As the cryptocurrency sector starts another day with the majority of its assets in the red, American economist and gold bug Peter Schiff has taken it as a sign that Bitcoin (BTC) is going down the drain, voicing a particularly dire warning for owners of spot BTC exchange-traded funds (ETFs).

Specifically, Schiff has observed the current price action of the flagship decentralized finance (DeFi) asset, asserting “it’s not looking good” and telling ‘HODLers’ to better hope that Bitcoin can hold $60,000 or “it’s a long way down,” according to his X post on April 25.

At the same time, he argued that the drop might not be a major shock for investors who have been in the field for a long time, but that spot Bitcoin ETF owners or “newbies,” as he called them, would face an unpleasant surprise. As he pointed out:

“All the hard-core Bitcoiners are used to big drops. But the newbies who own the ETFs are in for a rude awakening.”

Schiff’s BTC price prediction vs. gold

Earlier, Schiff noted that Bitcoin was likely at the beginning of another pullback with “support at $60,000,” but he didn’t expect it to hold up. On the other hand, he argued that the recent pullback of his favorite asset – gold – was “likely over” and that “$2,300 looks like the new $2,000,” with resistance above $2,400.

As a reminder, the popular economy analyst is a known Bitcoin critic, often voicing negative views of the maiden crypto asset, including that Bitcoin is a “failure,” challenging its status as a safe haven asset, and projecting its “catastrophic crash” due to more BTC entering ETFs.

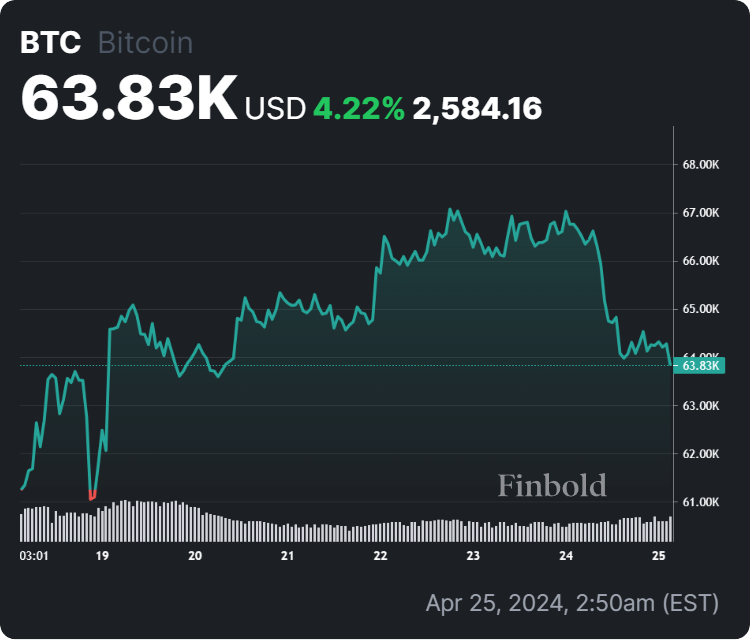

Meanwhile, the largest asset in the crypto market was at press time changing hands at $63,839, suggesting a decline of 3.94% on the day, advancing 4.22% across the week, and losing 9.34% to its price over the past month, according to the most recent chart data.

In conclusion, Schiff might be right about some things, but his critics often highlight that he has been bearish on Bitcoin ever since the crypto asset was trading in four digits, so one should take his analyses with a grain of salt and instead do due diligence and research individually before investing.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.