During periods of stock market volatility and widespread uncertainty, identifying winning stocks among thousands can be challenging. However, when examining their historical performance, certain choices distinguish themselves by consistently adapting, overcoming challenges, and emerging profitable year after year.

Finbold analyzed historical performance, CEO guidance, financials, and other relevant indicators to identify three stocks investors can confidently buy and hold for profitable returns.

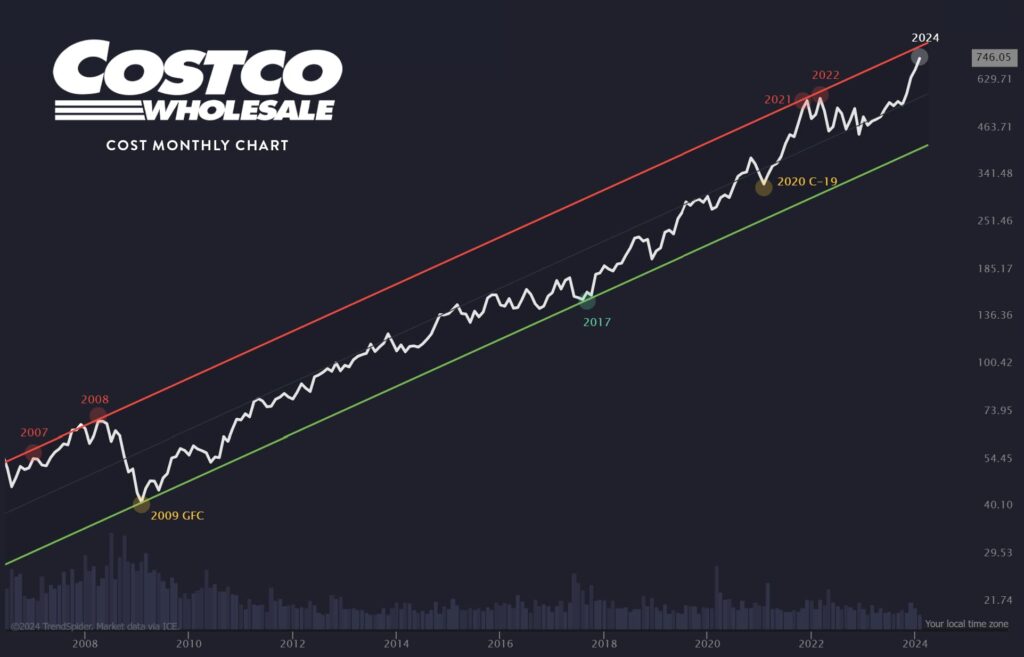

Costco Wholesale Corporation (NASDAQ: COST)

Commonly known as Costco (NASDAQ: COST), it is an American multinational corporation that runs membership-only big-box warehouse club retail stores. As of 2023, Costco holds the distinction of being the third-largest retailer globally.

There are promising indications that the upcoming year will bring further positive growth news. In early February, Costco revealed that comparable-store sales had risen by 5% through late January. Notably, Costco is seeing a significant rebound in its e-commerce segment, which typically sells more consumer discretionary products such as furniture and jewelry.

For investors prioritizing dividend-paying companies, Costco recently distributed a substantial special dividend that decreased its cash balance by over $7 billion.

Microsoft (NASDAQ: MSFT)

When thinking about the technology sector, one of the first companies that comes to mind is Microsoft (NASDAQ: MSFT), a tech giant that has further solidified its already significant presence in the industry through a series of projects aimed at diversification that bolstered stock price by more than 60% in 2023.

Many of these gains stemmed from Microsoft’s early adoption of generative artificial intelligence (AI), emphasizing diversification. Following its substantial investment in ChatGPT from OpenAI, Microsoft astounded the tech community by introducing Copilot.

Additionally, Microsoft Azure, its cloud computing division, deserves mention. As the world’s second-largest cloud infrastructure provider, Microsoft is ideally positioned to offer cloud-based AI services to its users. Notably, during its fiscal 2024 second quarter, Azure experienced a remarkable 30% year-over-year growth.

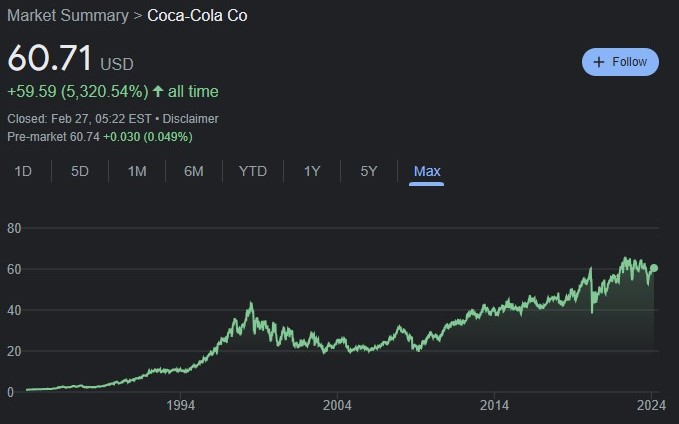

Coca-Cola (NYSE: KO)

Although Coca-Cola (NYSE: KO) might not be the top choice for every investor, it’s secure. As a soft drink industry giant, Coca-Cola stands head and shoulders above its competitors.

Regarding dividends, KO leads the pack in this arena, too. The company has a remarkable track record of consistently paying and increasing dividends for 62 consecutive years. Its dividend-friendly approach has earned it a significant place in Warren Buffett’s portfolio.

Moreover, Coca-Cola allocates a substantial portion of its revenue to advertising to maintain its status as the leading soft drink brand. Interestingly, the company is more diversified than many realize. Alongside familiar sodas like Sprite and Fanta, Coca-Cola also owns Powerade sports drinks, Minute Maid juices, Gold Peak tea, and Dasani water.

Since its initial public offering (IPO), KO stock has grown remarkably, with its valuation increasing by over 5,000%.

Although these selections may appear obvious to certain investors, they are frequently underestimated because of their steady progress, which demands a long-term investment mindset. This approach is typically the safest and requires minimal effort.

Investors allow these companies to work for them by employing diversification and dividend strategies to enhance the attractiveness of these stocks.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.