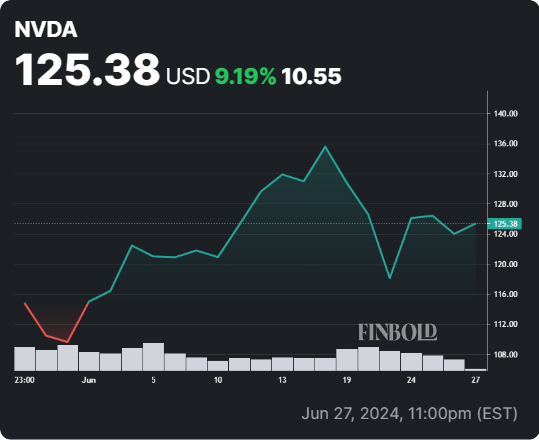

The recent 12% pullback by Nvidia (NASDAQ: NVDA) stock, which retraced its price below the $120 mark, presented a favorable opportunity for investors to “buy the dip” and opened many questions about the future of the most popular semiconductor maker and its stock price in the upcoming years.

NVDA stock opened trading on June 28 at $125.38, with a positive gain of 2.49% from the pre-market and a 3.23% advance in the previous five trading sessions.

While it might be hard to predict what the upcoming years hold for NVDA shares, the following year is only six months away, and the narrative is already forming regarding Nvidia’s stock price target in 2025.

Picks for you

Nvidia company reaching number one place will benefit NVDA stock

Nvidia recently surpassed Microsoft (NASDAQ: MSFT) to become the world’s most valuable public company, with a market cap reaching $3.34 trillion on June 18. However, Nvidia’s shares experienced a decline in subsequent sessions, causing it to lose its top position to both Microsoft and Apple (NASDAQ: AAPL).

Despite this, Truist Securities analysts believe achieving the number one market cap does not systematically challenge future investment returns.

Their comprehensive analysis of data from the past 26 years shows that stocks like Microsoft, Cisco (NASDAQ: CSCO), ExxonMobil (NYSE: XOM), Apple, and Amazon (NASDAQ: AMZN) initially underperformed the S&P 500 in the short term after reaching the top market cap, but generally outperformed in the long term over one-year, three-year, and five-year periods.

William Stein raised his price target on NVDA shares from $128 to $140, reflecting strong confidence in Nvidia’s long-term growth potential despite short-term market fluctuations.

Key factors work in favor of NVDA stock

Ray Wang, founder and principal analyst at Constellation Research, remains bullish, setting a $200 price target based on seven key factors. These include Nvidia’s visionary leadership, high entry barriers in the chip market, significant switching costs, dominant market share, and extensive product roadmap.

Wang emphasizes Nvidia’s ecosystem, which has established its GPU as the standard for artificial intelligence (AI) applications and points to the company’s impressive growth and profitability metrics.

He argues that “when we are looking at Cisco, Intel, Nvidia has learned from these lessons, and they have to go much broader than just building chips, what Nvidia has done, it has built partnerships that will last in the next era.”

Recent volatility is typical for a stock like Nvidia

Ben Reitz, Head of Technology Research at Melius Research, suggests that this volatility is typical for Nvidia and is driven by rebalancing and profit-taking.

Despite short-term fluctuations, Reitz highlights Nvidia’s dominance in the AI market through its full-stack approach as he assigns it a “buy” rating at a $160 price target while drawing parallels to the Wintel duopoly and Apple’s iPhone success.

He believes that “Nvidia has the most upside of all Magnificent Seven stocks we cover, even though we really like Apple and a few others.”

Reitz emphasizes Nvidia’s foresight in building a robust computing language and ecosystem that monetizes AI, ensuring sustained growth. Despite recent stock movements, he remains optimistic, noting Nvidia’s unparalleled innovation pace and market share.

He also hints at the potential for significant shareholder returns, given Nvidia’s projected $270 billion cash generation over the next three years.

The analysts’ tone regarding Nvidia stock in 2025 seems already set as they see the chipmaker giant as poised to continue with gains in the upcoming year.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.