With the rising tensions around the world, it is no surprise that stocks in the war and defense sector are recording massive price gains, but what is interesting is the connection between these companies and some of America’s most prominent politicians, including United States Senator Lindsey Graham.

As it happens, the largest political donors to the senior Republican senator from South Carolina over the years have been the companies that have directly benefitted from war, according to the information revealed by the stock trade tracking platform Insider Tracker in an X post on January 29.

On top of that, to further draw attention to this connection, the platform attached Graham’s recent post in which he calls for war against Iran following the recent escalation of violence against the US forces in the Middle East region that, as the Senator said, has seen more than 100 incidents.

Picks for you

#1 Raytheon (NYSE: RTX)

Indeed, one of the companies benefitting from the increased tensions is Raytheon (NYSE: RTX), which supports other contractors’ essential military platforms and contributes to advanced military technology through its United Technologies branch specializing in aerospace components.

At press time, the price of Raytheon stock stood at $90.08, recording a 0.37% decline over the day but nonetheless increasing 5.95% on its weekly chart and growing 7.02% across the month after signing an important contract with the US Air Force, as per data on January 30.

#2 Lockheed Martin (NYSE: LMT)

Furthermore, the second mentioned stock is that of the defense and aerospace behemoth that engages in research, design, development, manufacture, integration, and sustainment of cutting-edge technology systems, products, and services worldwide, Lockheed Martin (NYSE: LMT).

That said, the LMT stock has recorded some losses in recent weeks that have threatened to offset the increases starting after the October 7 attack on Israel. Notably, its current price is $428.01, down 0.44% on the day, losing 6.7% across the week and dropping 5.15% over the last month.

#3 General Dynamics (NYSE: GD)

Meanwhile, one of the leading military shipbuilders and suppliers, which also manufactures tanks and land vehicles, such as the Abrams tank line and Stryker combat vehicles, and offers cybersecurity and logistics solutions, General Dynamics (NYSE: GD) has profited from the war as well.

Presently, GD stock is trading at $264.78, down 0.11% in the last 24 hours, but nonetheless recording gains on all of its other charts after rising sharply on January 24, and is currently up 6.01% on the week, with an accumulated 2.57% advance on its monthly chart.

#4 L3Harris Technologies (NYSE: LHX)

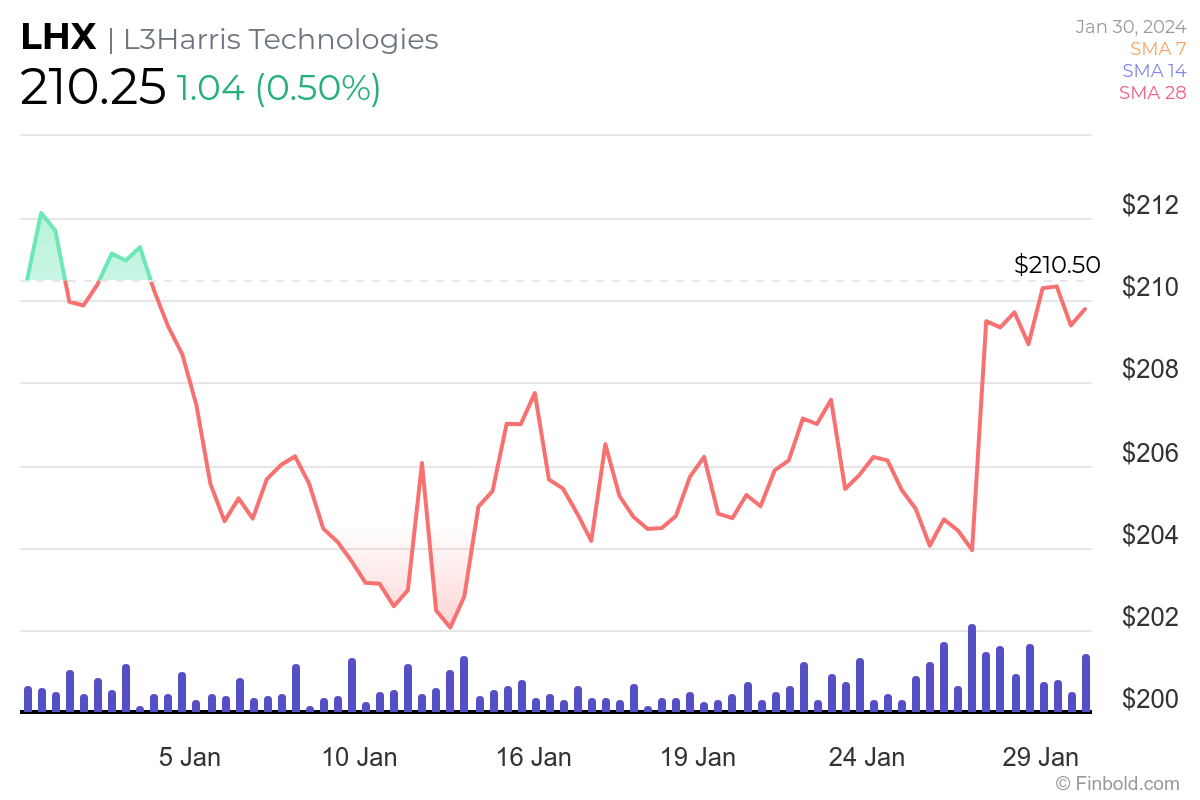

Another is Lockheed’s main competitor, L3Harris Technologies (NYSE: LHX) provides defense and commercial technologies across air, land, sea, space, and cyber missions through its Integrated Mission Systems, Space and Airborne Systems, Communication Systems, and Aviation Systems.

Its stock is currently changing hands at the price of $210.25, up 0.5% on the day and gaining 1.66% over the past week with a sharp increase on January 26, targeting to recover the losses of 0.32% from the previous month, according to the most recent information retrieved by Finbold.

#5 Northrop Grumman (NYSE: NOC)

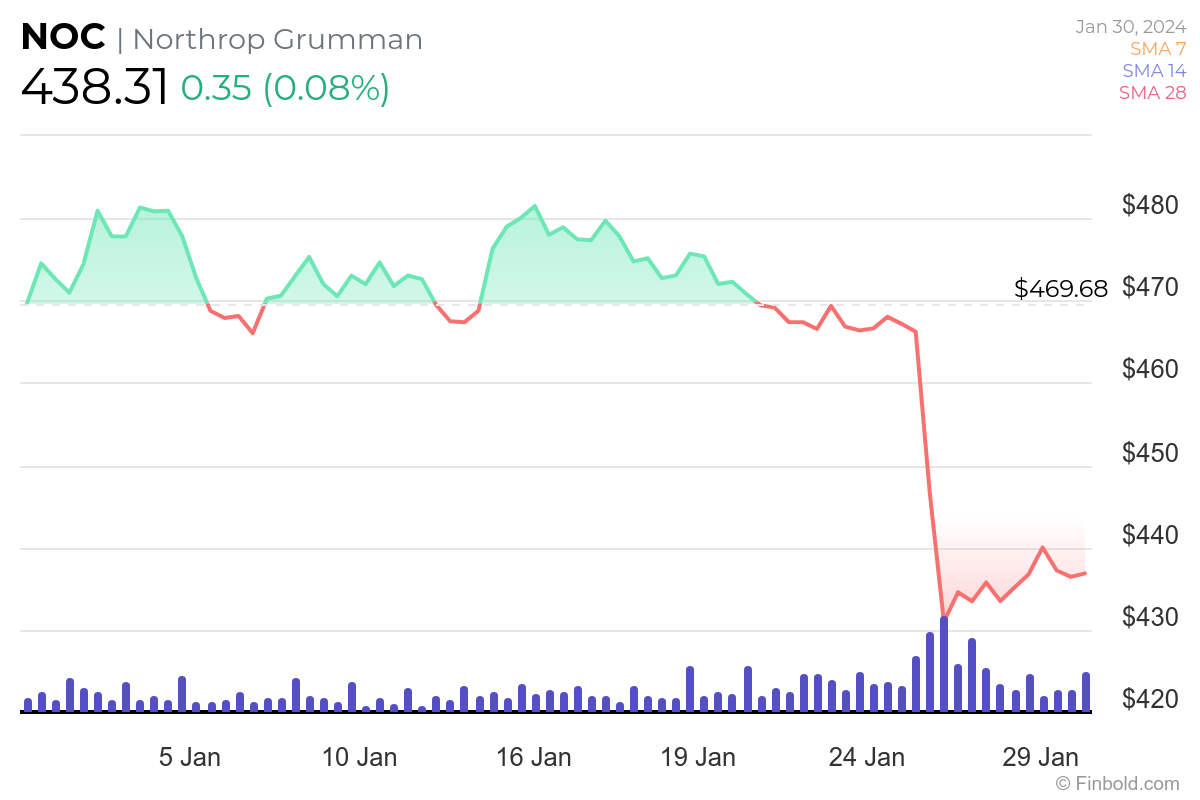

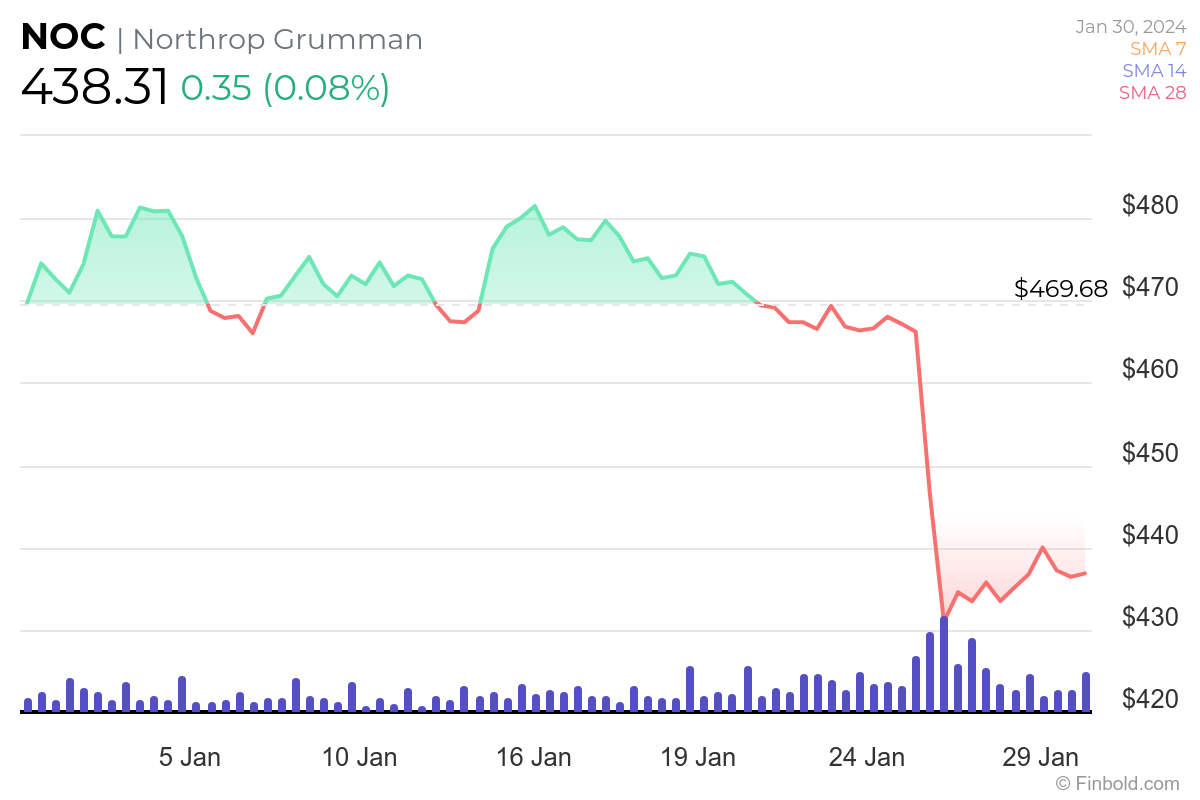

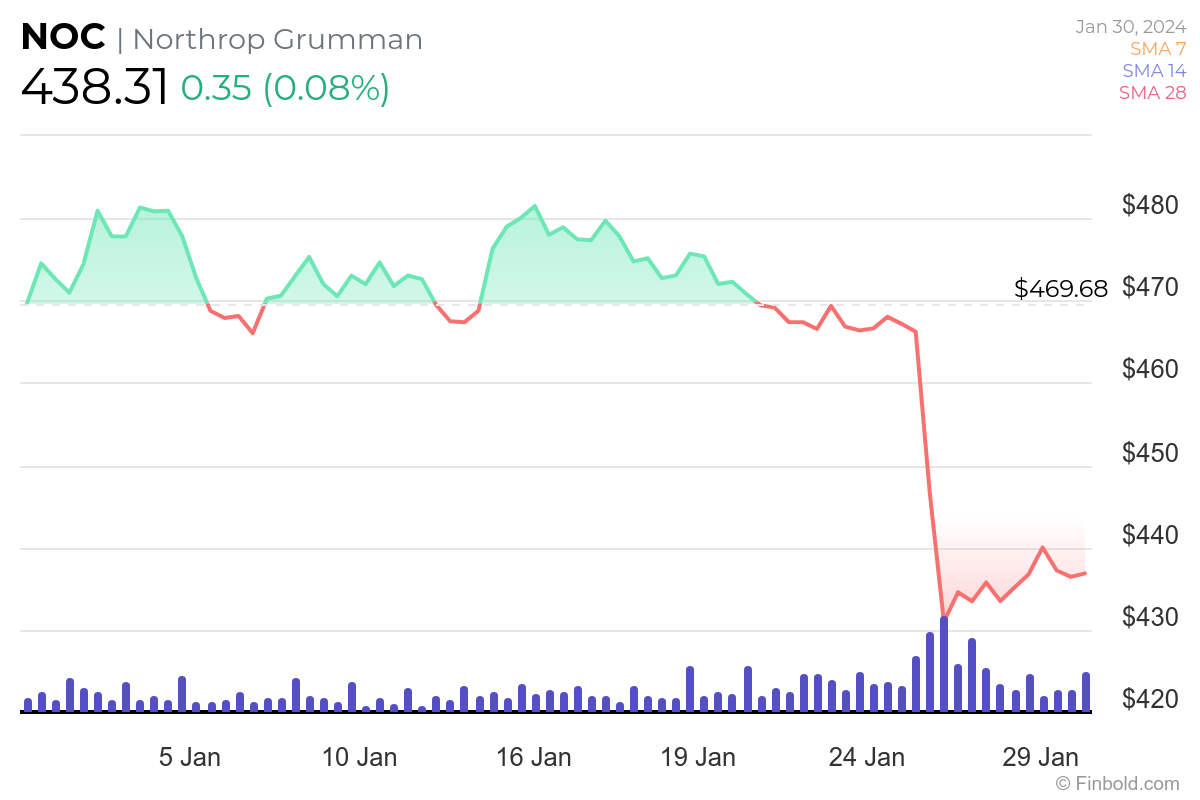

Finally, the aerospace, defense, and security giant that mainly caters to the US government under the Department of Defense and intelligence community, Northrop Grumman (NYSE: NOC) is also among Graham’s supporters that have benefitted from the increasing warmongering around the world.

As things stand, NOC shares are changing hands at the price of $438.31, up 0.08% in the last 24 hours, as it moves to recover the losses of 6.07% over the previous seven days and the decline of 5.88% from the past month, as the latest charts indicate.

Conclusion

As seen above, some US politicians have benefitted from the rising conflicts and saber rattling worldwide, sparking questions over whether such influential people should have access to trading stocks, considering that their actions and policies can (in)directly affect prices.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.