Last month, the energy sector saw notable gains thanks to escalating geopolitical tensions in the Middle East and Russia. Among the beneficiaries is Occidental Petroleum (NYSE: OXY), a favorite stock of renowned investor Warren Buffett, which is poised for a significant increase in value as it nears a Golden Cross formation.

Recent strong performance on price charts, coupled with Buffett’s renewed investments and further acquisitions, all point towards a promising outlook for OXY stock and its potential future performance, which now exhibits itself in an imminent Golden Cross formation, which occurs when a short-term moving average (50-day) of an asset rises above a long-term moving average (200-day).

The broader energy sector is experiencing gains

OXY stock isn’t the only one seeing gains in the energy sector. With oil prices steadily rising since the beginning of the year due to reports of demand surpassing supply amidst heightened tensions in the Middle East and Russia limiting production, other stocks and commodities are also on the brink of a Golden Cross formation.

Picks for you

Specifically, both crude oil and Exxon Mobil (NYSE: XOM) price charts are signaling an imminent Golden Cross formation, suggesting a positive trend for the broader sector.

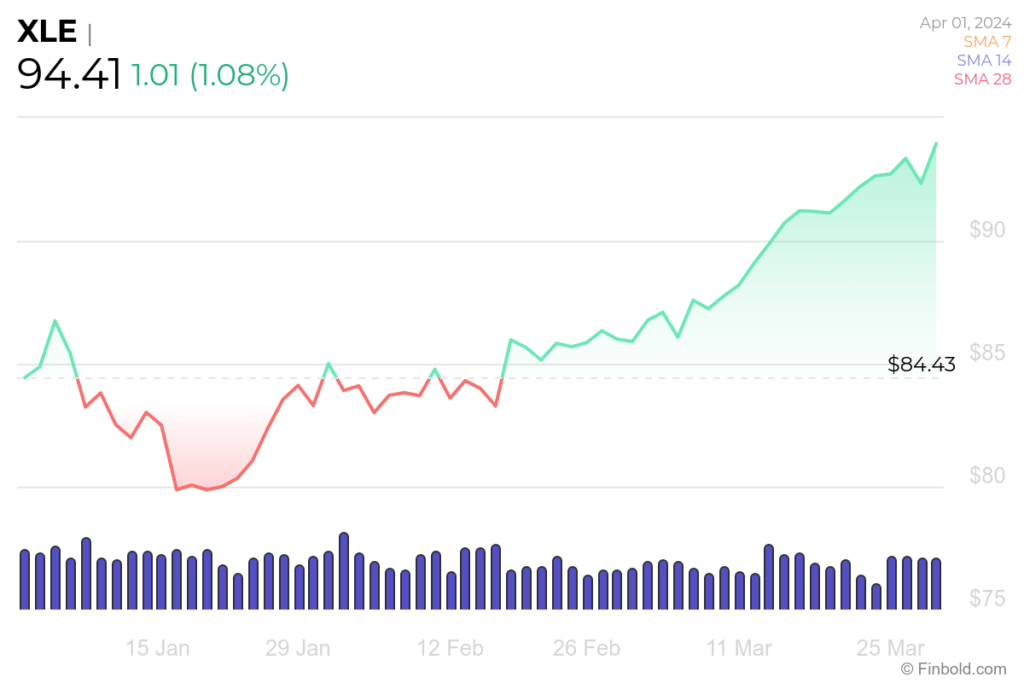

XLE ETF as an indicator of performance

In the first quarter of 2024, the Energy Select Sector SPDR Fund ETF (NYSEARCA: XLE), which mirrors the S&P 500 energy sector, saw a rise of approximately 10.2%. This performance closely mirrors that of the broader S&P 500 index, which increased by 10.7% over the same period.

Comprised of companies involved in oil production, drilling, refining, and transportation, this index has been the top-performing sector within the S&P 500 over the past month and ranks third year-to-date.

As of March 28, 2024, XLE manages assets totaling $39.44 billion. Apart from Exxon, its major components include Chevron (NYSE: CVX), ConocoPhillips (NYSE: COP), SLB (NYSE: SLB), and EOG Resources (NYSE: EOG).

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.