Apple (NASDAQ: AAPL) has seen its stock price oscillate significantly in recent months.

According to technical analysis, from April 10, 2024, Apple received a low rating of 0 out of 10, indicating poor performance compared to the market and negative signals for both short-term and medium-term timeframes.

However, the stock price showed signs of recovery by the end of last week. Though technical analysis remains cautious, with a current rating of 2 out of 10, this increase suggests some improvement from the earlier negativity.

AAPL stock price analysis

While there’s a current upward trend, with a gain of 0.86% today and 4.37% over the past week, it’s important to consider the wider picture.

Notably, AAPL shares surged on Thursday, reaching $175.04, marking their best performance since May 2023. However, this positive momentum is tempered by ongoing concerns about iPhone sales in China and recent car project cancellation.

Despite these challenges and a year-to-date decrease of 4.90%, JPMorgan analyst Samik Chatterjee believes investors are becoming more comfortable with Apple’s current valuation.

“Hedge fund investors are increasingly warming up to the opportunity of the AI upgrade cycle, but the uncertainty still pertains to whether the upgrade cycle starts with iPhone 16 in September 2024 or iPhone 17 in September 2025.”

Samik Chatterjee

This optimism stems from the potential for growth in artificial intelligence (AI), fueled by CEO Tim Cook’s promise of an AI announcement at the upcoming developer conference and anticipated strong iPhone sales with AI features in 2026.

Wall Street weighs in on AAPL stock

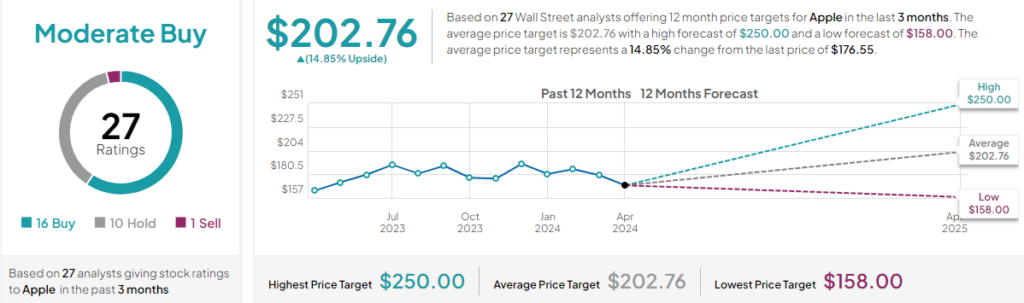

Insights from Wall Street analysts who have provided 12-month price targets for Apple over the last 3 months reveal varying perspectives. Out of 27 experts, 16 recommend buying the stock, 10 suggest holding it, and 1 advises selling.

Their price targets range from a high of $250 to a low of $158, with an average of $202.76, offering a collective outlook on Apple’s expected performance in the coming year, according to TipRanks data from April 15.

As mentioned previously, JPMorgan forecasts that Apple will integrate AI technology into the iPhone 17 Pro by 2025. Consequently, the firm has adjusted its price target to $210, on April 11, citing this development as a contributing factor.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.