Finding insider buys among the S&P 500 companies and their stock might prove challenging in 2024, with an overall sentiment heavily favoring sales by CEOs and other higher executives; however, there are some notable exceptions.

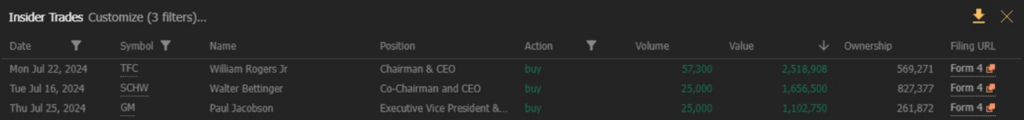

The data from the previous 30 days reveals that some higher executives showed trust in their companies and purchased their stock, according to the stock analytics platform TrendSpider.

TFC, SCHW, and GM stock recorded sizeable insider buys

The latest data reveals that the second half of July saw sizable insider buys in Truist Financial (NYSE: TFC), Charles Schwab (NYSE: SCHW), and General Motors (NYSE: GM) stocks.

In the largest purchase during July, the CEO of Truist Financial, William Rogers Jr, bought 57,300 shares on July 22 at an average price of $43.78 per share, for a total amount of $2,518,909.

Charles Schwab CEO Walter Bettinger conducted the second-largest purchase on July 16, where Bettinger bought 25,000 shares at an average price of $67.43 for a total investment of $1,656,500

Finally, On July 25, Paul Jacobson, General Motors’ CFO, purchased 25,000 shares at $44.13 each, for a total of $1,102,750.

There were also 24 other instances during the previous 30 days where notable insiders purchased stock from their companies for an amount that didn’t exceed $1 million.

The trend still heavily favors insider sales

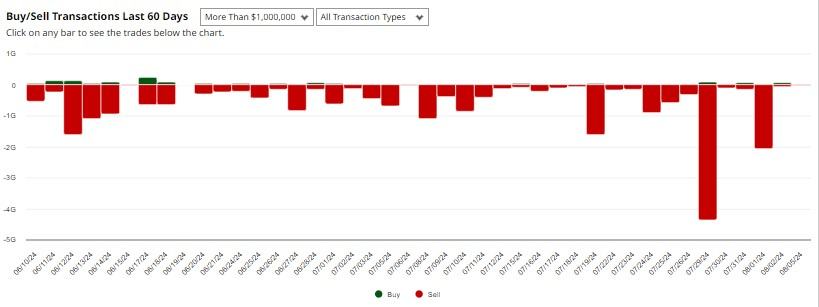

Looking at the comparison between insider sales and buys in the past 60 days, it is clear that insider sales heavily outperform insider buys.

The most sizable disparity occurred recently, on July 29, when stock sales outpaced purchases by $4.3 million compared to just $81,000.

The insiders from notable companies such as Nvidia (NASDAQ: NVDA), Amazon (NASDAQ: AMZN), and Apple (NASDAQ: AAPL) strictly focused on selling their holdings in 2024, aiming to maximize their gains due to a broader stock market rally.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.