Tesla (NASDAQ: TSLA) and Palantir (NYSE: PLTR) have been some of the most-followed and well-publicized tech businesses of the last couple of years.

These companies have distinct technological advantages — whereas TSLA kickstarted the global shift to electric vehicles, PLTR has managed to secure a foothold as the go-to big data company — particularly for governments and government agencies.

Their performance through 2024, however, has been anything but similar. While Palantir shares have been on a steady upward trend, rallying by 174.34% on a year-to-date (YTD) basis, Tesla stock has managed to provide just 8.46% in returns over the same period of time.

While at first glance, this might seem like an easy choice, the automaker has seen a reversal of fortune as of late, with shares rallying by 23% in the last five days — and the data analytics company’s current growth trajectory would be hard to sustain.

Both of the companies are seen as frontrunners in terms of AI — with renowned Wedbush analyst Dan Ives referring to Palantir as the ‘Messi of AI’, while also opining that, at the moment, Tesla is the most undervalued business in the artificial intelligence space.

In order to provide some additional clarity, Finbold has consulted OpenAI’s most advanced publicly available model — ChatGpt-4o.

PLTR shares skyrocketed in 2024 — while TSLA stock has struggled

So, why the comparison? Both tech leaders have seen a significant shift in sentiment as of late. TSLA shares spent most of the year in the red — marred most recently by a disappointing Robotaxi reveal.

This was followed by a strong and unexpected earnings beat — which has renewed optimism that the stock could reach as high as $380 up from its current stock price of $269.43.

In contrast, PLTR stock saw an incredible bull run — but at current valuations, even the most bullish Palantir investors are worried about a potential correction — one that would, by all accounts, have to be severe.

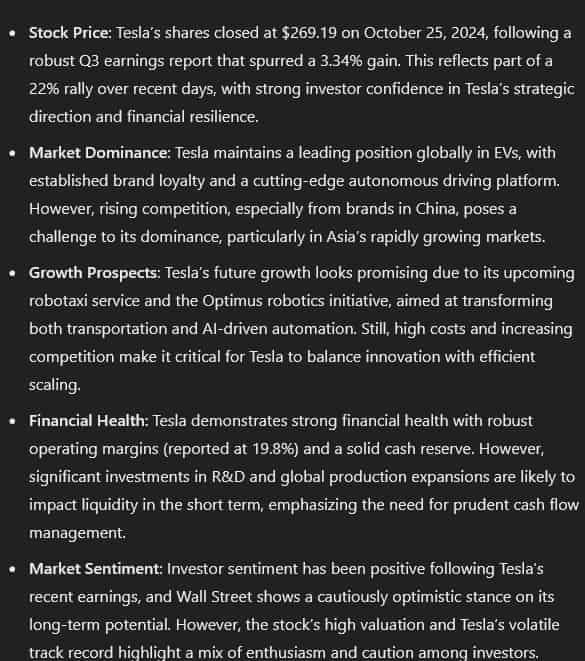

ChatGPT’s take on Tesla

When prompted to evaluate the electric vehicle trailblazer, OpenAI’s most advanced model gave a cautiously optimistic take.

Brand loyalty, robust margins, and the potential of robotaxis and Optimus robots were highlighted as advantages — however, increasing competition, the constant need for a high R&D budget, and the historical volatility of TSLA stock, together with its high valuation, were noted as causes for concern.

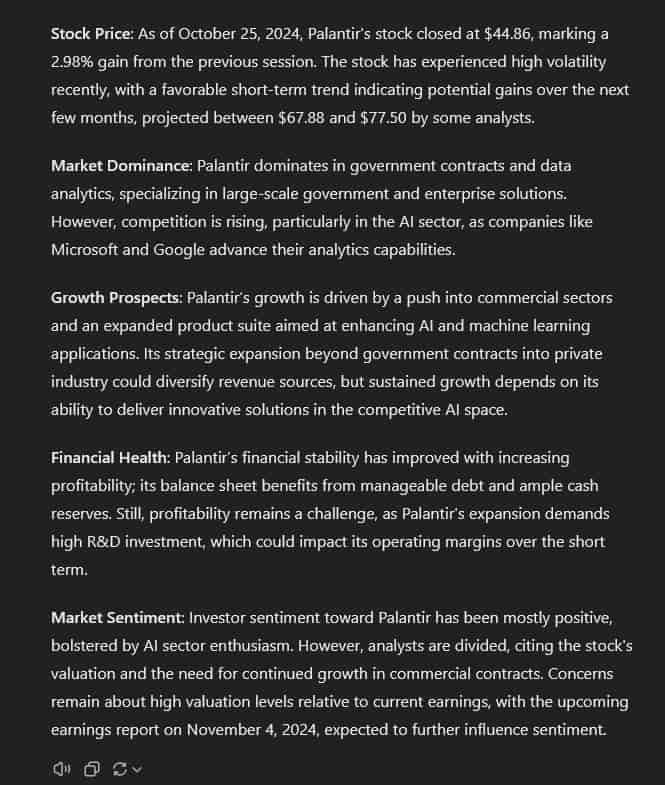

ChatGPT’s take on Palantir

The large language model noted the data analytics company’s dominance in terms of long-term government contracts and recent expansion into commercial sectors, but, on the whole, the outlook was less bullish when compared to its stance on the automaker.

GPT-4o drew attention to increasing competition from Microsoft (NASDAQ: MSFT) and Google (NASDAQ: GOOGL), as well as the need to continually deliver innovative solutions in the commercial sector, as well as the company’s high valuation as risk factors.

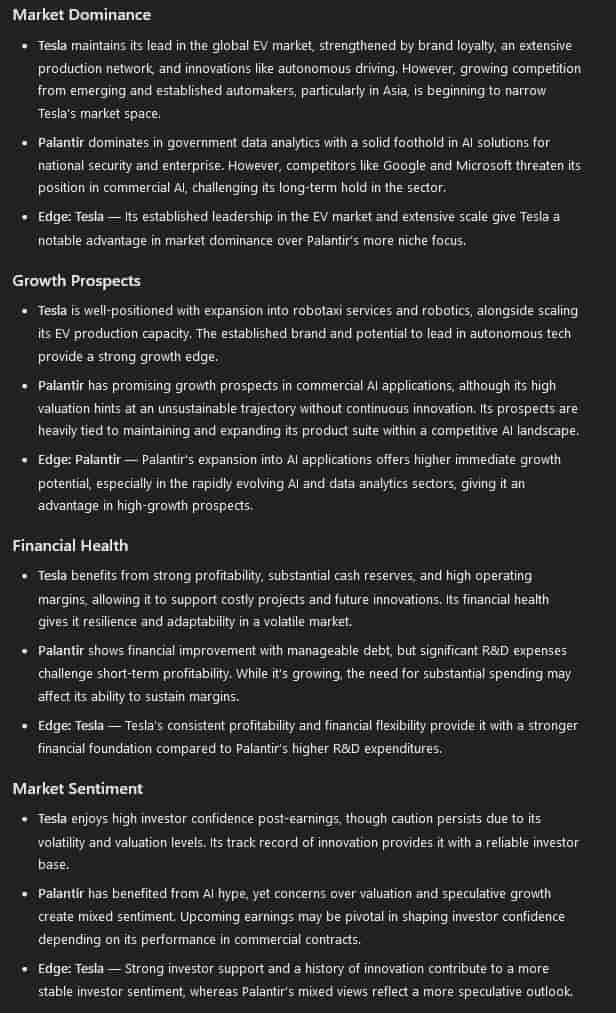

OpenAI’s ChatGPT-4o decides which stock provides a better opportunity

Ultimately, the artificial intelligence model gave the edge to the EV pioneer in three out of four categories.

While PLTR’s superior growth prospects in the short term were noted, TSLA’s consistent profitability, leadership, scale in EV markets, and history of innovation coupled with financial health led ChatGPT-4o to deem Tesla stock the better pick for 2025.

PLTR’s high valuation was consistently the most highlighted issue — however, the AI model did concede that the big data business has shown financial improvement in terms of financial health.

Although the results generated by large language models — even advanced ones, should not be a substitute for personal research, these findings are generally well-founded and show simple, yet effective reasoning.

It would seem that TSLA is the more appealing choice at the time of publication — but Palantir’s next earnings call, due November 4, will shed more light on the company’s realistic growth prospects and fair valuation, allowing investors to make their own judgments.