As we approach the end of the first month of 2024, investors are closely scrutinizing the overall stock market to gather insights into the potential trajectory of various sectors for the remainder of the year.

Notably, the general market commenced the year positively, with specific equities building upon the momentum from the 2023 end-year rally, spurred by indications that the Federal Reserve might lower interest rates this year.

Against this backdrop, the market performance has been diverse, with select sectors already exhibiting signs of breaking out, supported by robust fundamentals.

The 2024 winning sectors

According to data retrieved from Finviz on January 30, the communication services sector leads the stock market year-to-date with an 8.53% gain. This sector involves telecommunications, media, and internet services, reflecting the ongoing demand for connectivity and online content.

Notable performers in this sector include Alphabet (NASDAQ: GOOGL), with a 10% YTD gain, and Meta Platforms (NASDAQ: META), boasting a 15% gain in 2024.

The technology sector closely follows, showing a 6.5% gain this year. Technology companies, ranging from established giants to startups, remain influential, driven by advancements in artificial intelligence (AI), cloud computing, and cybersecurity.

Key players in technology include semiconductor giant Nvidia (NASDAQ: NVDA), surging nearly 30% in 2024, with significant growth in 2023 as the company tailored its products for the AI sector. Other leading stocks in the category include Advanced Micro Devices (NASDAQ: AMD), up 28%, and Broadcom (NASDAQ: AVGO), rallying 12% in 2024.

The healthcare sector has gained 2.4% YTD, fueled by diverse companies, from pharmaceutical giants to medical device manufacturers, capitalizing on sustained demand for healthcare products and services.

The financial sector recorded a solid 1.83% while the traditionally cautious consumer defensive sector is up 1.09%YTD, with companies providing essential goods and services such as food, beverages, and household products. Its stable performance mirrors consistent demand regardless of economic fluctuations.

2024 losing sectors

While some sectors exhibit positive performance, others grapple with challenges. The industrial sector, encompassing manufacturing, construction, and transportation companies, has experienced a 0.24% decline. This sector is particularly sensitive to economic indicators, and concerns about a potential slowdown may impact its performance.

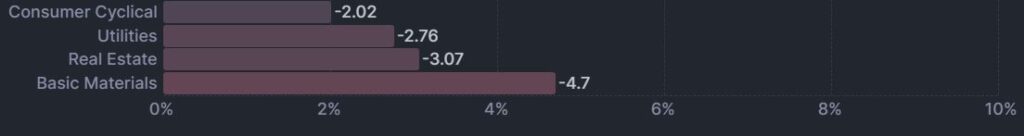

The consumer cyclical sector, comprising companies linked to discretionary spending such as autos, apparel, and leisure, is faring even worse, with a 2.02% decrease. Notably, worries about inflationary pressures and cautious consumer spending likely contribute to this sector’s struggles.

In contrast to its traditional role as a haven for investors seeking stability, the utilities sector has seen a significant 2.76% decline. In this instance, interest rate uncertainties may pressure utility companies’ debt levels and dividend payouts, contributing to the sector’s underperformance.

The real estate sector is also grappling with challenges, showing a 3.07% decline, while the basic materials sector is down a substantial 4.7%. This sector includes companies involved in producing and processing raw materials, and its performance is often linked to global economic activity and commodity prices, which have exhibited volatility recently.

In conclusion, while various stock sectors are currently experiencing a rally, it does not assure that this momentum will be sustained throughout the year. The overall stock market remains susceptible to macroeconomic fluctuations and is influenced by the economy’s overall health.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.