Nvidia (NASDAQ: NVDA) stock has been regularly setting records, reaching new all-time highs almost daily on a seemingly unstoppable upward trend. However, one recent milestone is that NVDA reached a weekly RSI above 90.

When the RSI surpasses 70, it typically indicates sell signals, suggesting that a security is overbought or overvalued. An RSI above 90 may indicate a potential price decline for NVDA shares.

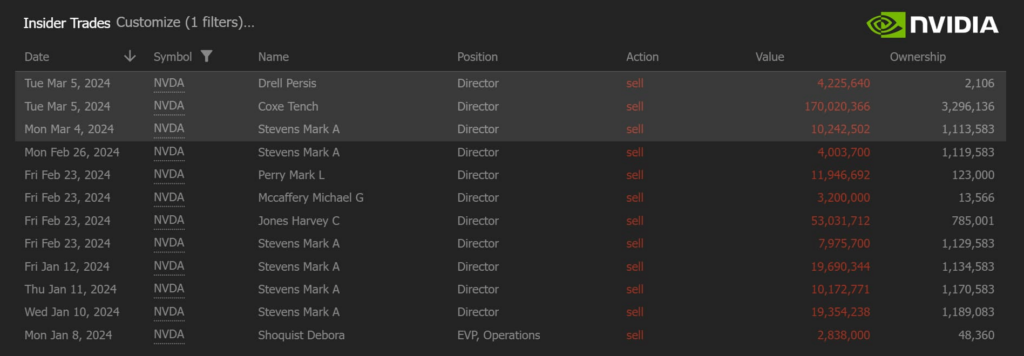

Insiders sold over $180 million of NVDA stock this week

And maybe NVDA stock won’t beat technical indicators this time, with an insider argument against its price.

During the first week of March, Nvidia shareholders opted to capitalize on their investments by selling over $180 million worth of Nvidia shares.

For instance, Tench Coxe, the third-largest shareholder of Nvidia, recently divested 200,000 NVDA shares, amounting to $170 million.

Additionally, Mark Stevens, a director since 2008, sold 12,000 shares on March 4, with prices ranging from $852.06 to $855.02, resulting in a total sale value of approximately $10 million.

Do these insider trades suggest more than profit-taking, especially given the surge in the weekly RSI past 90?

History and Cisco offer more insight

In March 2000, Cisco (NASDAQ: CSCO) reached its zenith, trading 37 times trailing sales, a remarkable feat that positioned it as the most valuable listed company globally. Since then, Cisco has seen its earnings-per-share surge nearly tenfold, accompanied by a comparable rise in sales-per-share.

However, despite these impressive metrics, the stock still lags, sitting at 39% below its 2000 highs.

Presently, Nvidia is in a similar position, trading 37 times sales.

A high weekly RSI, insider trading, and a potential pattern similar to that of CSCO stock could spell an ominous sign for NVDA stock’s future.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.