Although the news of a delayed launch for its Blackwell artificial intelligence (AI) chip has pushed the price of Nvidia (NASDAQ: NVDA) stock down, the technology giant’s shares have since recovered, with Wall Street analysts retaining their optimistic expectations throughout.

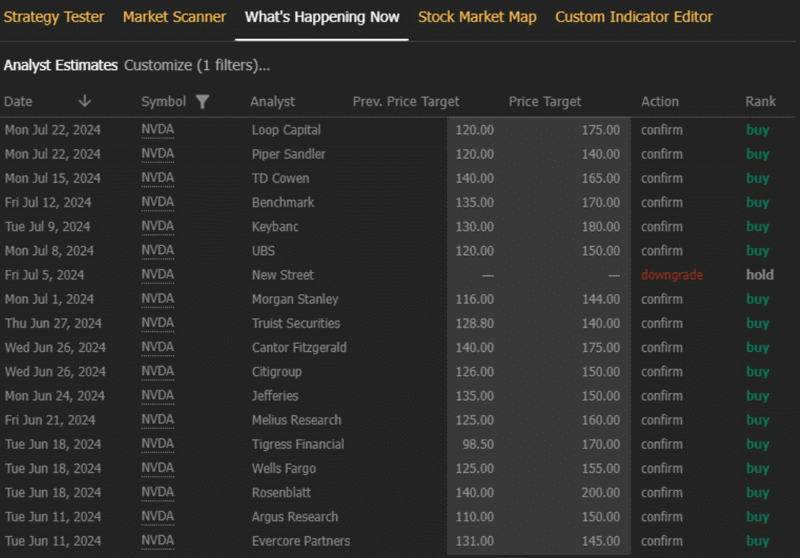

As it happens, analysts have been upgrading Nvidia stock price targets across the board over the last two months, with projections ranging between $140 and $200, according to the observations by the market analytics platform TrendSpider shared in an X post on August 7.

Nvidia stock price target 2025

Indeed, market experts are generally confident in the semiconductor behemoth’s dominance in the AI field and its long-term prospects, which they believe will reflect on the Nvidia stock price in the following months despite near-term volatility caused by the Blackwell news.

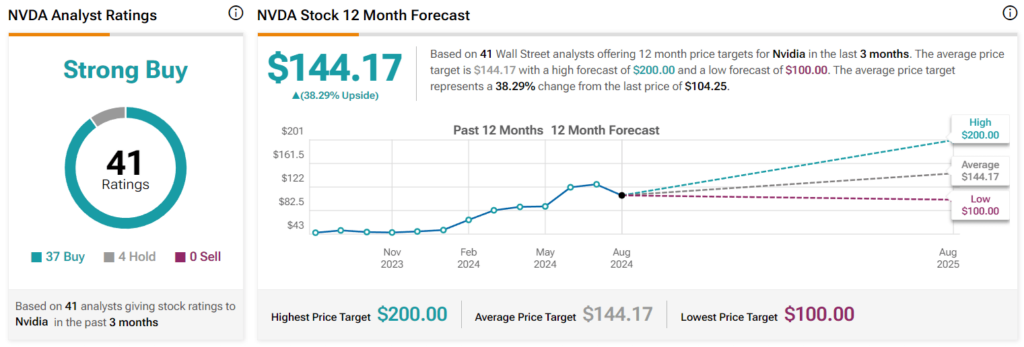

As such, they view NVDA shares as a ‘strong buy,’ with only four analysts suggesting to ‘hold’ for now, and with no ‘sell’ recommendations, and their average price target, based on the views they shared across the past three months, currently stands at $144.17.

At the same time, the lowest Nvidia stock price target suggested by Wall Street experts resides at the $100 level, while the highest projection sees NVDA shares hitting $200 sometime in the following 12 months, according to the latest TipRanks information retrieved on August 7.

Among these analysts is New Street Research’s Pierre Ferragu, who has recently raised the company’s rating on Nvidia stock to a ‘buy,’ with a target price of $120, after downgrading NVDA shares to a ‘hold’ in early July, now arguing that the “delay in Blackwell is only a tactical setback.”

In addition, Bernstein research and analyst Stacy Rasgon suggest that Nvidia is a ‘buy,’ with the price target remaining at $130, with the score reiteration arriving several weeks after the company noted that NVDA was among its “top picks” alongside Broadcom (NASDAQ: AVGO).

Nvidia stock price history

Meanwhile, the price of Nvidia stock currently stands at $104.35, recording an increase of 1.47% in pre-market trading, during which it briefly crossed the $108 level, while declining 7.64% across the week, and accumulating a loss of 18.68% in the last month, still holding onto the 116.42% surge since the year’s turn.

So, why is Nvidia stock so high today? Notably, the recovery arrives against the backdrop of multiple analysts sharing their bullish observations, which highlight Nvidia’s AI strength, with Oppenheimer opining that its “competitive position remains sound, and we don’t expect any share loss from a minor delay.”

Furthermore, Toshiya Hari of Goldman Sachs (NYSE: GS) has urged investors to remain calm and continue with their current strategies, acknowledging that the Blackwell delay was not ideal but also pointing out that it should not impact Nvidia’s 2025 earnings power or its market dominance, arguing that:

“We expect there to be little to no impact on CY2025 earnings and, most importantly, the company’s long-term competitive position. (…) As such, we are not making any adjustments to our base case Data Center revenue estimates and continue to forecast 39% yoy growth in CY2025 off a CY2024 base that is up 134% yoy.”

Moreover, analysts at Raymond James also see the potential consequences of the delay as “modest” at worst, pointing out that the demand and sales of Nvidia’s Grace Hopper Superchip and GPU microarchitecture, as Blackwell’s predecessor, might benefit from it instead:

“While we are unable to independently verify these claims, a few months of delay should have a limited impact on NVDA’s near-term estimates, in our view. (…) We expect any potential delays in Blackwell to drive upside to Hopper demand in the short term, which could actually benefit gross margins.”

All things considered, NVDA stock might be facing some volatility at the moment due to the delay affecting traders’ expectations. However, experts remain confident that the setback is only temporary and that the Nvidia stock price will recover in the longer term. That said, doing one’s own due diligence is critical when investing.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.