The legal battle between the Securities Exchange Commission (SEC) and blockchain firm Ripple is persisting, with both sides currently tussling over financial statements.

Specifically, the regulator had previously filed a motion to compel Ripple to disclose its financial statements for 2022-2023 and post-complaint contracts.

In the latest development, Ripple has countered the SEC’s demand by filing a motion challenging it. Defense attorney James Filan, in a post on X (formerly Twitter) on January 19, revealed that Ripple deemed the motion ‘untimely.’

The court filing disclosed that Ripple argues the SEC’s requests are untimely, emphasizing that the regulatory body had ample opportunities during fact discovery to pursue the requested information.

Furthermore, Ripple’s legal team contended that the appropriateness of post-complaint discovery has previously undergone litigation.

“The SEC requests are irrelevant and has no bearing on the court’s remedies determination. The SEC’s considering whether Ripple’s post-complaint conduct violated the law will need a lengthy fact discovery period or a new litigation,” Ripple said.

Ripple also highlighted that, during this dispute, the SEC consistently asserted that such discovery was irrelevant to remedies. Consequently, Ripple asserts that the SEC should be prevented from reversing its position.

Possible delays

Expressing concern about potential delays caused by the SEC’s demand, Ripple believes that reexamining whether its post-complaint conduct breached the law could extend the proceedings, necessitating an extensive and protracted fact-discovery period.

It’s worth noting that the SEC-Ripple trial, set to begin in April, originated from charges filed by the regulator in 2020, alleging that Ripple raised funds by selling unregistered securities in XRP tokens.

In a significant development in 2023, Ripple partially won when the judge ruled that XRP does not qualify as a security.

Despite ongoing legal challenges, Ripple continues to view the case as part of hostile regulatory actions in the United States.

The company’s CEO, Brad Garlinghouse, noted that the regulatory situation prompted the exploration of a possible initial public offering (IPO) outside the US. However, the IPO plans have been put on hold for now.

XRP price analysis

Elsewhere, the latest developments in the case have had a minimal impact on the value of XRP, which continues to trade under pressure. By press time, XRP was valued at $0.55, reflecting daily gains of about 0.60%. On the weekly chart, XRP is down over 4%.

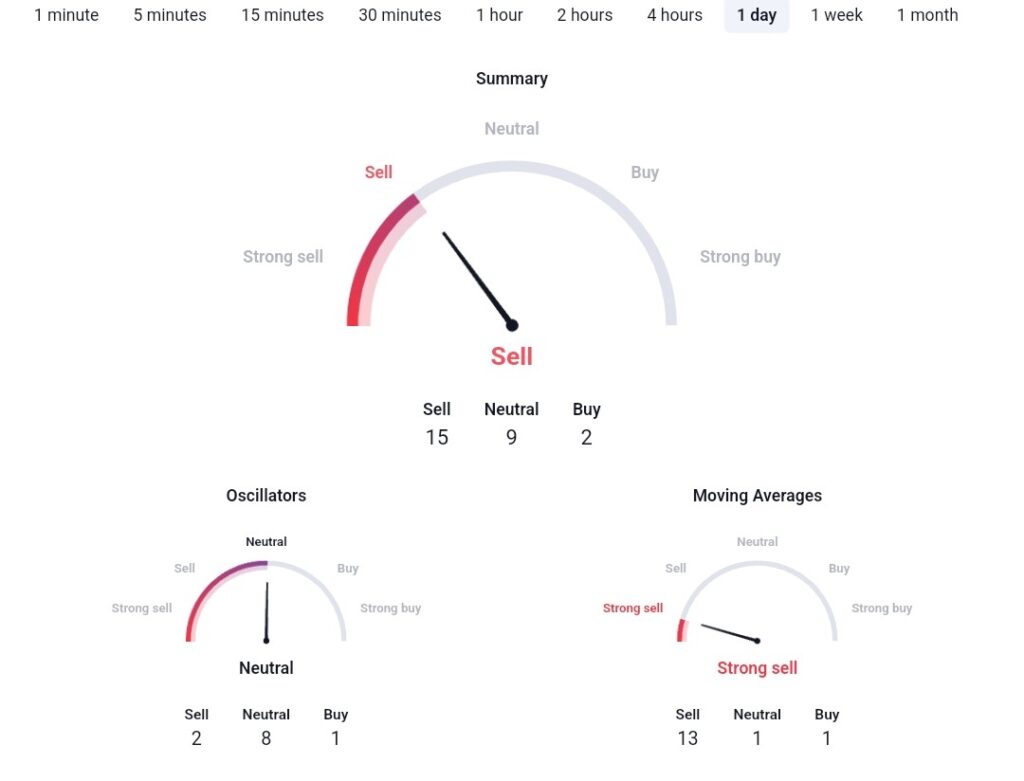

At the same time, XRP technical analysis reveals bearish sentiments, with a summary of one-day gauges indicating a ‘sell’ rating at 15, moving averages are for ‘strong sell’ at 13, and oscillators align with ‘neutral’ sentiment at 8.

Overall, since XRP lost its support level at $0.60, analysts speculate that the token might experience further drops before a potential rally.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.