Amid his multiple warnings against investing in Bitcoin (BTC) and particularly its spot exchange-traded funds (ETFs), American economist and staunch gold advocate Peter Schiff has made another comparison between his favorite precious metal and the maiden cryptocurrency.

As it happens, Schiff shared his view that the flagship decentralized finance (DeFi) asset was “in a stealth bear market when priced in real money,” and that not many people realize this “given all the hype about Bitcoin and lack of coverage of gold,” according to his X post on April 15.

Furthermore, the popular economics analyst highlighted that Bitcoin was “trading below 27 ounces of gold,” and was “down over 27% since hitting its record-high of 37 ounces of gold 2.5 years ago,” despite the largest asset in the crypto sector recently hitting a new all-time high (ATH) priced in US dollars.

Peter Schiff Twitter crusade

As a reminder, Schiff earlier made a doomsday prediction about the future of Bitcoin, pointing out that it was on the brink of a “catastrophic crash” due to a large amount of BTC entering spot Bitcoin ETFs, making the asset more vulnerable, as Finbold reported on March 19.

More recently, he warned the “ignorant” young people buying Bitcoin that their preference for the digital asset over gold could have significant consequences in the future, crediting the crypto’s popularity among this demographic to “ignorance and lack of experience.”

On top of that, he has argued that his favored precious metal was far superior to Bitcoin considering that the latter has not yet managed to hit a new ATH priced in gold, and asserting that this fact diminished the argument that Bitcoin was ‘digital gold.’

More recently, he denounced the original crypto as a “fake asset,” dismissing as “crazy” the belief that “Bitcoin means different things to different people,” praising silver as a much better alternative, and referring to the popular precious metal as “the new Bitcoin” and “Bitcoin 2.0.”

Additionally, he has opined that too many people are confident in the future price increase of Bitcoin and hold onto their long positions in it but may end up disappointed, as he urged his followers on social media to sell all their Bitcoin and go buy some gold and silver via his website before it’s too late.

BTC price prediction

Meanwhile, Bitcoin doesn’t lack supporters in the opposite camp from Schiff, with predictions of its future price following the Bitcoin halving date this week ranging from $80,000 by crypto expert CryptoJelleNL to a whopping $2 million by the ‘Rich Dad Poor Dad’ author Robert Kiyosaki.

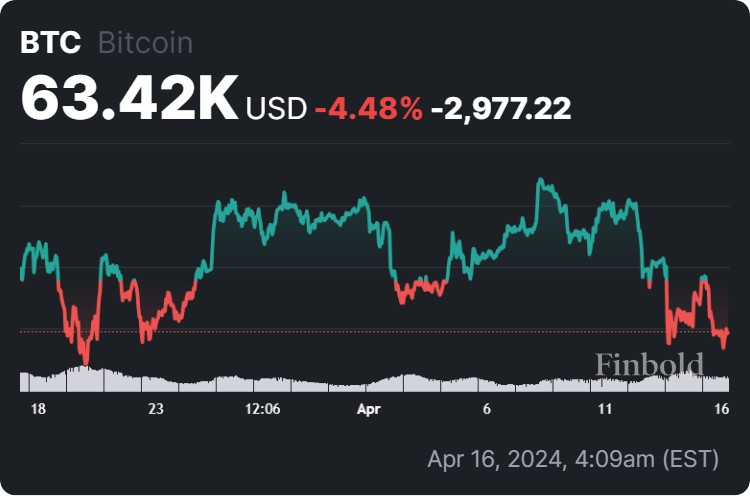

For now, Bitcoin is changing hands at the price of $63,420, down 4.98% on the day, declining 10.15% across the week, and recording an accumulated loss of 4.48% on its monthly chart, according to the most recent information retrieved on April 16.

All things considered, Peter Schiff might be correct in some of his views but, as the commenters to his X posts often like to point out, he has been singing the same tune about Bitcoin for a long time, ever since its price stood at $1,000, and Bitcoin has since increased by more than 6,200%.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.