With artificial intelligence taking the spotlight, two standout companies, Nvidia (NASDAQ: NVDA) and Super Micro Computer (NASDAQ: SMCI), have seen significant surges in their stock prices. However, these surges may have rendered these investments too costly for some investors, leading them to seek out more affordable options.

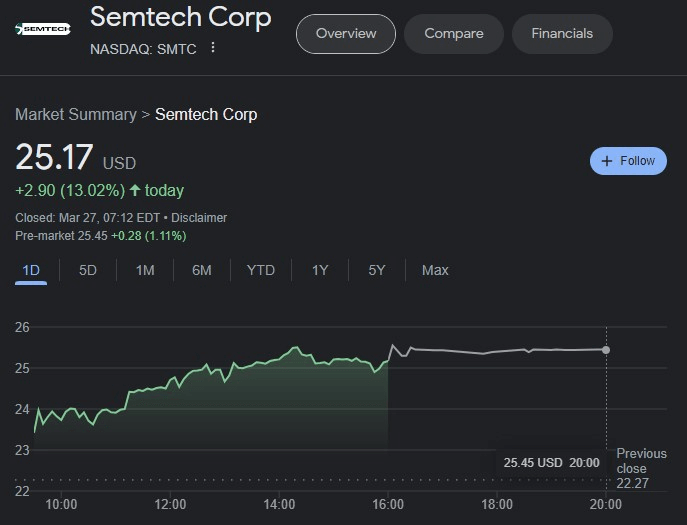

Enter Semtech (NASDAQ: SMTC), a potential solution for investors. Semtech surged by 13.02% in the last trading session, contributing to its year-to-date gains of 16.31% and boosting its valuation to $25.17 at the market close.

Why is SMTC stock a great alternative?

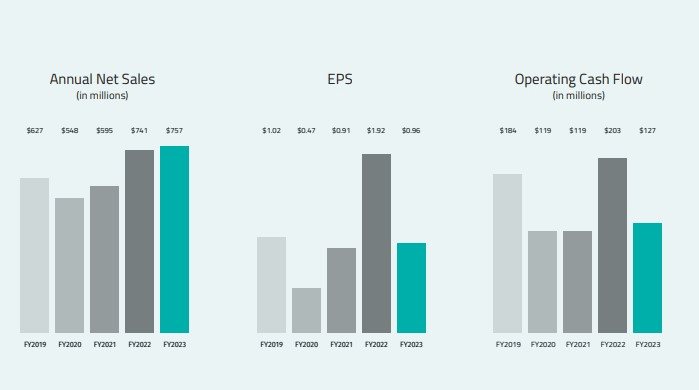

Semtech emerges as a standout performer in the technology sector, showcasing robust growth indicators and signaling a bullish trajectory. Notably, its track record of consistently surpassing earnings estimates, with an average positive surprise of 4.17% over the last four quarters, underscores its resilience and potential for continued success.

This promising outlook is underpinned by Semtech’s strategic emphasis on product differentiation, operational agility, and targeted expansion efforts in high-growth markets and regions.

The company’s recent earnings report, which revealed a 17% sequential increase and a 15% year-over-year uptick in earnings per share, exemplifies its sustained momentum and ability to deliver results.

Additionally, the escalating demand for more efficient energy management solutions across residential and industrial sectors, coupled with the growing necessity for advanced connectivity solutions in mobile devices and low-power sensor networks, positions Semtech favorably for future growth and market leadership.

Analysts and financials speak in favor of SMTC stock

Baird analyst Tristan Gerra highlights Semtech’s strong positioning in the emerging AI platform market as one of the select few players qualified for high-density copper interconnect.

Moreover, the company is well poised in the realm of AI architectures with its 800G modules. Another promising avenue for Semtech lies in next-generation optical links, particularly linear drive pluggable optics (LPOs), which represent a significant growth catalyst.

Described as a ‘classic turnaround story’ by Gerra, Semtech benefits from new leadership that aims to capitalize on its strengths in optical networking.

Looking ahead, investors anticipate Semtech’s fiscal fourth-quarter report, slated for release later on March 28, as the next potential catalyst for the company’s stock performance.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.