In a time of global economic uncertainty, managing investment portfolios has become a critical topic among investors seeking ways to navigate this period.

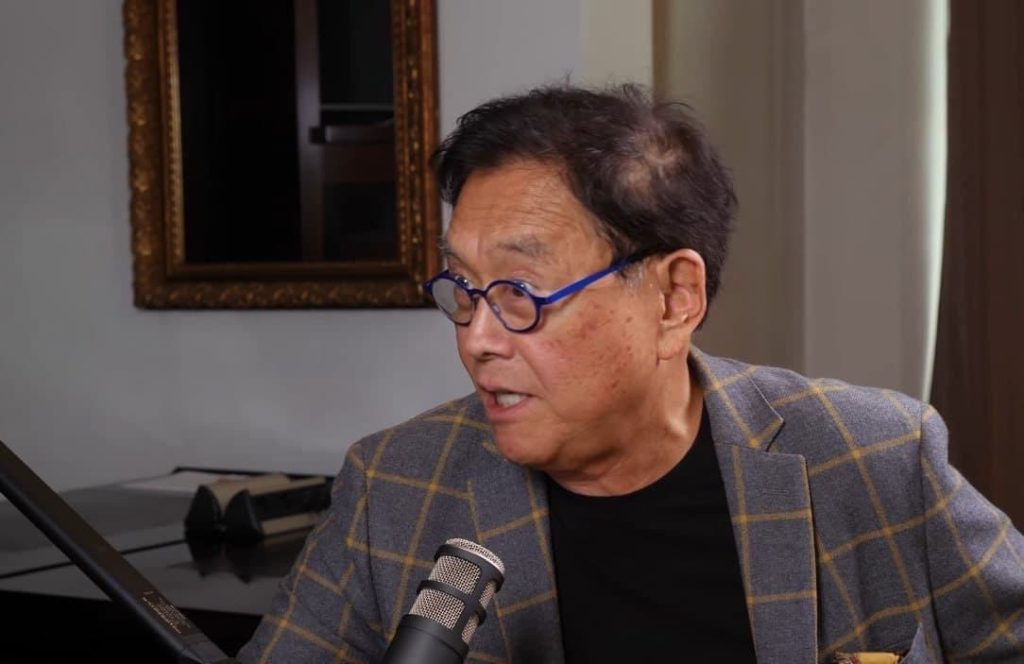

In this line, the author of the best-selling personal finance book ‘Rich Dad Poor Dad’ Robert Kiyosaki, has raised the alarm about what he anticipates as the “greatest crash in world history.” In preparation for this crash, Kiyosaki has urged investors to consider a significant shift in their portfolios to protect their wealth.

Through a post on X (formerly Twitter) on October 29, Kiyosaki criticized traditional investment advice advocating for a 60% allocation to bonds and 40% to stocks, suggesting that such an approach may not withstand the potential crash in 2024.

In this instance, Kiyosaki advised investors to reallocate their portfolios to include gold, silver, and Bitcoin (BTC). He noted that these assets have the potential to withstand the impending crash.

“Forever and ever financial experts have promoted the idea “Smart Investors invest in 60/40 60% bonds 40% stocks. In 2024 60/40 investor will be biggest losers. Before going down with the ship consider a shift to 75% Gold, Silver, Bitcoin 25% real estate/oil stocks. This mix may allow you to survive the greatest crash in world history,” he said.

Kiyosaki Bitcoin and gold price projection

Previously, Kiyosaki projected gold breaking through the $2,100 mark and continuing to surge, with a predicted next milestone of $3,700. Similarly, he envisions Bitcoin eventually reaching $135,000.

According to the author, both gold and silver are considered “GOD’s money,” and in the event of a stock and bond market crash, their values are likely to skyrocket.

At the same time, the financial educator maintains that at their current valuations, the value of gold, silver, and Bitcoin are a bargain, and he encourages investors to allocate funds to these assets.

Overall, Kiyosaki has consistently advocated for investments in precious metals and Bitcoin while expressing skepticism about the sustainability of traditional financial products, which he maintains are destined for a crash.

As reported by Finbold, Kiyosaki has previously highlighted several concerning factors currently impacting the economy. He believes that hyperinflation, the potential introduction of a central bank digital currency (CBDC), and possible inaccuracies by the United States government are key factors to watch out for.