Nvidia’s (NASDAQ: NVDA) dominance in the artificial intelligence (AI) chip space could be threatened as its rivals step up to eat into its market share, a scenario that could impact the company’s share price.

Currently, Nvidia is recording losses and trading below the $120 resistance level. By press time, NVDA was changing hands at $115, dropping almost 3% since the last trading session. Year-to-date, the stock is down 16%.

Regarding the emerging competition, cloud giants, including Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOGL), and Microsoft (NASDAQ: MSFT), are ramping up their in-house AI hardware development with a twist.

Picks for you

For Amazon, reports indicate that Amazon Web Services is offering its Trainium-powered servers at just 25% of the cost of Nvidia’s H100 GPUs, marking a major push to lure AI customers away from Nvidia’s expensive chips.

This aggressive pricing strategy could erode Nvidia’s market share and pricing power as more enterprises opt for cost-effective alternatives.

Notably, Nvidia has long enjoyed a near-monopoly in AI accelerators, with its chips being the go-to choice for training and inference workloads. However, as tech giants seek to cut reliance on third-party chips, Nvidia’s competitive edge could weaken.

AI predicts NVDA stock price

For investors, this raises concerns about Nvidia’s long-term valuation and how the stock might be impacted. Already, Nvidia has experienced a massive crash in the past, following the emergence of DeepSeek AI, which reportedly used fewer resources to train its model.

The Chinese model raised concerns that demand for Nvidia’s expensive chips might wane.

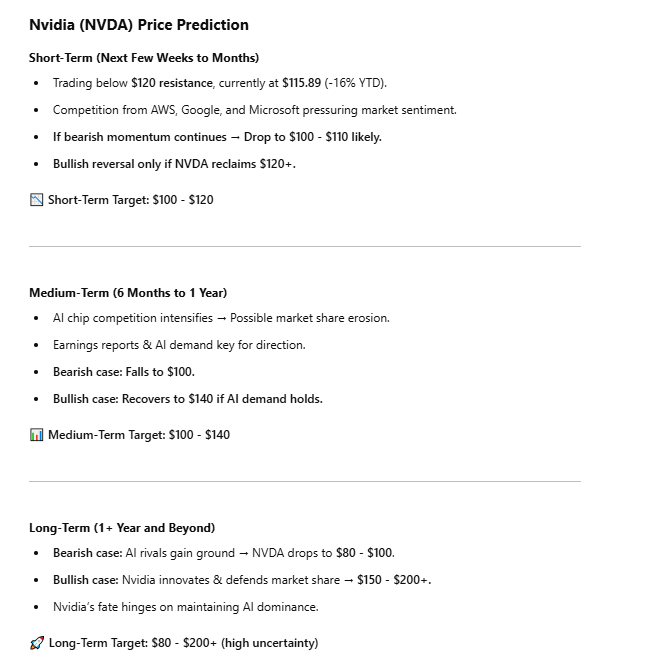

To determine how Nvidia stock might trade in the coming months with Amazon undercutting its chips, Finbold explored insights from OpenAI’s ChatGPT-4o. In the short term, the AI model stated that if the stock fails to bounce, downside risks could push NVDA toward $110 or even $100 in the coming weeks as the market digests the growing competitive pressures.

ChatGPT stated that Nvidia’s trajectory will largely depend on how well it defends its market position over the next six to twelve months.

If Amazon, Google, and Microsoft continue to erode Nvidia’s dominance with cheaper, in-house AI solutions, the stock could fluctuate between $100 and $140. However, a strong performance in its core AI segment could stabilize the stock and set the stage for a potential rebound.

Looking further ahead, ChatGPT-4o outlined two contrasting scenarios. In a bearish case, if Nvidia’s grip on the AI market weakens and competitors continue to gain ground, the stock could experience a deeper correction, falling toward $80 or lower.

In a more optimistic outlook, if Nvidia successfully innovates and maintains its leadership in AI chips and software, particularly with its CUDA ecosystem, NVDA could recover to $150 or over $200 in the long run.

What next for Nvidia stock price

For sustained price growth, Nvidia needs to reassure investors of its leadership in the AI space, especially with the next-generation Blackwell chips. To this end, investors will be keeping an eye on Nvidia’s annual GPU Technology Conference (GTC), which will spotlight the company’s AI leadership. CEO Jensen Huang is expected to deliver a keynote address.

Interestingly, not all market players are convinced that Nvidia’s AI position is under threat. For instance, in an X post on March 18, Wedbush Securities’ Dan Ives stated that the firm is the “heart and lungs” of the global AI boom. He highlighted the “off-the-charts demand” for Nvidia’s Blackwell chips, positioning the company as central to enterprise and consumer AI applications.

Ives also noted Nvidia’s focus on the Rubin platform, quantum computing, and autonomous robotics—the “holy grail of AI”—during the GTC event.

Featured image via Shutterstock