For newcomers to the stock market scene, it’s wise to take cues from successful investors like Warren Buffett, the chairman of Berkshire Hathaway (NYSE: BRK.A).

Recently, one of his investments, Occidental Petroleum (NYSE: OXY), showed signs of breaking out of its stagnant price range, as well on the monthly price chart, suggesting a potential to surpass its resistance level at $66.

If the ongoing trend persists, OXY’s share price could be primed to surpass its 6-year high, which was set way back in 2018, when its price reached a high of $83.33.

Given the ongoing increase in oil prices since the start of the year, fueled by reports of demand outpacing supply amid escalating tensions in the Middle East, and Russia limiting its production, it’s clear why OXY stock is surging.

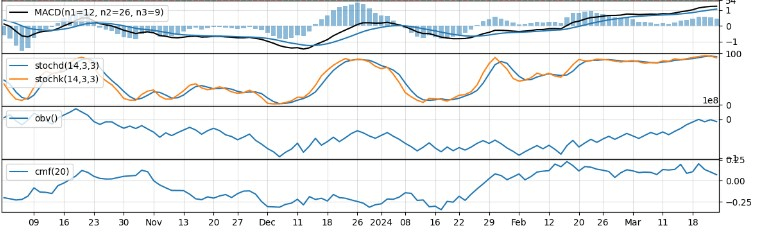

OXY stock technical analysis

As of the most recent close on March 28, OXY stock was priced at $64.99, showing a gain of 1.23% in the latest session. Over the past five trading days, it has seen a 1.55% increase.

Looking at the bigger picture, OXY shares have surged 8.23% year-to-date.

A support zone is identified between $61.25 and $61.44, marked by various trend lines and significant moving averages across multiple time frames.

Conversely, there’s a resistance zone between $66.15 and $67.30, also defined by multiple trend lines.

Considering further technical indicators, OXY’s stock price is expected to undergo a short-term consolidation or pullback following its recent bullish trend.

Overbought conditions and weakening momentum suggest a potential change in market sentiment. Keeping an eye on critical support and resistance levels for potential entry or exit opportunities is advised.

The futuristic approach draws Buffett towards OXY stock

In his recent annual letter to Berkshire shareholders, Buffett commended Occidental Petroleum for its extensive oil and gas holdings, indicating the company’s focus on securing future energy resources.

He also lauded their leadership in carbon capture efforts, acknowledging Berkshire’s support despite uncertainties about its economic feasibility. This prompts inquiries into the concept of carbon capture and its potential to mitigate fossil fuel emissions.

Fossil fuels such as oil, coal, and natural gas produce carbon dioxide (CO2), contributing to global warming. Carbon capture technology, as the name implies, prevents these harmful carbon molecules from dispersing into the atmosphere or soil.

Buffett acknowledges the potential economic advantages of carbon capture technology while also recognizing its broader benefits for the public and the planet.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.