The coffeehouse giant Starbucks (NASDAQ: SBUX) found itself entangled in the Israel-Hamas war as it sued the Workers United union for using its name in calling for a ceasefire, as it sued them for copyright infringement.

The legal action required Workers United to discontinue the use of the name “Starbucks Workers United” for their labor organizing group. The lawsuit argued that using this name had triggered customer outrage and negatively impacted the company’s reputation.

Nevertheless, Starbucks faced a new challenge when its forceful response to the pro-Palestine post triggered a social media storm, leading to widespread boycott calls against the coffeehouse chain.

Multiple boycotts led to a fall in revenue

On January 30, the Seattle-based coffee company announced a revised outlook, anticipating revenue growth of 7% to 10% in the current fiscal year. This is a reduction from the earlier forecast of a 10-12% increase in early November.

Starbucks reported first-quarter net revenue of $9.43 billion, falling short of the estimated $9.6 billion. In the first quarter, comparable sales for the coffeehouse giant increased by 5%, below the estimated 6.39%. International comparable sales for the world’s most popular coffee place in the first quarter rose 7%, below the estimated 11.6%. The adjusted earnings per share (EPS) in the first quarter were 90 cents, below the estimated 93 cents.

Starbucks encountered several challenges in the quarter. On November 16, employees from over 200 U.S. stores staged a walkout, expressing dissatisfaction with the company’s slow progress in negotiating union contracts. This marked the largest strike thus far in the two-year endeavor to unionize Starbucks’ company-owned U.S. stores.

It encountered additional challenges, including boycotts in the Middle East and other regions, following its legal action against Workers United in October concerning a pro-Palestinian message on a union social media account.

Starbucks stock price analysis

At the time of press, SBUX stock was trading at $94.08, adding 0.30% since the previous closure. This stock added 1.65% to its value in the last five trading sessions.

SBUX is trading in the lower range of its 52-week span, raising concerns. This is particularly noteworthy, considering the S&P 500 Index is reaching new highs.

A support zone between 91.27 and 93.06 is marked by the convergence of various trend lines and significant moving averages across multiple time frames.

Conversely, a resistance zone exists between 94.83 and 97.52.

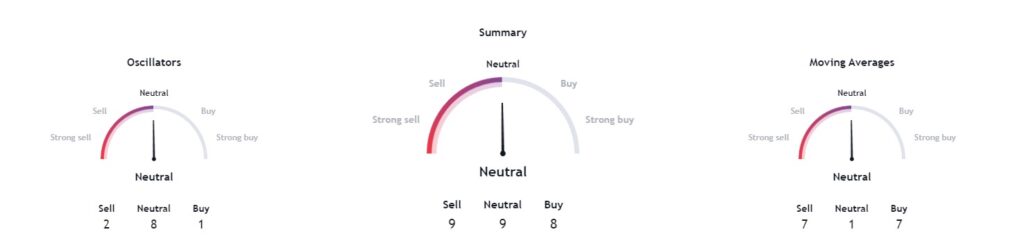

Technical indicators for SBUX are ‘neutral’ at 9. Moving averages are also ‘neutral’ at 1. As well as oscillators at 8.

Ultimately, what seemed like negligible effects of ongoing boycotts on Starbucks stock was misleading; the latest report conclusively revealed a significant impact, culminating in the company’s missed financial estimates.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.