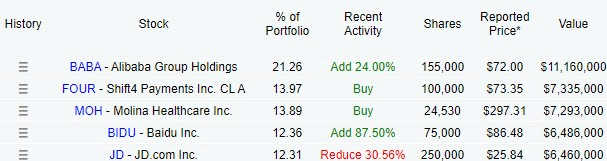

Recent 13F fillings for Q2 revealed that JD.com (NASDAQ: JD) stock is now legendary investor Michael Burry’s fifth-largest holding at 12.31% portfolio weighting after a 30.56% reduction in the previous quarter.

Interestingly, during the previous trading day, JD stock fell 4.57%, decreasing the price of JD shares to $28.19 at the close. Losses extended in pre-market trading by 7.09%.

So, what exactly caused the slump in this Chinese e-commerce company’s stock on August 21?

News of Walmart offloading JD stock sent its price crashing down

After reports of Walmart‘s (NYSE: WMT) plan to sell JD stock at $24.85 to $25.85 per share, with 144.5 million shares offered, JD shares experienced a sudden dip.

Namely, since then, a Reuters report on August 21 confirmed that Walmart had sold its entire stake in the e-commerce company, offloading all shares, which amounted to 5.19% of the total shares available, for a potential profit of $3.74 billion.

The dip in JD shares was caused by Walmart’s price offering for its holdings of shares being about 11% lower than the August 20 closing price, thus negatively affecting its performance in the upcoming trading session.

According to Walmart executives, this move comes after the company decided to focus on its own China and core online business.

JD stock is a victim of a brutal price war in China

Despite a continuous price war with its rivals Alibaba (NYSE: BABA) and PDD Holdings (NASDAQ: PDD), the parent company of Temu, JD reported stronger-than-expected Q2 earnings, however, with diminishing revenue growth and profit margins.

Conversely, JD stock has experienced a 77% downturn from its February 19, 2021, all-time high of $106.09, managing to record only a 3.64% gain in 2024 so far.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.