Decentralized finance (DeFi) project Solana (SOL) has gained attention for its speed and scalability. However, recent analyses have revealed a critical issue affecting the platform: an alarmingly high rate of failed transactions.

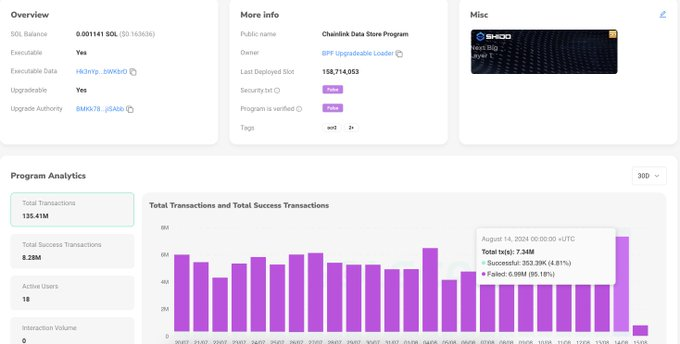

In particular, a detailed analysis by a Cardano (ADA) developer using the pseudonym Dave, shared in an X post on August 19, revealed that nearly 93.89% of all transactions executed via the Chainlink Data Store Program on Solana failed in the last 30 days. This equates to approximately 127.13 million failed transactions compared to only 8.28 million successful ones.

What’s striking is the financial burden these failures impose on users. According to the expert, the average fee for a failed transaction stands at 0.000005 SOL, amounting to approximately 635.65 SOL lost in total over the past month. Based on SOL valuations at the time of publishing the analysis, this translates to a staggering $91,090.48. This amount excludes high-priority fees, further inflating users’ costs.

Given this data, the main question is how the system remains sustainable despite significant failures. For Solana, the network infrastructure might offer the answer, as many of these failed transactions stem from spam or arbitrage transactions, where on-chain bots flood the network to exploit tiny inefficiencies for profit.

For these bots, the cost of spamming the network is negligible compared to the potential rewards, leading to congestion and the subsequent failure of legitimate user transactions.

Solana’s congestion woes

Interestingly, Solana’s congestion problems aren’t new. The network has grappled with these issues for a while, and recent upgrades aim to address them. Introducing solutions like QUIC, designed to improve communication between users and the network’s block leaders, is a step in the right direction.

However, this new architecture has flaws, particularly in restricting connections during high-demand periods. As a result, legitimate transactions often get discarded alongside spam, exacerbating user frustration.

Despite these issues, Solana’s ecosystem continues to thrive. The platform has seen a rise in decentralized exchange (DEX) activities and the launch of new projects like the Saga smartphone. Additionally, the network has been central to the meme cryptocurrency trend, with several popular coins launching on the platform.

Indeed, this interest in meme coins has recently contributed to a significant spike in the value of SOL.

SOL price analysis

Solana has experienced significant volatility in the short term, with the asset trading at $140 as of press time. On the 24-hour chart, this reflects a daily loss of about 3.2%, while on the weekly timeframe, SOL is down 3%.

In the meantime, with Solana lacking notable catalysts to influence the price, the asset is reliant on the general market trajectory. Amid this movement, the crypto is targeting a reclamation of the $150 resistance level.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.