Palantir Technologies (NYSE: PLTR), known for its role in providing data analytics software, is potentially set for a bearish correction just weeks after enjoying positive sentiment.

It’s worth noting that after impressive Q2 2024 financial results, Palantir’s stock price embarked on a bullish momentum, targeting the $40 mark. However, the stock’s rally was cut short, failing to reach the $35 level.

PLTR was trading at $31 at press time, gaining over 2% in the last 24 hours. The tech firm’s focus on artificial intelligence (AI) has helped PLTR rally 86% in 2024.

PLTR stock price bearish outlook

According to an analysis shared by trading expert TradingShot in a TradingView post on August 30, the stock has been in a rising channel since early May 2023, suggesting a potential decline in price following its recent bullish trend.

Since hitting a low on May 4, 2023, Palantir has been trading within a “channel up” pattern, consistently forming higher and lower highs. Recently, the stock reached the upper boundary of this channel—the “higher highs” trend line—signaling a potential end to its bullish run. This move aligns with the analysis of the Sine Waves, indicating that the bullish leg has concluded.

TradingShot’s analysis pointed to a medium-term pullback in Palantir’s stock price. Historically, corrections within this channel have been marked by “lower highs,” where the stock price breaks below the 50-day moving average (MA50) and eventually hits the 100-day moving average (MA100). The previous three bearish legs followed similar patterns, with prices dipping below the MA50 and reaching at least the MA100 before rebounding into a new bullish leg.

Based on this pattern, TradingShot forecasted that Palantir will likely test the one-day MA100 soon. The predicted price target for this bearish leg is $26, a level above the minimum correction percentage seen within this rising channel.

The analysis also emphasized the importance of the Relative Strength Index (RSI) in identifying potential buying opportunities within this channel. Historically, the most vital buy signals have occurred when the one-day RSI drops into the support zone of 35.85 – 30.20. If Palantir’s stock price declines as expected and the RSI falls to this level, it could present a robust buying opportunity for investors looking to capitalize on a rebound.

Palantir records surge in institutional ownership

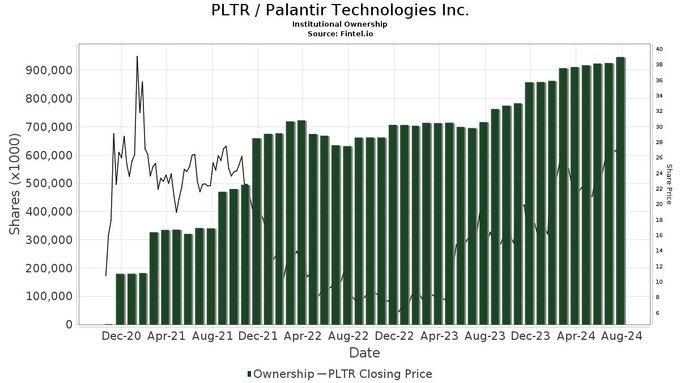

Despite the bearish analysis, Palantir continues to experience a notable surge in institutional ownership, now at approximately 44%. This growth represents a significant 25% increase compared to the same period last year, indicating growing confidence in the data analytics company among large financial institutions.

Institutional ownership is often viewed as a barometer of confidence among professional investors, including hedge, mutual, and pension funds. An increase in this metric typically signals positive sentiment, suggesting that these large-scale investors are optimistic about a company’s prospects.

For Palantir, the consistent rise in institutional ownership since mid-2021 has occurred despite fluctuations in its stock price, revealing steady belief in the company’s strategic expansion efforts, government contracts, and the rising demand for its data analytics solutions.

Overall, higher levels of institutional investment often contribute to greater price stability, as these investors generally hold a longer-term perspective than retail investors, potentially leading to reduced volatility.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.