Salesforce (NYSE: CRM) has been in the red throughout 2025, following mixed earnings and growing fears of weakening demand for its artificial intelligence offerings.

Those concerns intensified last week after President Donald Trump announced sweeping new tariffs on major U.S. trading partners, sparking volatility across global equity markets.

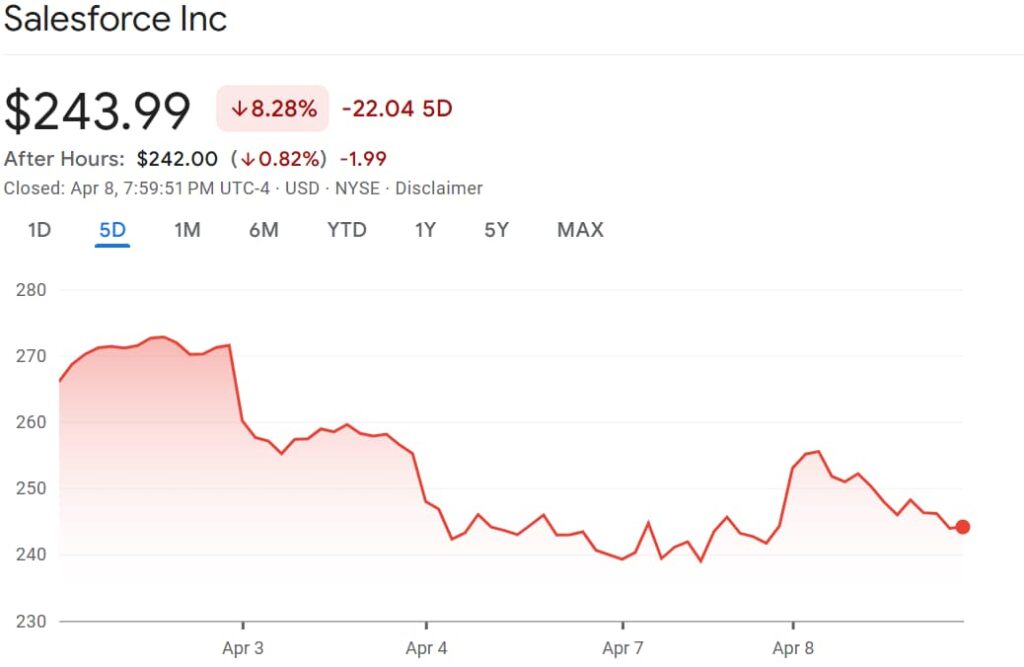

The next day, Salesforce stock plunged 6% to $255.23 and the slide hasn’t stopped. As of the close on April 8, shares ended the day at $243.99.

In pre-market trading on April 9, Salesforce stock slipped another 0.82% to $242.00, extending its five-day loss to 8.28%.

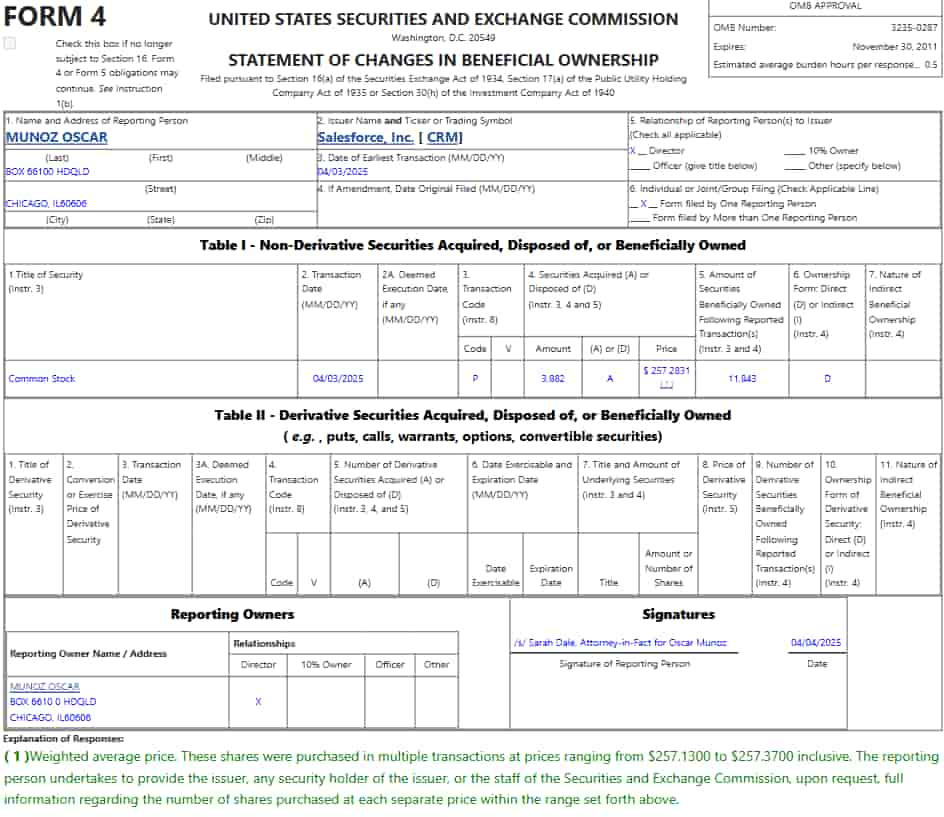

Amid the pullback, an insider bought the dip, scooping up approximately $1 million worth of the company’s stock, according to a Form 4 filing made public on April 4.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

Insider buys nearly $1 million worth of CRM stock

To be more precise, Oscar Munoz, Salesforce board director and former chief executive of United Airlines (NYSE: UAL) purchased 3,882 shares of the company on April 3 at an average price of $257.28, amounting to approximately $998,773.

The transaction brought his total holdings to 11,843 shares, representing roughly 0.0012% of Salesforce’s outstanding stock. Munoz had also bought the stock back in June 2024, when he acquired 2,051 shares at $243.69 per share, spending nearly $500,000.

The latest insider trading disclosure comes at a time when Salesforce stock is down nearly 27% year-to-date and trades roughly 30.8% below its all-time high of $369, set in December 2024.

Featured image via Shutterstock