In recent weeks, extreme volatility in specific stocks has resurged following the return of popular trader Keith Gill, also known as Roaring Kitty, to social media. After a nearly four-year hiatus, Gill disclosed a sizable stake in GameStop (NYSE: GME), reigniting interest in the stock.

This activity has led to a short squeeze, a significant, short-term spike in a stock’s share price. A short squeeze happens when many short sellers are forced to buy shares to exit their positions simultaneously, driving the stock price up sharply.

However, short interest in GME stock recently died down as notable institutional sellers, such as Citron Research, exited their positions upon the news of GameStop executives’ newly raised $4 billion cash fund.

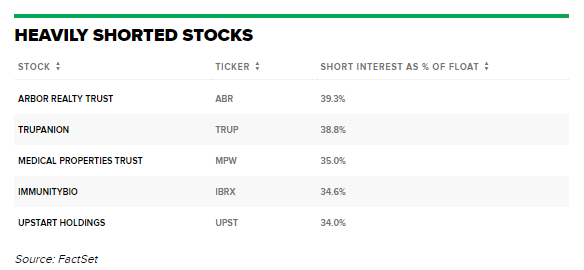

Its place has been filled by other notable firms with market caps larger than $2 billion and currently experiencing short-interest levels higher than 30%, indicating a high short percentage of the overall stock float.

Arbor Realty Trust (NYSE: ABR)

Arbor Realty Trust (NYSE: ABR) is a real estate finance company that focuses on investments in a diversified portfolio of structured finance assets in the multi-family and commercial real estate markets. The company primarily invests in real estate-related bridge loans.

Following the Q1 report, which missed earnings estimates, ABR has experienced heavy short-selling interest, amounting to almost 40% of the total float.

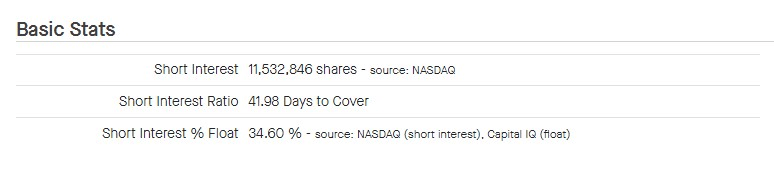

Trupanion (NASDAQ: TRUP)

Trupanion (NASDAQ: TRUP) offers pet insurance policies for cats and dogs, covering accidents, illnesses, and certain medical conditions. It aims to capture the largest share of the rapidly expanding pet insurance business.

A high short interest of 34.60% follows the news of insider selling activity by Melissa Joy Hewitt, the General Manager of Trupanion, where she sold 1,200 shares of common stock at a weighted average price of $30.04 per share, totaling over $36,000 on June 3.

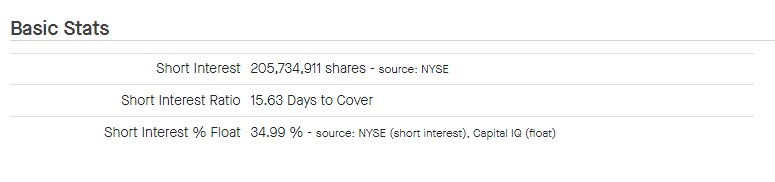

Medical Properties Trust (NYSE: MPW)

Medical Properties Trust (NYSE: MPV) from Alabama is a real estate investment trust that invests in healthcare facilities subject to NNN leases where the tenant agrees to pay the property expenses such as real estate taxes, building insurance, maintenance, rent, and utilities.

The company disclosed on May 16 that it had received a notice of non-compliance from the New York Stock Exchange (NYSE) due to a delay in filing its quarterly financial report, followed by heavy short interest of 34.99% in the upcoming month.

Two other notable listings are Immunitybio (NASDAQ: IBRX) and Upstart Holdings (NASDAQ: UPST), with short interests amounting to 34.6% and 34%, respectively.

Considering that any level above 20% of short interest in a stock is considered extremely high, these candidates might experience short squeezes as early as next week.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.