Thomas Carper, renowned for his bets against the US economy, has returned to the trading scene after nearly a month-long hiatus. He’s back in action with a substantial volume of trades made over the past few days.

Notably, he allocated up to $100,000 towards the iShares Global Clean Energy ETF (NASDAQ: ICLN), aligning with his role as Chairman of the Senate Committee on Environment, and acquired multiple lithium stocks. Further, he purchased stock in Dominion Energy (NYSE: D), coinciding with his involvement on an energy subcommittee.

Not all trades are purchases

Conversely, Senator Carper divested from the phosphate mining company Mosaic and liquidated holdings in physical silver and gold ETFs.

Moreover, he sold stock in Equitrans Midstream (NYSE: ETRN), a natural gas pipeline company, reflecting his strategic adjustments within his investment portfolio.

These investment shifts and divestments may suggest an anticipation of forthcoming legislation favoring renewable and clean energy stocks, while potentially disadvantaging crude oil producers and traditional energy suppliers.

Was Carper right to divest from the energy sector?

As oil prices have steadily climbed since the start of the year, driven by reports of demand outpacing supply amid heightened tensions in the Middle East and Russia limiting production, both stocks and commodities have experienced notable gains on price charts. Some of them are now on the verge of forming a Golden Cross.

The Energy Select Sector SPDR Fund ETF (NYSEARCA: XLE), which reflects the S&P 500 energy sector, witnessed a rise of about 10.2%. This growth closely mirrors the broader S&P 500 index, which saw a 10.7% increase during the same period.

Consisting of companies engaged in oil production, drilling, refining, and transportation, this index has been the top performer within the S&P 500 over the past month and ranks third year-to-date.

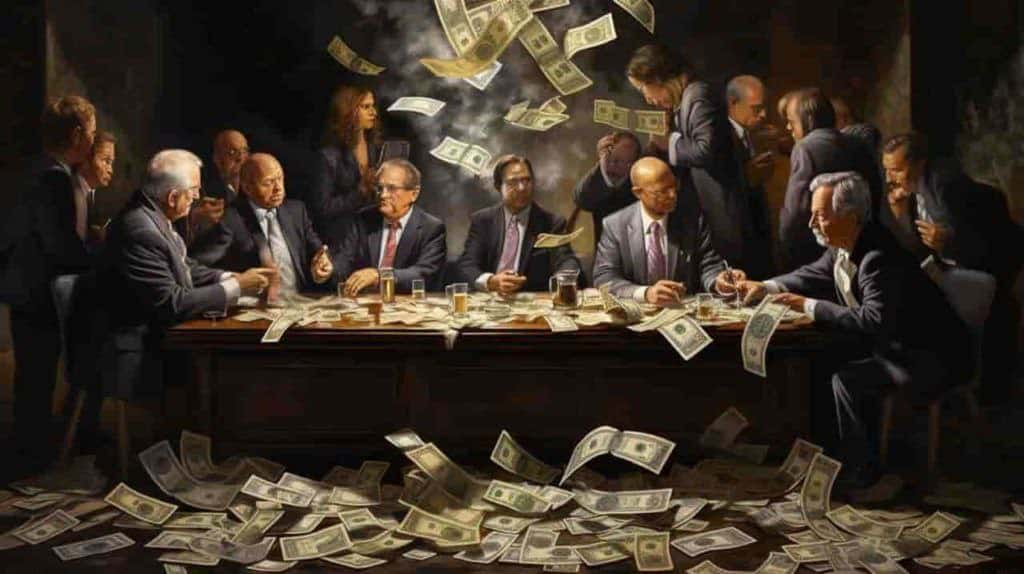

Senator Carper’s bold trading activity suggests a departure from the energy sector, despite its impressive performance. It raises questions about whether he possesses undisclosed information that could soon alter market dynamics.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.