The first name that comes to mind when people think of technology must be Microsoft (NASDAQ: MSFT), one of the earliest tech names, redesigning itself amid the artificial intelligence revolution.

And who better to show you the ropes than OpenAI, the parent company of the famous ChatGPT, in which Microsoft invested over $13 billion since the early funding rounds, and the results are already starting to show.

To further bolster its AI bet, Microsoft plans to invest $7.16 billion to develop new data centers in the northeastern region of Aragon, Spain, emerging as a significant cloud computing hub in Europe.

Examining the MSFT stock price charts, the nearly 20% gain on a year-to-date basis is a promising sign. The stock price has finally broken through the resistance set at $430 and is continuing to trend upwards, with support levels identified at $388.03.

Despite MSFT stock currently trading near its 52-week high, the broader technology sector experienced more substantial gains in the first half of 2024 than the tech giant, while the S&P 500 had a similar performance.

Wall Street sets MSFT stock 12-month price target

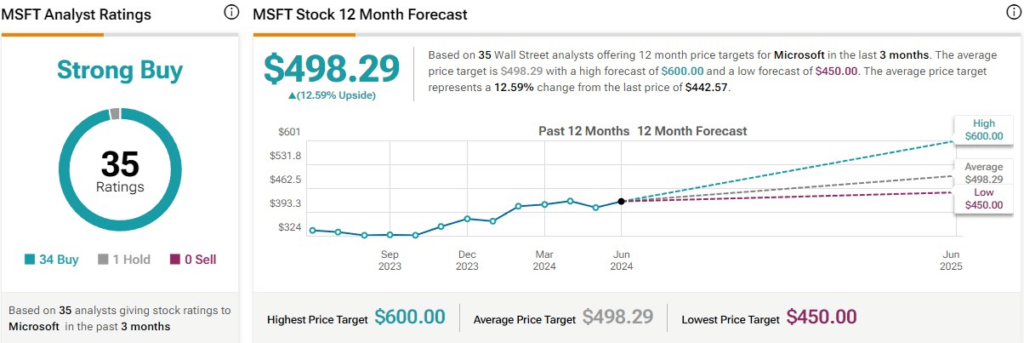

Never in doubt, confidence in MSFT stock is reflected in Wall Street analysts’ opinions, as they assign a ‘strong buy’ rating. Of 35 experts, 34 vested a ‘buy’ recommendation upon MSFT, one advised a ‘hold,’ while none went for ‘sell.’

The average price target is set at $498.29, which represents a 12.59% upside from the current MSFT shares price level.

Investment firms believe MSFT can go even higher

As noted from the newly released ratings, the most recent price targets reflect a higher upside potential than the general consensus.

Jefferies analyst Brent Thill has maintained his “buy” rating on the stock, keeping the target price unchanged at $550. Key takeaways from recent discussions included the ongoing increase in capital expenditure (Capex), the strong performance of Azure, and the promising trajectory of the M365 Copilot initiative, according to Jefferies

Tigress Financial Partners analyst Ivan Feinseth raised the price target on Microsoft stock to $550 while maintaining a “buy” rating, inspired by the growing expansion of data centers and renewed investments in the AI sector.

Microsoft stock received a “buy” rating and a $570 price target from New Street Research. The firm highlighted Microsoft’s strong position and high-quality franchises, predicting profitable growth in the low teens for years to come.

New Street also noted Microsoft’s favorable position in the developing Generative AI revolution, with limited downside risks if AI developments falter.

The firm’s “excellent execution” was praised for enhancing existing franchises with cloud-based features, successfully monetizing them through subscriptions, and leveraging its strong market and ecosystem advantages to democratize cloud services, summarizing the current market sentiment regarding this tech giant.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.