President Joe Biden recently brought taxes – capital gains taxes – into the forefront of the discussion with a budget plan that immediately proved a hot topic of discussion.

The plan would entail raising the maximum capital gains tax rate to an unprecedented 44.6%. For comparison, the rate started off at 7%, rose to 12.5% with the introduction of the Revenue Act in 1921, and only briefly stood at the previous record of 40% under President Carter.

Biden’s proposal also made a stir as it included another unprecedented element: an unrealized gains tax that would affect investors worth more than $100 million.

Picks for you

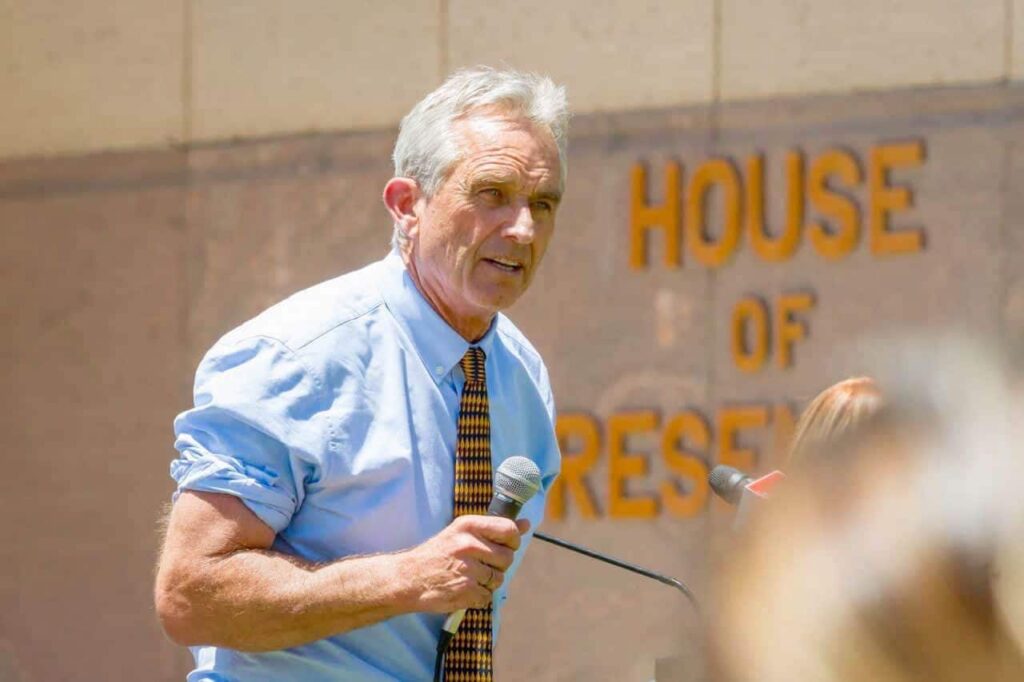

Having analyzed in response what a Trump tax rate might look like and the issues its implementation might face, Finbold decided to turn toward the independent Dalcassian candidate, Robert F. Kennedy Junior, the third most likely man to become president and see what his plan might look like.

The RFK capital gains tax

Given that he was one of the first to mention tax policy during the campaign, RFK Jr. has been surprisingly tight-lipped about hypothetical and desired changes to capital gains tax rates.

Some likely policy decisions can, however, be inferred from his other promises, best exemplified by one of the campaign slogans: It’s “We The People,” Not “We The Corporations.”

This, paired with the promise to close the Washington revolving door of politicians and bureaucrats swiftly moving to executive and lobbyist jobs and vice versa, might indicate that changing tax rates might be less of a priority than closing the numerous loopholes.

In a tax sense, these loopholes helped lead to a situation in which the IRS head recently claimed the richest Americans managed to evade paying about $150 billion each year.

Such a conclusion is further bolstered by the preferences of RFK Jr. voters, as compiled by the platform iSideWith, which indicates closing loopholes, levying more taxes on the richest, and keeping the capital gains rate unchanged not to disincentivize investing are high priorities.

RFK’s Bitcoin centerpiece

One area Kennedy has not been vague in is taxing Bitcoin (BTC). Already in the summer of 2023, RFK Jr. explained he believed that BTC should be exempted from capital gains taxes, particularly when being converted into dollars or another fiat currency.

While the approach is very enticing to any crypto trader, something can be said about the conclusion reached by Joseph Thorndike and Robert Goulder: it carries a paradox in its heart.

Indeed, exempting Bitcoin from capital gains taxes would, in all likelihood, contradict Kennedy’s hypothetical anti-corruption drive as it would open new loopholes to replace the ones he would have presumably closed.