriented model for the tokens built into their blockchain. This model is more secure than the Ethereum Virtual Machine (EVM) model, where ERC-20 tokens result from a smart contract call that tracks account balances.

Instead, tokens in asset-oriented blockchains operate as the native token itself and avoid giving special authorizations to applications, which often results in security breaches and wallet-draining.

MultiversX (EGLD) scalability and price analysis

The MultiversX production network is the first and only mainnet with all three types of sharding fully implemented and running. It has “network sharding,” “state sharding,” and “transaction sharding.”

Essentially, MultiversX scales through an adaptive sharding model, where the network adds more shards according to the demand. Each shard has a theoretical capacity of 10,000 TPS, and the network currently operates with three shards.

As of this writing, the token eGold (EGLD) trades at $28.53, down 58% year-to-date, suggesting an oversold cryptocurrency. It has a $775 million market cap, 83 times lower than Solana’s $65 billion capitalization.

Radix (XRD) scalability and price analysis

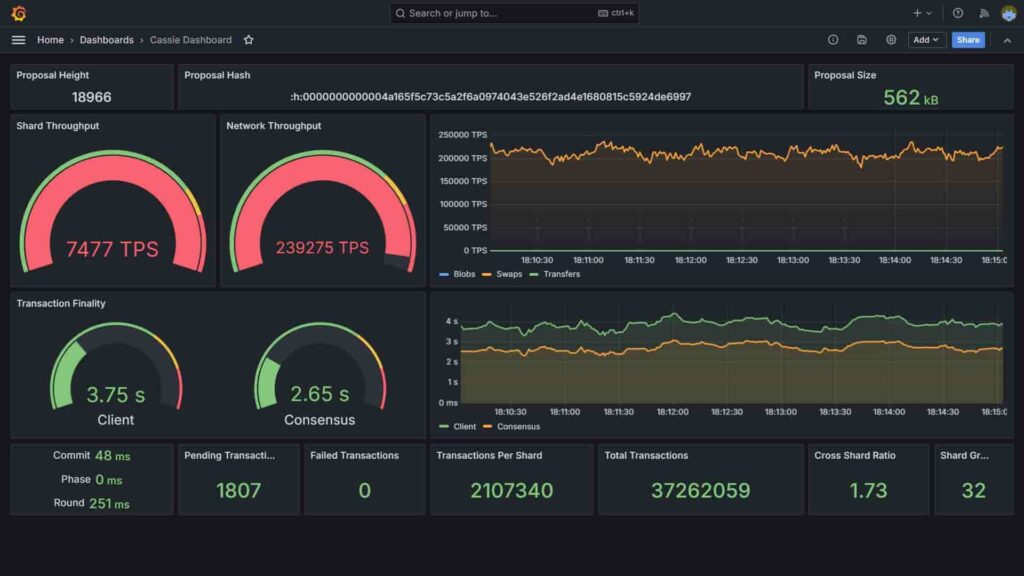

On the other hand, Radix still does not have sharding implemented in the mainnet. Instead, the blockchain is currently testing this implementation with promising results. Additionally, the project bets on having atomic composability for all its transactions, which translates to a seamless user experience while using different shards.

Dan Hughes’s recent tests suggest the network will be able to handle over 200,000 swaps per second. Swaps are more complex transactions that usually achieve lower throughputs than usual TPS. The testnet confirmed these swaps in 3.75 seconds, on average, using 32 shards.

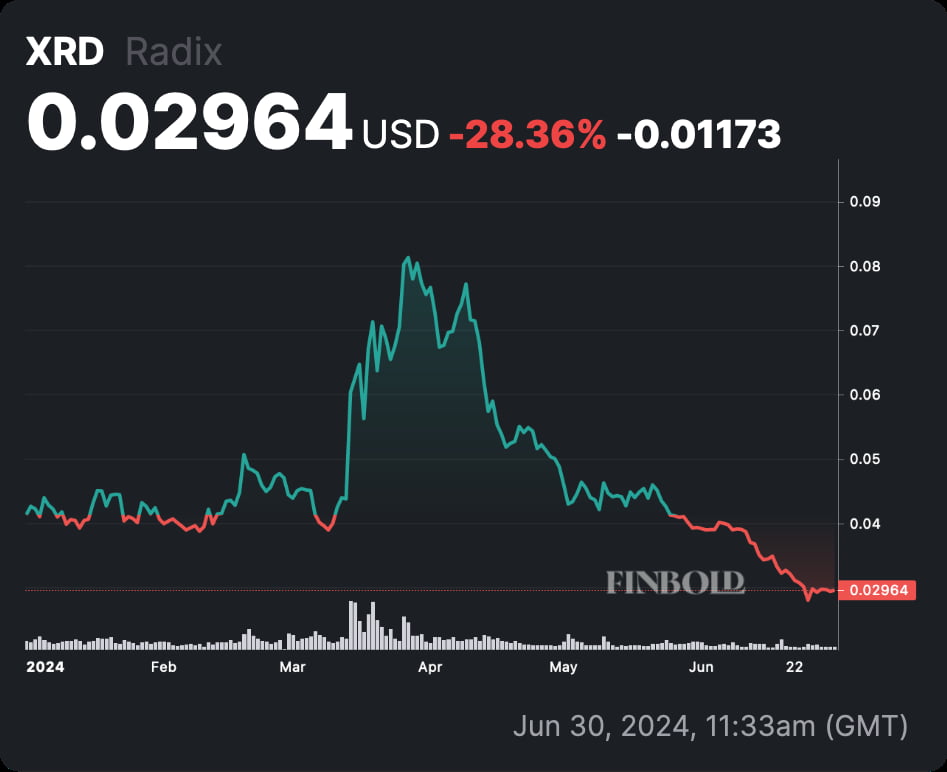

In the meantime, XRD is priced at $0.029, below its Initial Coin Offering (ICO) price. It is down 28% year-to-date and has a $300 million market cap, which represents a 216 times lower capitalization than Solana’s.

However, both EGLD and XRD present considerable risks for investors despite their promising technology. Investors must be cautious and do their due diligence before making any financial decision, as these low-cap cryptocurrencies could still perform negatively.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk