After going through a bit of a rough patch, the electric vehicle (EV) industry seems to be getting back on its feet, but some of its representatives, particularly the Shanghai-based automaker Nio (NYSE: NIO), are yet to follow with significant increases in their stock prices.

Indeed, Nio has been among the weaker performers across the stock market this year, having declined as much as 48.63% in 2024 alone and continuing to fall further in recent weeks and months to a price of $4.33, which is a far cry from its yearly high of August 2023.

By comparison, 87% of all other assets in the stock market have performed better than NIO in the past year, although the Chinese EV manufacturer has managed to outperform 55% of stocks in the automobile industry, making it an average performer in this aspect.

That said, its competitors like Tesla (NASDAQ: TSLA), Rivian (NASDAQ: RIVN), and Volkswagen (FWB: VOW), have also been recording losses in the same period as Nio, with the exception of BYD Company (HKEX: 1211), which has managed to climb over 13% year-to-date (YTD).

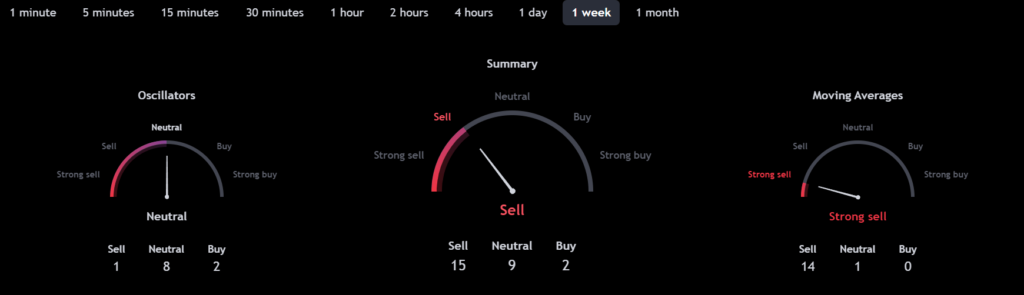

Technical indicators suggest trend continuation for NIO stock

Furthermore, NIO stock is demonstrating a continuously declining trend in the short to long term, suggesting a losing appeal among investors, who have been looking at other stocks as more interesting additions to their portfolios at this time.

At the moment, NIO stock is positioned between support at $4.24 and resistance at $5.63, with a decisive breakthrough at either of these likely to set the stage for further moves. Additionally, its relative strength index (RSI) has stayed in a downtrend, which aligns with the possibility of further price declines.

On top of that, NIO shares are at press time changing hands at the price of $4.33, which is below the stock’s 5, 10, 20, 100, and 200 simple moving averages (SMA), the only exception being the 50 SMA, signaling a prevailing bearish trend.

Tough times for NIO stock

In addition to the poor technical indicators for its stock price, Nio has been struggling with other problems that have stunted its growth, attempting to address these troubles with an upcoming release of the second edition of its smartphone for Innovation Day 2024.

As a reminder, the company launched the first generation of this phone back in September 2023, and the recent announcement has failed to move the sentiment needle for NIO stock from a ‘sell’ to a ‘buy’ as purchasing a smartphone from an EV manufacturer does not seem to sit well with consumers.

Change in sight for NIO stock?

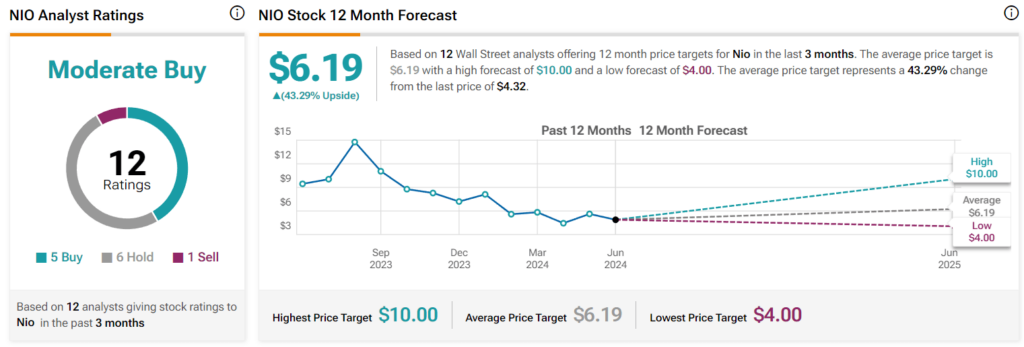

On the other hand, certain Wall Street analysts believe that NIO shares are a ‘buy,’ specifically five of the 12 finance experts offering their Nio stock price targets for the next 12 months, whereas six have recommended a ‘hold,’ and only one voted for a ‘sell.’

Notably, their optimism seems to be the result of Nio’s record-breaking delivery figures, which saw 20,544 vehicles, including 12,164 electric SUVs and 8,380 electric sedans, delivered in May, a dramatic 233.8% increase from May 2023, with 66,217 EVs delivered in 2024 alone.

All things considered, NIO might not be looking at a price improvement any time soon, at least according to most technical indicators and historical price action. However, some analysts seem to think differently, with a consensus of 12 of them setting the stock’s average price at $6.19 for the next 12 months.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.