In the past year, commodities investors and traders have increasingly relied on artificial intelligence (AI) tools such as Google Bard for gold price analysis, seeking objective insights into different commodities to enhance their trading decisions.

Considering the current geopolitical tensions, rising insecurity regarding the projected inflation rates, and fear of recession, it is no wonder that gold is gaining popularity, acting as a haven for investors.

During the first half of the February 6 European session, the gold price (XAU/USD) struggled near a one-week low of around $2,015, which it had reached the previous day. Expectations of the Federal Reserve (FED) maintaining higher interest rates for an extended period limit a modest profit-taking slide in the US Dollar (USD), exerting downward pressure.

In light of these trends, we sought Bard’s opinion on the performance projection of the most popular commodity for the end of 2024. We also sought insights into potential scenarios and factors influencing its price.

Potential price scenarios

When asked about the potential price, Bard cannot offer a precise price but instead offers potential price ranges with their likelihood. Therefore, it has predicted that the most likely range will be between $1,900 and $2,100 per ounce.

The moderate range scenario anticipates a slight uptick in inflation or moderate geopolitical tensions, which could elevate the demand for safe-haven assets like gold. Moreover, if interest rates rise slower than expected, it could enhance gold’s appeal, propelling it toward a range between $2,000 and $2,200.

A bullish scenario envisions vital drivers that could propel gold prices upward. High inflation exceeding central bank targets, a significant economic recession accompanied by inflationary pressures, and escalating geopolitical tensions are anticipated factors. These circumstances could lead investors to view gold as a hedge against economic uncertainty, increasing its demand and price from $2,200 to $2,500 per ounce.

Key factors that are driving gold price, according to Bard

As mentioned before, there is a list of factors that may affect the price of gold. However, some wield greater power than others.

Fluctuations in interest rates play a significant role in influencing gold’s attractiveness to investors. As interest rates rise, it becomes less appealing compared to interest-bearing investments.

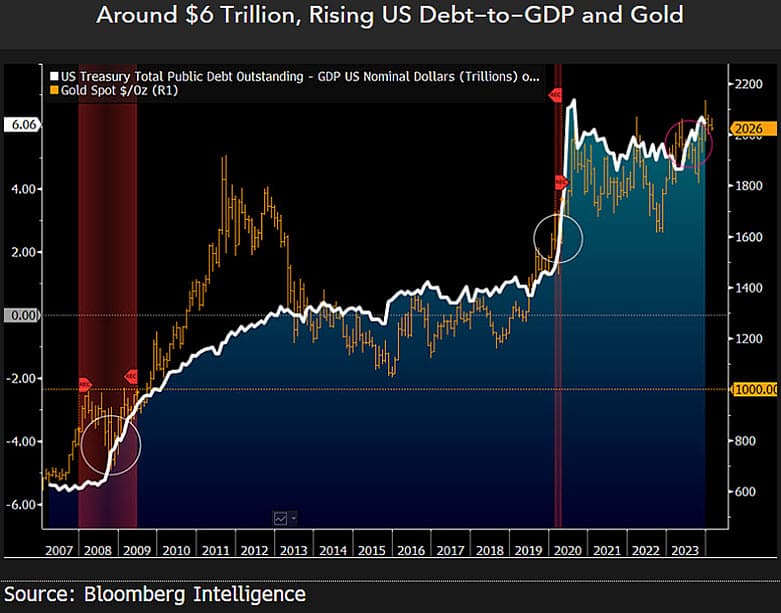

The current trajectory of gold approaching $2,000 per ounce mirrored its position in 2008 when it was at $1,000 per ounce, particularly concerning U.S. debt and China’s economic status.

Compared to the onset of the Global Financial Crisis, gold’s valuation seems relatively subdued relative to factors like the U.S. debt-to-GDP ratio, the S&P 500 Index performance, and the yields of Chinese government bonds versus US Treasuries. During 2008, gold showed more robust performance against U.S. stocks, lower U.S. debt-to-GDP levels, and an ascending China, per commodity strategist Mike McGlone’s post on X from February 6.

However, if interest rates escalate to levels that trigger economic concerns, investors often turn to gold as a haven asset. Moreover, gold historically serves as a hedge against inflation, increasing its value as inflation rises. Geopolitical tensions also notably impact gold prices, as heightened uncertainty prompts greater demand for safe-haven assets like gold.

Additionally, the strength of the U.S. dollar is a crucial factor affecting gold prices, as a strong US dollar generally exerts downward pressure on gold prices since gold is priced in dollars.

With many factors in play, it is impossible to give an exact price prediction for commodities, especially considering their vulnerability to outside-world events. However, potential scenarios might make it easier for investors to analyze their options and gain better insight before trades.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.