Cardano (ADA), a decentralized finance (DeFi) project, is currently experiencing a sell-off that has resulted in the asset recording a decline in its ranking based on market capitalization.

However, crypto trading expert Ali Martinez has suggested that technical analysis points to a potential rebound in the price of ADA, indicating that the current trajectory should not be a cause for concern.

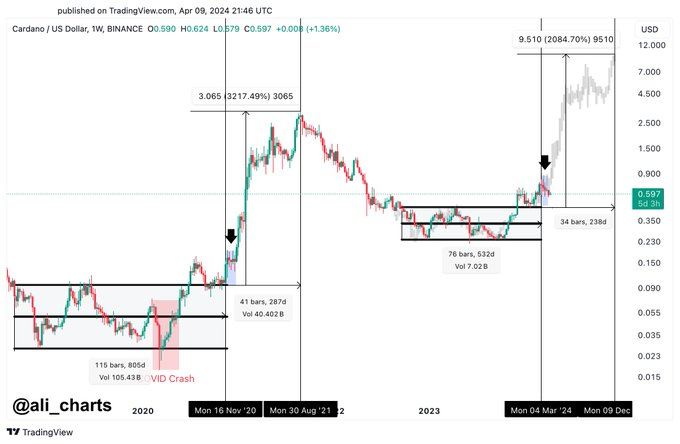

Martinez’s analysis resonates with sentiments he expressed on March 16, where he highlighted parallels between ADA’s current trajectory and historical patterns observed between 2018 and 2021.

Fast forward to April 10, in an X (formerly Twitter) post, Martinez maintained his bullish outlook on Cardano, asserting that the token is currently consolidating a factor that aligns with its expected trajectory.

He pointed out that the consolidation ranges between $0.55 to $0.80 before ADA records a breakout of almost 200% to $1.70 en route to $5. This assertion suggests that Cardano’s current consolidation phase is essential for its upward momentum.

“Nothing has really changed for Cardano. ADA is exactly where it should be, consolidating in the $0.55 to $0.80 range before a breakout to $1.70,” he said.

ADA sustains inactivity

Amid the optimism from Martinez’s analysis, ADA is trading in the shadow of the gains witnessed in 2021. Notably, under the latest sell-off, Telegram-backed Toncoin (TON) has surpassed ADA and ranked as the ninth-highest cryptocurrency by market capitalization.

Despite Cardano’s blockchain sustaining momentum in network development, ADA has garnered little interest this year, with investor attention focused on other entities such as Bitcoin (BTC) exchange-traded funds (ETFs).

ADA’s losses have also coincided with the institutions’ choice to remove the token from their balance sheets. Particularly, Grayscale Investments notably dropped ADA from its Crypto Large Cap Fund, characterizing the move as a “rebalancing” action involving the sale of ADA tokens to reinvest in other fund components.

This period of inactivity has led ADA to earn the phrase “crypto zombies,” alongside Ripple’s XRP, a factor refuted by founder Charles Hoskinson.

For ADA to align with Martinez’s projections, the asset will need backing, especially if the general market sustains bullish gains.

In the meantime, ADA was trading at $0.57 by press time, dropping almost 7% in the last 24 hours.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.