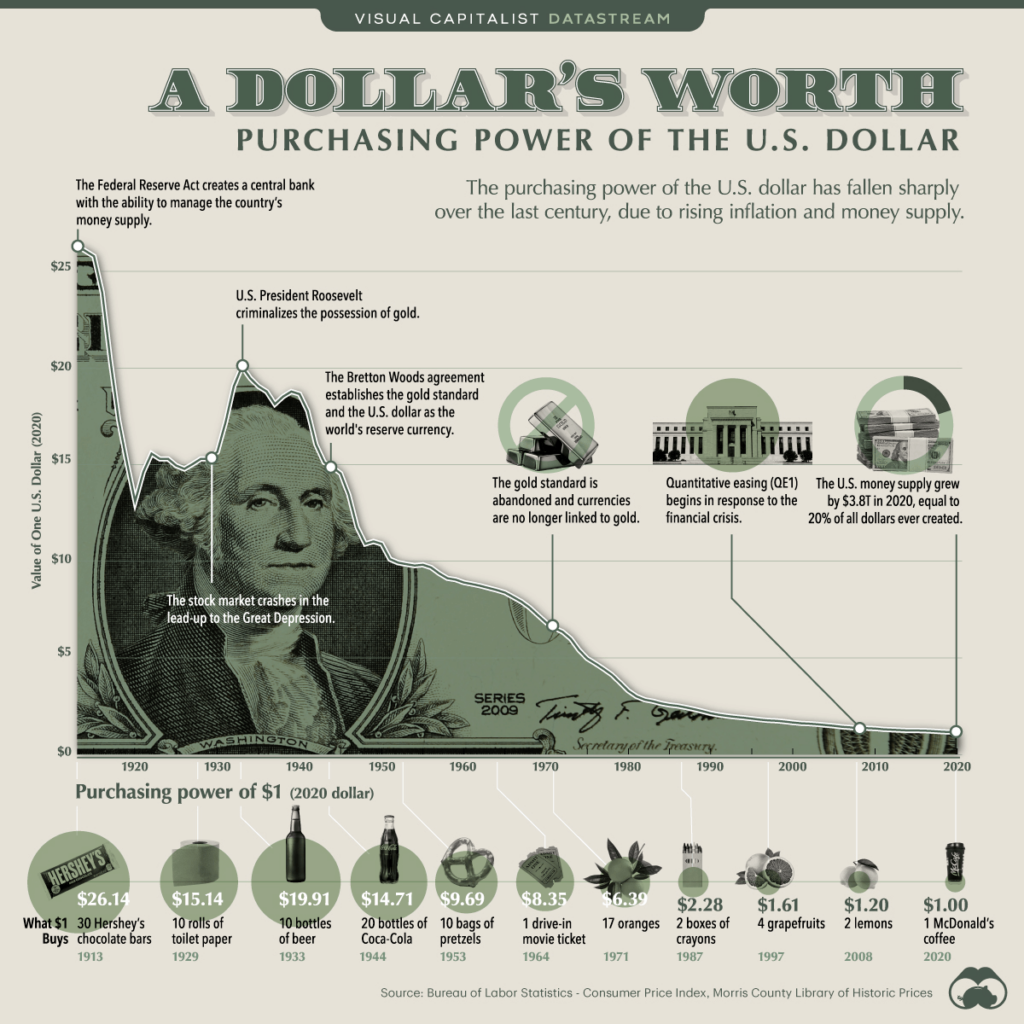

For the average citizen, inflation and the expanding money supply pose significant challenges.

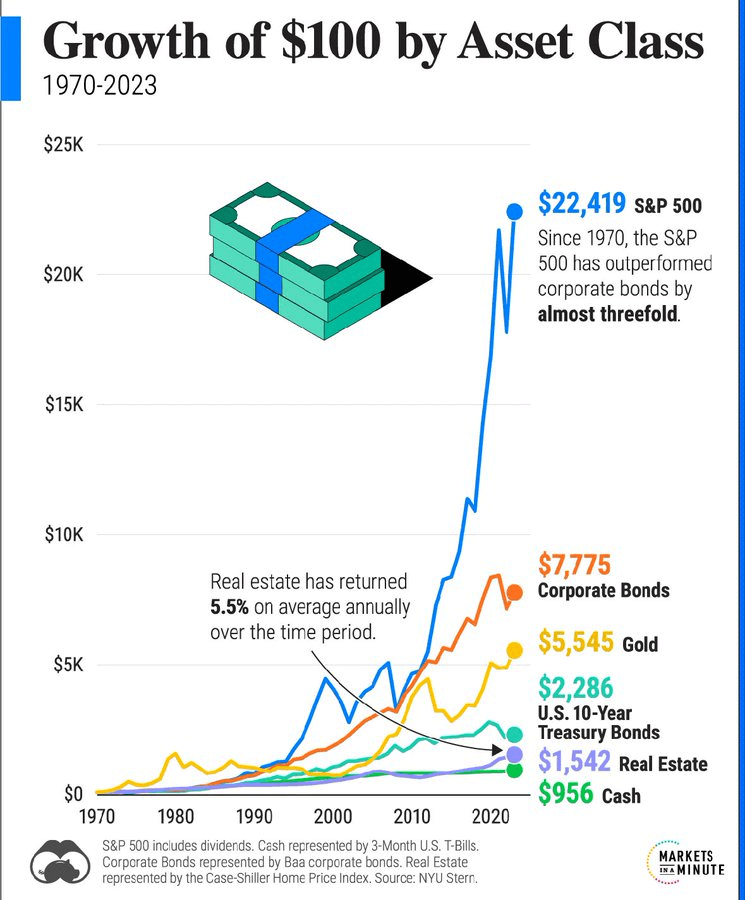

Seeking alternatives to safeguard against these threats, some have turned to stocks that have shown substantial growth, outpacing inflation by a considerable margin.

Looking at the past 10 years, Nvidia (NASDAQ: NVDA) has shown a remarkable increase of over 20,000%..

Advanced Micro Devices (NASDAQ: AMD) stock has surged by more than 4,000%, while Microsoft (NASDAQ: MSFT) and Netflix (NASDAQ: NFLX) have both seen gains exceeding 1,000%.

Tesla (NASDAQ: TSLA), Amazon (NASDAQ: AMZN), Apple (NASDAQ: AAPL), and Meta (NASDAQ: META) have also experienced notable increases in their stock values, ranging from around 900% to nearly 700%.

Alphabet’s (NASDAQ: GOOGL) growth stands at 444%, while the S&P 500 index has risen by 229%. Additionally, gold has appreciated by 70%, while the US Consumer Price Index (CPI) has increased by 32%.

Those who choose the US dollar as a form of savings made a mistake

Many individuals who choose to save their earnings through traditional methods, such as holding physical cash, especially in US dollars, may be in for an unpleasant surprise.

Over recent years and decades, inflation and the increasing money supply have significantly eroded the purchasing power of the US dollar, resulting in minimal returns on initial investments.

Historical example as an argument for investment in the stock market

With a robust annual return of 11.3% and a growth exceeding 200% over the past decade, the S&P 500 emerges as a top investment choice. It not only safeguards your money against inflation but also offers the potential for a handsome profit.

This is clearly illustrated by considering a $100 investment made in the S&P 500 in 1970, which would now be worth $22,419, vastly outperforming all other conventional investment options.

The stock market has made a return of 183.641% larger than that of cash, making a compelling case for reconsidering where to allocate savings and investments.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.