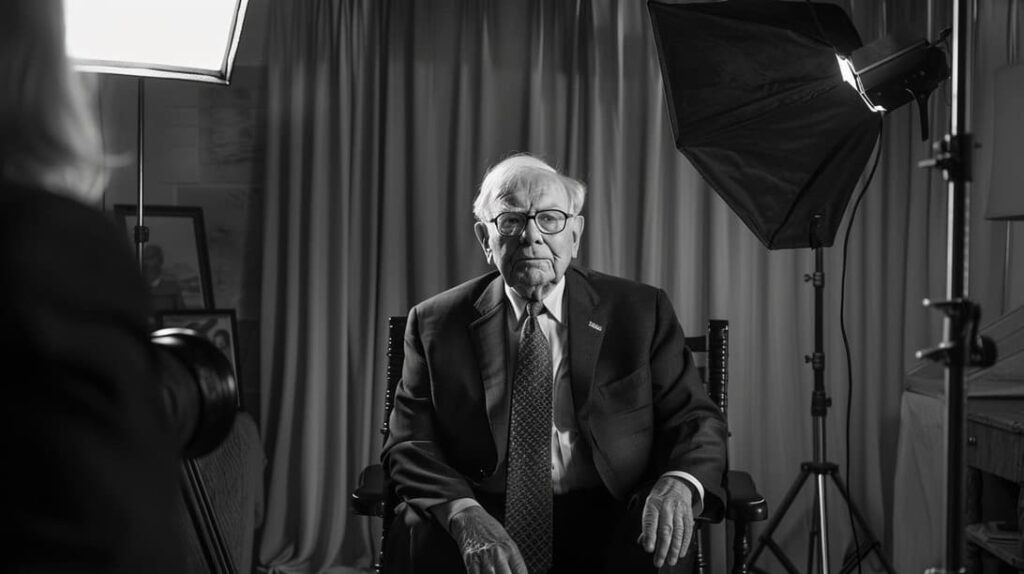

Warren Buffett, often referred to as the ‘sage of Omaha’ and the chairman of Berkshire Hathaway (NYSE: BRK.A), is widely recognized as one of the most astute investors. In his annual letter to shareholders, he offered a cautionary note about the stock market that every investor can benefit from.

Buffett’s annual letter to Berkshire Hathaway investors highlighted the growing volatility in the stock market, largely driven by retail investors and the craze surrounding meme stocks. He likened the current market environment to a casino, where investors engage in rapid trading, hoping for big wins.

“Berkshire’s ability to immediately respond to market seizures with both huge sums and certainty of performance may offer us an occasional large-scale opportunity. For whatever reasons market now exhibit far more casino-like behavior than they did when I was young. The casino now resides in many homes and daily tempts the occupants.” said Buffett in his letter to shareholders.

Picks for you

Sage of Omaha pointed out that the proliferation of stock trading apps has fueled this casino-like atmosphere, enabling investors to make impulsive decisions based on market swings. He underscored the temptation faced by individuals who can now easily trade from the convenience of their homes.

Don’t listen to pundits and ‘experts’

Berkshire Hathaway epitomizes Buffett’s disciplined investment approach, disregarding the chatter from market pundits and speculative investment fads.

Buffett’s message underscores the importance of maintaining a calm and steady approach to investing, rather than being swayed by market speculation and short-term trends.

He highlights the enduring strength of the American economy and the opportunities it presents to patient and discerning investors. By exercising patience and tuning out external noise, investors can potentially achieve long-term success in the market.

Understanding your investments is key to success

In his letter to Berkshire Hathaway investors, Warren Buffett praised the enduring success of American Express (NYSE: AXP) and Coca-Cola (NYSE: KO), emphasizing their longstanding positions in the company’s portfolio. Despite market changes, Berkshire Hathaway remains committed to these iconic brands, reflecting a dedication to long-term strategies.

Buffett’s decision to hold onto American Express and Coca-Cola shares throughout 2023 shows his confidence in their strength, resilience, and dividends. His patience was rewarded with a Coca-Cola dividend increase earlier this month.

This strategy possibly explains why Buffett has mainly steered clear from AI and technology stocks, such as Nvidia (NASDAQ: NVDA) despite their astronomic surge.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.