Tesla (NASDAQ: TSLA) and its investors continue to face ongoing challenges. In addition to recent poor performance and declining demand, technical indicators are now signaling trouble for TSLA stock.

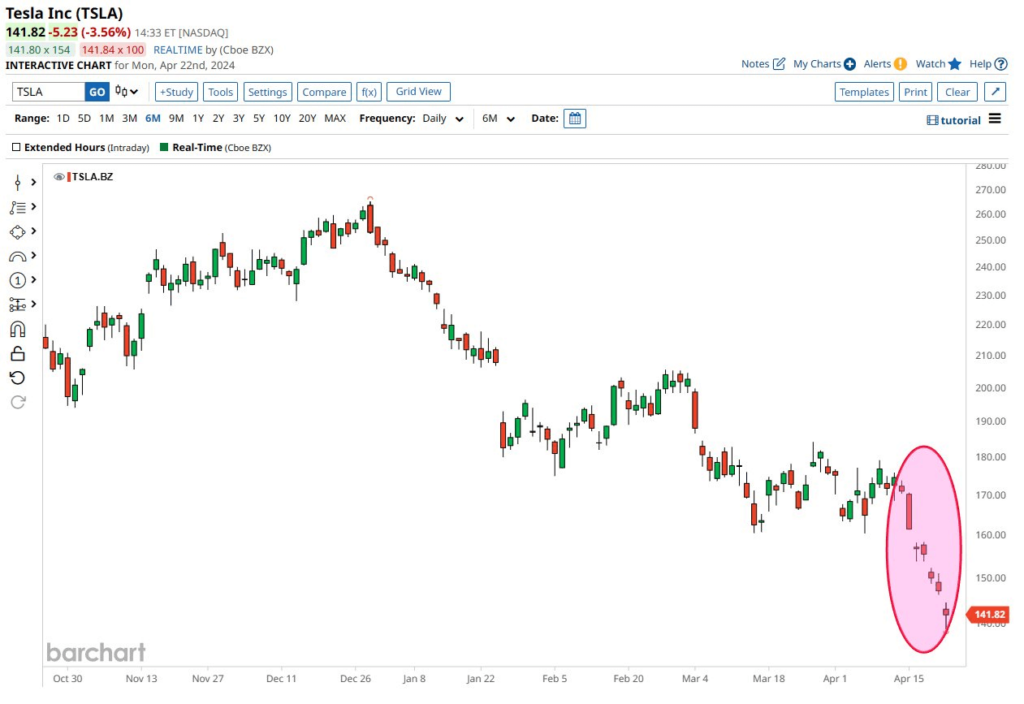

The stock has formed a ‘tear drop’ pattern on the price chart, with losses extending for seven consecutive trading sessions, marking Tesla’s longest losing streak since December 2022.

And with the analysts projecting lower-than-expected numbers in the earnings call, the losing streak is set to continue at least for one more trading session, barring any surprises.

What do analysts predict for Tesla stock?

Analysts anticipate Tesla’s first-quarter revenue of $22.34 billion, slightly lower than last year’s $23.33 billion. Tesla has beaten revenue estimates in three of the previous five quarters.

However, analysts expect earnings per share (EPS) to drop to $0.51, compared to $0.85 last year. Tesla has a mixed track record with EPS estimates over the past five quarters.

Bank of America analyst John Murphy highlighted concerns over weaker EV fundamentals and sentiment, with investors focusing on demand and future growth plans.

Wedbush analyst Daniel Ives underscored the critical importance of Tesla and CEO Elon Musk’s first-quarter conference call. Ives warned of potentially ‘darker days’ ahead if the call doesn’t provide a new strategy outlook.

Technical indicators work against TSLA shares

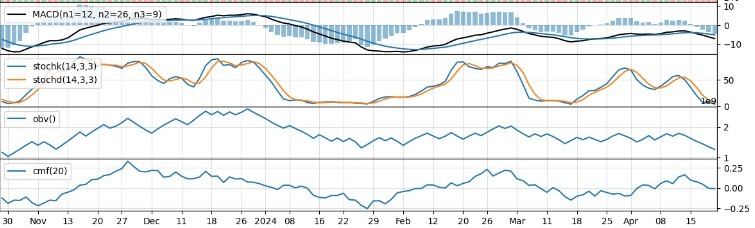

According to technical analysis, the short-term forecast for TSLA suggests a bearish trend. Various indicators, including trend indicators, momentum oscillators, and volume indicators, all indicate a continuation of the stock price’s downward trajectory.

Additionally, the narrowing Bollinger Bands, along with negative On-Balance-Volume (OBV) and Chaikin Money Flow (CMF), reinforce this bearish outlook.

All eyes are pointed towards Elon Musk ahead of the scheduled earnings call. Investors expect a clear-cut strategy on how to turn the tides for TSLA stock; otherwise, even darker days are ahead.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.