The electric vehicle (EV) market has undergone a notable correction since the start of 2024. This shift had a major impact on Nio Inc. (NYSE: NIO), one of the leading Chinese EV manufacturers.

The company’s stock price has decreased 53.8% during the same time frame.

Nio stock price analysis

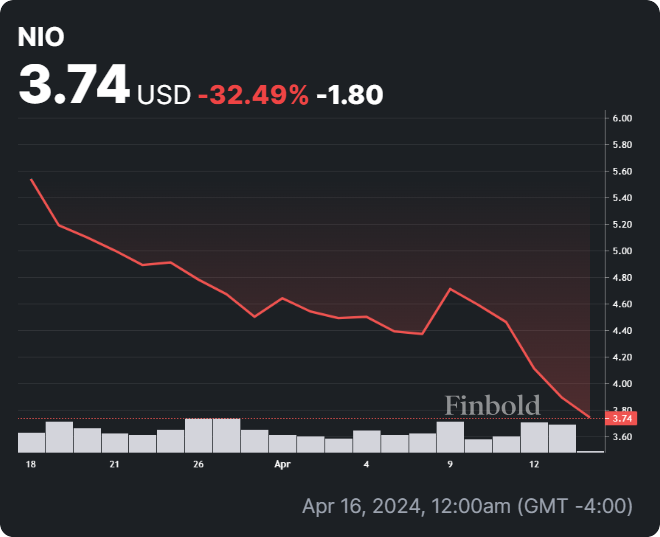

At the press time, NIO’s current price is $3.74, reflecting a decline of 5.35% with its closing price on April 15.

Analyzing its recent performance, the stock has experienced a notable downward trend, with a decrease of 14.41% over the course of the last five trading sessions.

Moreover, NIO has witnessed a substantial drop of 32.49% over the past month, indicating considerable volatility and investor sentiment shifts within a relatively short time frame.

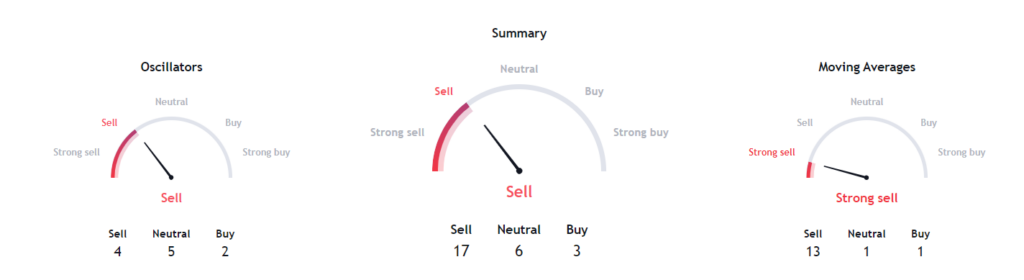

Looking at the technical indicators spells out a decidedly bearish sentiment with an overall ‘sell’ rating. Moving average, point towards a ‘strong sell,’ while oscillators are tilting towards a ‘sell’ rating.

Nio’s challenges

NIO’s recent delivery figures fell short of analyst expectations, and even dipped slightly year-over-year, which raises concerns about the company’s ability to meet demand and maintain production capacity.

While there was a rise in deliveries to 11,866 vehicles in March, the total for the first quarter of 2024 amounted to 30,053, which missed forecasts and marked a 3% decline compared to the previous year.

Meanwhile, a recent report from Macquarie analysts offers a “neutral” outlook on NIO, setting a price target of $5 as of April 15. The report describes the company as being “near a turning point,” predicting that 2024 will serve as a transition year for NIO as it aims to enhance its margins amidst intense competition in the electric vehicle sector.

In comparison, Li Auto (NASDAQ: LI), a prominent competitor in China’s EV market, has received a more optimistic assessment from Macquarie. The analysts have issued an “outperform” rating with an ambitious price target of $40, citing its leading sales volumes, superior vehicle profit margins, and an upward trend in cash flow generation.

The final word on NIO

Ultimately, NIO’s financial situation is a cause for concern. The company is struggling with persistent net losses, which grew at an alarming rate of 36.8% in the last quarter. To make matters worse, revenue growth is also slowing down.

This combination creates a huge hurdle for NIO’s short-term financial condition. The company needs to take decisive action to improve its performance.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.