As this month’s first week ends, the “September Effect” leaves its mark, with finance markets down between 4% and 5%. United States jobs results may have played a role in this bearish outlook, with analysts now waiting for inflation data through the Consumer Price Index (CPI) on Wednesday, September 11

On September 7, the finance expert Chris Pulver went to TradingView to share insights on the stock market. As explained, this month is a historically losing period for stocks, a phenomenon called the “September Effect,” with 10-year and 70-year average results of -0.9% and -0.72%, respectively.

So far, the S&P 500 has already lost 4.85% month-to-date, surpassing the “September Effect” long-term averages. However, Pulver warns of potentially high volatility, driving the index down 10% to the chart’s support before briefly correcting upwards.

In particular, the analyst blames this week’s crash on the recent U.S. jobs data, which he says has disappointed.

U.S. CPI inflation data as the ‘September Effect’ blooms

This week, Chris Pulver will be closely watching the U.S. CPI data, which can cool off the selling trend. Essentially, the market will receive lower inflation data as positive, potentially challenging the “September Effect” so far.

On that note, analysts forecast a 2.6% year-over-year CPI inflation, lower than the 2.9% inflation from last month. A lower-than-expected inflation would be extremely bullish, while higher numbers would likely cause damage, fueling the bearish sentiment.

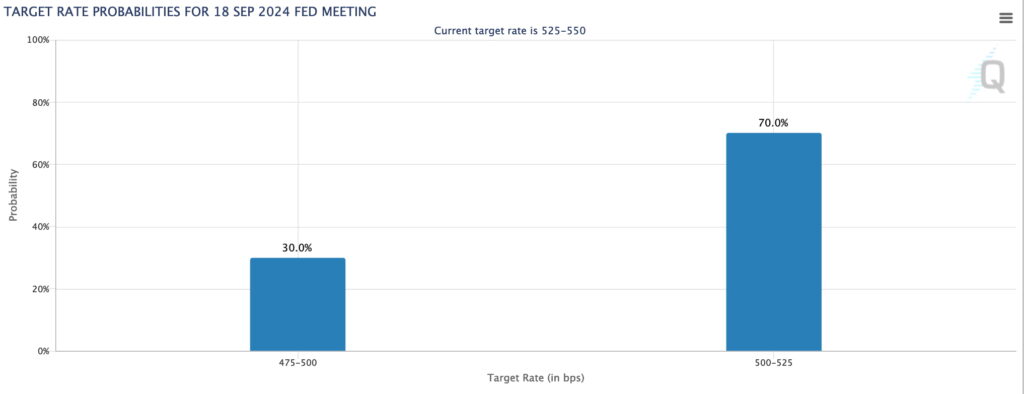

This is because the Federal Reserve will use the Consumer Price Index data in confluence with jobs to potentially decide on the first interest rate cut in years. The meeting will happen on September 18 and is one of the world’s most awaited finance events, with broad influence.

As of this writing, target rate probabilities from CME FedWatch indicate a 100% chance of an interest rate cut this month – with a 70% chance of a 25 basis points (bps) cut and a 30% chance for a 50 bps rate cut.

In closing, the finance expert warns short-term traders and investors of high unpredictability and volatility as macroeconomics plays its role. Nevertheless, Chris Pulver is optimistic that the long-term game is simple for investors looking at higher time frames.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.