Meta Platforms (NASDAQ: META) impressive stock performance follows an almost 200% surge last year, driven by CEO Mark Zuckerberg’s implementation of cost-cutting measures. Describing 2023 as a “year of efficiency,” Zuckerberg aimed to address the stock’s decline to a six-year low in 2022.

And the effects are still being felt as this company’s valuation has surpassed the $1 trillion threshold, a feat it hasn’t achieved since September 2021.

Investors are waiting to see the performance in numbers, as Meta is set to unveil its Q4 report on February 1.

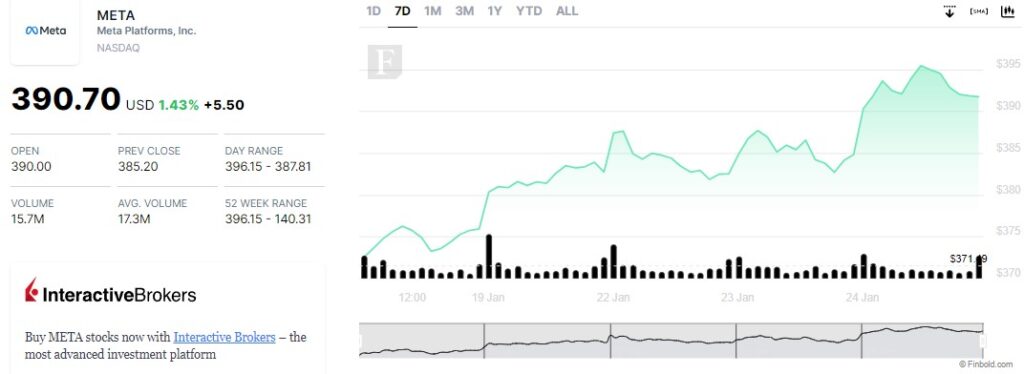

META stock was trading at $390.70 at the final bell on January 24, marking an increase of 1.43% since the previous closure and a 5.15% gain in the last five trading sessions.

2024 marked by AI

With the AI wave showing no signs of slowing down, Meta looks to capitalize on it and enter the market as soon as possible, powering its capacity and bringing innovation.

Although Mark Zuckerberg lacks a specific timeline for achieving Artificial General Intelligence (AGI) or a precise definition, he is determined to develop it. Simultaneously, he is restructuring Meta by relocating the AI research group, FAIR, to the same division as the team responsible for constructing generative AI products across Meta’s apps. The objective is to ensure that Meta’s AI advancements impact its billions of users more directly.

In the previous week, Zuckerberg announced that by the end of the year, Meta will acquire 350,000 H100 graphics cards from Nvidia and “almost 600k H100 equivalents of compute if you include other GPUs.” This suggests that the company is making substantial investments in its AI initiatives, amounting to billions of dollars.

Wall Street target for META stock

The turn towards innovation and strong performance are already giving results, as the analysts from TipRanks awarded this stock with a ‘strong buy’ stock rating. The price target is $409.03, indicating a 4.69% upside from the current price.

Of 34 analysts, 32 advised ‘buy,’ 2 to ‘hold,’ and none ‘sell.’

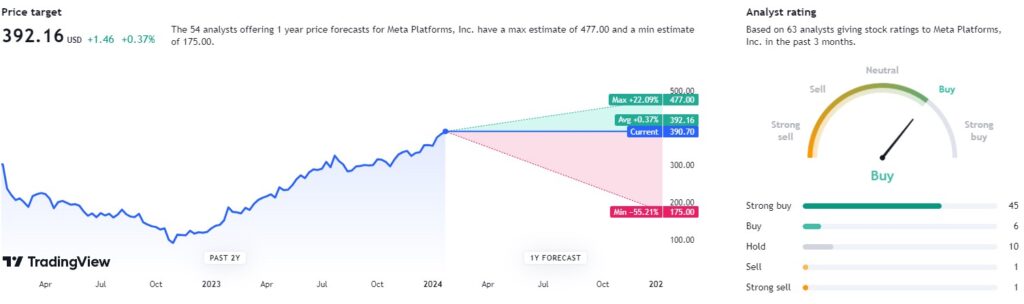

Analysts from TradingView are slightly less optimistic, with a ‘buy’ rating based on 63 ratings. Of these, 45 recommended a ‘strong buy,’ 6 ‘buy,’ 10 ‘hold,’ and only one each ranked this stock at ‘sell’ and ‘strong sell.’

The price target is $392.16, with a slight upside of 0.37% from the current level.

With its current involvement in AI and plans on expansion, it is hard to see this stock underperforming. Zuckerberg leads the charge and seems to do it quite well.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.