The cryptocurrency market is in a consolidation range after a remarkable bull rally, followed by a bearish correction. Meanwhile, the latter has favored an increased open interest in short positions for some cryptocurrencies that could short squeeze.

Essentially, a short squeeze happens when a sudden price increase forces multiple opened shorts to close, liquidating the bearish traders. This event fuels the uptrend, driving prices even further.

Therefore, identifying large liquidity pools to the upside could help cryptocurrency traders spot valuable opportunities in the derivatives market.

Finbold gathered data from CoinGlass on March 29 and spotted a short-squeeze potential for Solana (SOL) and Avalanche (AVAX).

Solana (SOL)

First, Solana’s open interest has maintained historical highs in the past few weeks, following its native token’s, SOL, price action. There are currently over $3 billion in Futures contracts while traders speculate on SOL’s volatility.

Interestingly, much of this interest is allocated to short positions, which has created large liquidity pools to the upside. In particular, with meaningful accumulation at $192, $194, and $197, making those potential targets in a short squeeze next week.

As of writing, SOL trades at around $185 and a run to these targets offers a possible 6.5% gain.

Avalanche (AVAX)

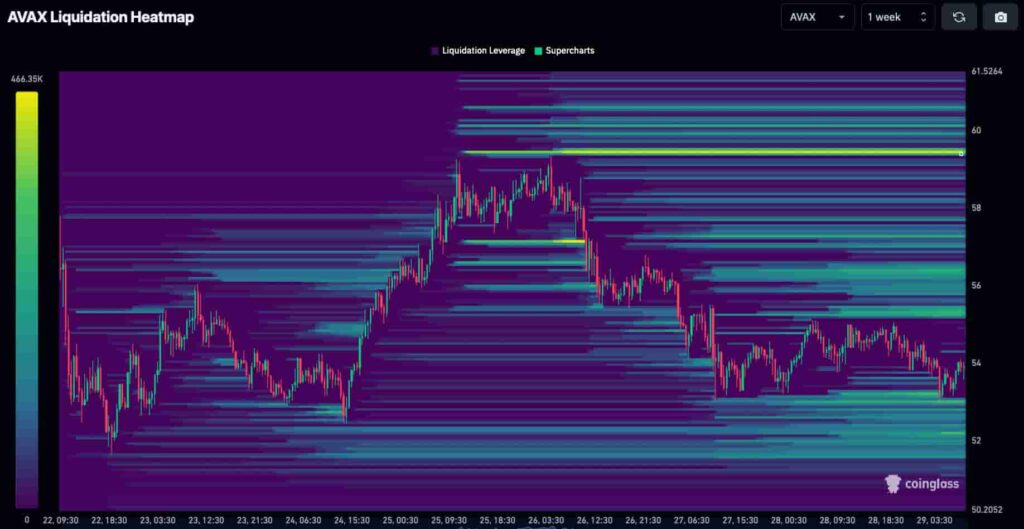

One of Solana’s most promising competitors, Avalanche, is also presenting a potential short-squeeze opportunity for next week. However, AVAX’s open interest is lower than $500 million, with a significantly lower capital flow than its leading competitor.

Like SOL, the majority of the market’s interest in Avalanche seems to weigh towards short positions. In particular, creating a massive liquidation target at the $59.5 price level, with over 11.5% potential gains from $53.35 registered at the time of publication.

Despite the relevant potential, short-sellers futures liquidations do not guarantee a short squeeze will occur. The cryptocurrency market is highly volatile and drastically changes every minute with news and technical analyses.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.