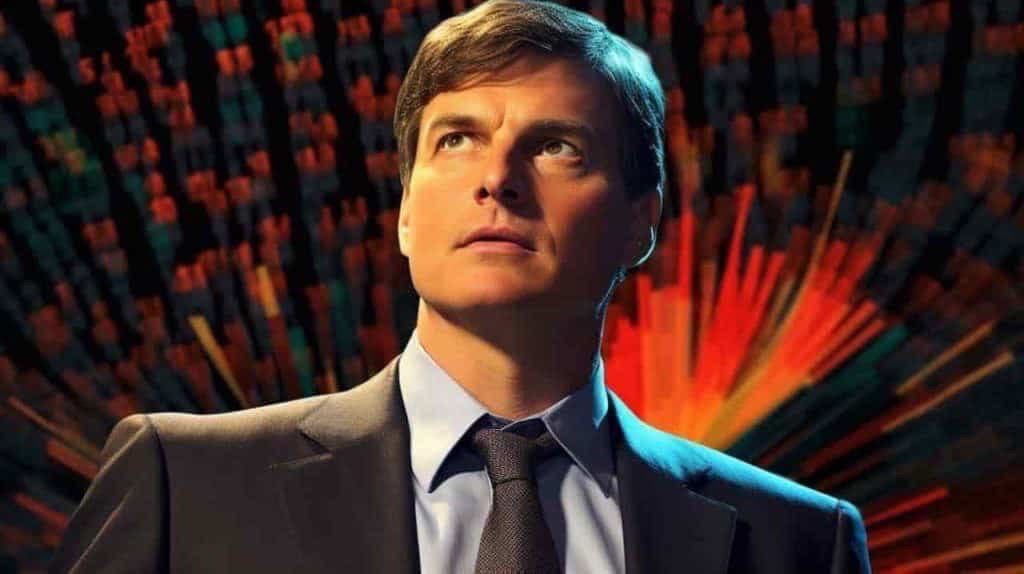

Several consecutive 13-f filings made by Michael Burry’s Scion Asset Management revealed a string of seemingly unprofitable trades.

Though the original 2023 bet against the semiconductor industry was dropped, the lackluster Alibaba (NYSE: BABA) long position remained in focus throughout the first quarter of 2024.

The latest filing, however – released on May 15 – changed the situation drastically as, while the two major Chinese stocks, BABA and JD.com (NASDAQ: JD) continued to dominate the portfolio, a series of smaller but highly successful investments took place.

One stock that has seen a particularly rapid rise following the latest 13-f filing is that of the solar panel manufacturing company First Solar (NASDAQ: FSLR).

First Solar stock price chart

While it is difficult to gauge the exact point of Burry’s purchase of FSLR stock, the company is up approximately 42% since the filing and 58.96% since the end of the first quarter of the year – the latest possible moment for ‘The Big Short’ investor to have bought the shares.

Whatever Burry’s purchase point, FSLR’s stock market performance since the start of 2024 ensures that the famous investor is in the green on the bet, given that the company spent the entire Q1 roughly in the range between $140 and $172.

In contrast, First Solar stock price today stands at $274.29 after a 59.32% year-to-date (YTD) rise.

Burry’s best 2024 bets

While FSLR’s two-week performance is certainly impressive, it is far from the only successful trade Michael Burry made in 2024.

An investment ‘The Big Short’ investor made approximately one year ago – Safe Bulkers (NYSE: SB) – recently completed an 80% 12-month rise, and, solidifying the gains even further, rose another 3.79% since crossing the threshold at the very beginning of June.

Earlier this year, another of Burry’s holdings – GEN Restaurant Group (NASDAQ: GENK) – made headlines after it managed several weeks of relentless rising, at one point finding itself 50% in the green within just 7 days.

Unlike with SB and FSLR, however, the famous investor dropped his GENK position before the end of Q1.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.