With Solana (SOL) trading at a new record high, the decentralized finance (DeFi) token’s technical indicators suggest it is primed for further upside.

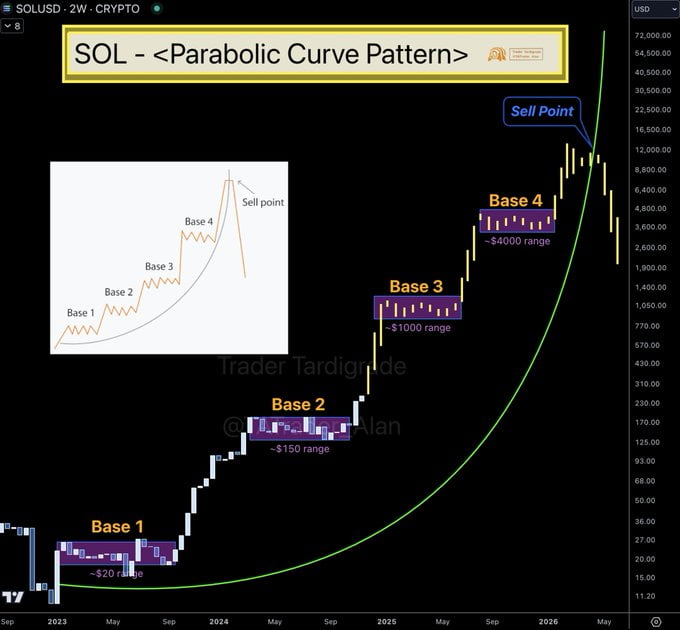

Specifically, Solana has completed Base 2 of its parabolic curve pattern, setting the stage for a climb toward the $1,000 range, known as Base 3, according to an analysis by Trader Tardigrade shared in an X post on November 22.

According to the outlook, SOL’s journey began with Base 1, where Solana consolidated in the $20 price range, laying the foundation for further gains. Base 2 was recently completed around the $150 range.

Looking ahead, the roadmap points to Base 4, a speculative target in the $4,000 range. If the parabolic curve pattern holds, Solana will likely become one of the most valuable assets in the market.

Significance of Solana hitting $4,000

To this end, if Solana were to achieve a valuation of $4,000, it would command a market capitalization of about $1.9 trillion, putting it on par with Bitcoin (BTC), which has a market cap of $1.947 trillion as of press time, assuming minimal growth in Bitcoin’s current valuation.

Such significant capital inflows would likely require contributions from institutional players. Notably, anticipating such inflows has partly driven Solana’s current rally to record highs, fueled by the potential rollout of a related exchange-traded fund (ETF).

With Donald Trump’s election, the chances of additional ETFs—beyond Bitcoin and Ethereum (ETH)—have accelerated. This development is seen as more feasible with Gary Gensler’s exit as chairman of the Securities and Exchange Commission. VanEck and 21Shares are among the firms seeking to launch a Solana spot ETF.

Attention will now turn to whether Solana can emulate Bitcoin’s trajectory and rally further if the ETF is approved. To this end, as reported by Finbold, an artificial intelligence platform has suggested that the asset could hit $390 as an immediate reaction to a possible ETF approval.

Meanwhile, SOL could experience additional capital swings, as the token’s total supply is expected to rise to 462.45 million by mid-2025, representing a 4.29% increase due to declining inflation.

It is worth noting that upcoming token unlocks will expand the circulating supply but won’t directly add capital. Their impact will depend on usage: heavy selling could pressure prices, while strategic reinvestment could boost the ecosystem’s value.

What’s next for SOL’s price

As things stand, the asset will be looking to maintain its current momentum. In this case, an analysis by Rekt Capital in an X post on November 22 noted that after claiming the $260 level, Solana needs a weekly close or retest above the key $250 level to trigger a move into price discovery and new all-time highs, surpassing its previous record.

By press time, Solana was trading at $254.71, having corrected about 1.3% in the last 24 hours. On the weekly chart, Solana is up 21%.

In summary, Solana’s momentum, institutional interest, and parabolic pattern position it for new highs, with an ETF approval potentially accelerating its growth. However, how the token interacts with the $250 support will be key.

Featured image from Shutterstock.