The ongoing broader market volatility has left investors grappling to identify the right assets to invest in even as the global economy stares at a possible collapse. Notably, traditional finance products like stocks, precious metals, and cryptocurrencies are all competing to stand out as possible buffers amid the prevailing high inflationary environment.

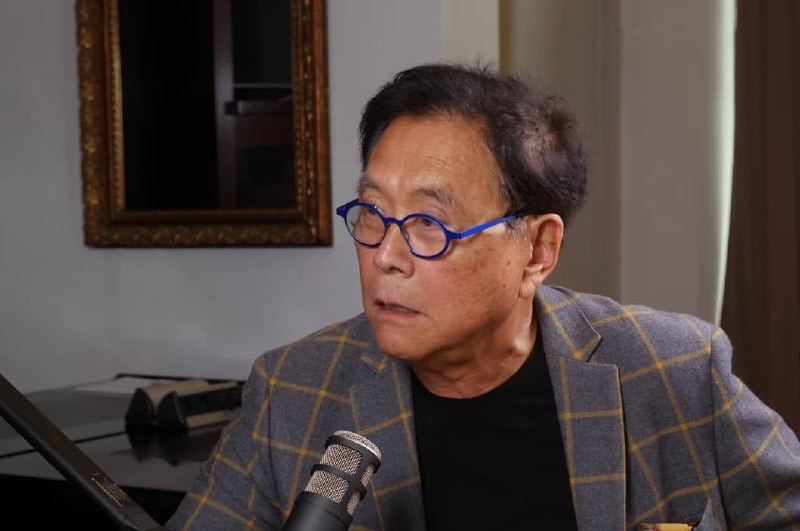

In this line, author of the personal finance book ‘Rich Dad, Poor Dad’ Robert Kiyosaki has stressed that investors need to opt for Bitcoin (BTC) and precious metals, terming cash, stocks, and bonds as’ toast’ in a tweet on October 7.

Global central banks ‘exposed’

According to Kiyosaki, trust in traditional finance investment products has been questioned with the global central banks‘ initiatives to curb the skyrocketing inflation. Kiyosaki cited the recent move by the Bank of England’s market intervention to stabilize the economy by announcing a program to purchase long-dated bonds.

“Why buy gold, silver, Bitcoin? Bank of England pivot means buy more GSBC. When pensions nearly collapsed it exposed Central Banks cannot fix…INFLATION. Pension have always invested in G&S. Pension funds now investing in Bitcoin. They know Fake $, stocks & bonds are toast,” Kiyosaki said.

Previously, Kiyosaki has maintained his stand on precious metals and cryptocurrencies, noting that they will likely survive the ongoing bear market.

Possible dollar crash

He also took issue with the government’s increased printing of money, noting that the dollar would likely crash in a few months. In this case, the author, while projecting the end of the dollar, advised that silver might be an ideal replacement. He suggested that the precious metal is likely to rally to $500.

Furthermore, Kiyosaki has castigated market players who are taking issue with the crypto bear market, noting that the same applies to stocks and the bond market.

It is worth pointing out that Kiyosaki’s push for cryptocurrencies was recently highlighted by the crash in global fiat currencies against the dollar. For instance, the crash saw investors increasingly venture into Bitcoin, as highlighted by the GBP/BTC trading volume.

Featured image via Cavaleria Com YouTube

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.