Finbold asked Claude 3 Opus‘s artificial intelligence (AI) model to build a $100 crypto portfolio with a high risk-reward ratio. So, Anthropic‘s most advanced LLM paid service suggested capital allocation in three cryptocurrencies, and justified its picks.

Cryptocurrency investors have been using AI tools to assist with research and building investment strategies since ChatGPT‘s popularization. As technology evolves, new tools offer different experiences and competitive advantages, despite still being failable and having limited data access.

For this experiment, Finbold asked for a condensed crypto portfolio considering a low budget of $100 for investment. Additionally, we asked Claude Opus AI to avoid common knowledge and seek the highest risk-reward ratio for a 100-dollar strategy.

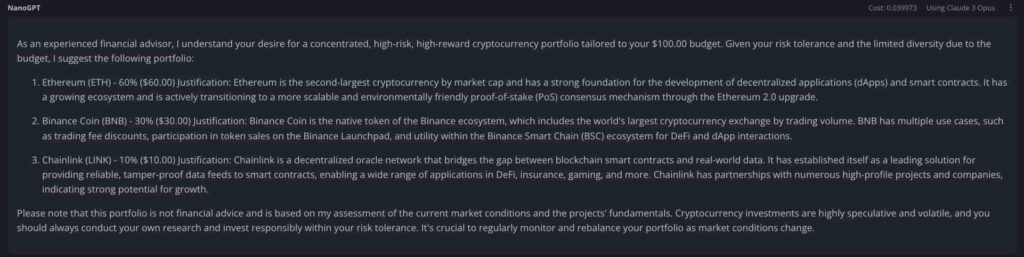

As a result, Claude suggested a $60 purchase of Ethereum (ETH), followed by $30 of BNB Chain (BNB) and $10 of Chainlink (LINK).

Claude Opus AI justification of its $100 crypto portfolio

Notably, Claude Opus did not include Bitcoin (BTC), which AIs previously mentioned as the dominating allocation for an ideal crypto portfolio. Therefore, Claude starts with a 60% allocation to Ethereum, focusing on what traders call altcoins.

However, Anthropic’s flagship product holds outdated data from the second-largest cryptocurrency, as noted in its justification. On that note, the AI mentions a transition to a proof-of-stake mechanism, which happened in September 2022.

“Ethereum is the second-largest cryptocurrency by market cap and has a strong foundation for the development of decentralized applications (dApps) and smart contracts. It has a growing ecosystem and is actively transitioning to a more scalable and environmentally friendly proof-of-stake (PoS) consensus mechanism through the Ethereum 2.0 upgrade.”

Moving forward, its second allocation went to BNB mostly due to its relation to Binance, the world’s largest cryptocurrency exchange. Claude Opus AI also mentioned the value of the DeFi ecosystem.

Finally, LINK is the smallest share to compose this $100 crypto portfolio due to its Oracle solution, bridging cryptocurrencies to real-world data, and strong partnerships with institutions.

All things considered, investors should not take Claude Opus AI’s result as a conclusive strategy for a 100-dollar crypto investment. The tool is prone to mistakes and is limited to the data it was trained on. Yet, using these insights to complement thoughtful research may help investors starting with cryptocurrencies.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.