Since early 2023, companies powered by Palantir (NYSE: PLTR) have performed 50% better than their industry averages, and the heavy commercial adoption of its technology has benefitted Palantir investors, particularly after the introduction of its artificial intelligence platform (AIP).

Indeed, commercial partnerships with Palantir have increased over 70% year-over-year (YoY), and the success of its partners continues to boost the odds of the competition also implementing Palantir’s technology stack, as tech and data product builder known as Sella observed on August 25.

With this in mind, Sella has analyzed some of Palantir’s largest and most important customers, including companies from aerospace and aviation, automotive, energy and renewables, financial services and banking, insurance, manufacturing and industrials, and the railway branch, to build his own Palantir ETF list, as well as monitor the relevant stocks’ performance.

Picks for you

#1 Airbus stock

Specifically, the most notable company in the aerospace and aviation sector singled out is Airbus (OTCMKTS: EADSY), which earlier this year Sella said was an ‘obvious pick’ for his exchange-traded fund (ETF), alongside United Airlines (NASDAQ: UAL), according to his X post from April 1.

At press time, the price of EADSY stock stood at $39.39, recording a 2.58% gain on the day, advancing 3.58% across the week, growing 11.08% in the past month, and accumulating an increase of 2.36% this year, according to the most recent chart data.

#2 Ferrari stock

Meanwhile, the analyst singled out Ferrari (BIT: RACE), an automotive pick alongside Stellantis (NYSE: STLA), as the best performer from his ETF list, pointing out that it has advanced 121% since the beginning of 2023, although he acknowledged that he was not very familiar with the company.

For now, the price of Ferrari stock amounts to €433.20 ($483.17), which indicates an increase of 0.49% on the daily chart, adding up to the weekly gain of 2.53% as well as the monthly growth of 13.82, while its year-to-date (YTD) chart is looking at a 40.86% advance.

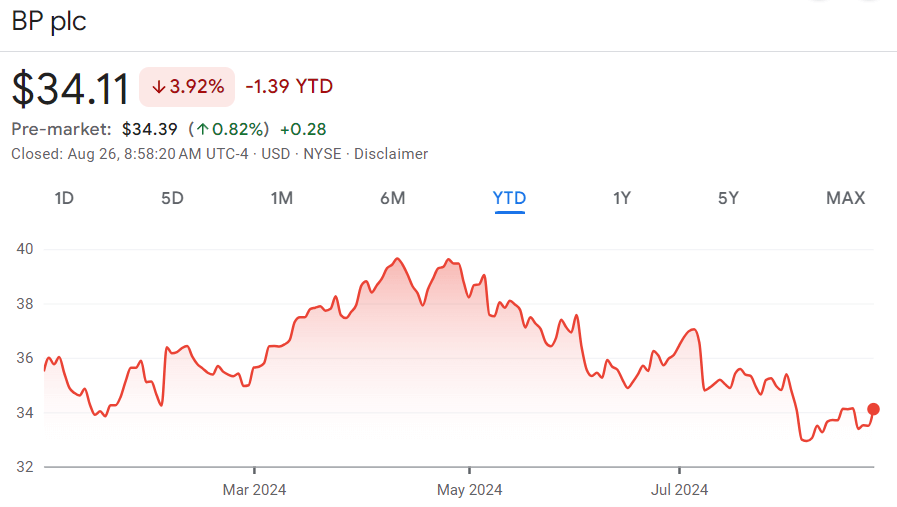

#3 BP stock

Meanwhile, Sella has argued that his pick for the energy & renewables sector, BP (NYSE: BP) alongside PG&E (NYSE: PCG), has dropped by 6% since January 1, 2023, “mostly down on macro,” but The Motley Fool analyst Edward Sheldon believes that some investors may consider buying them:

“For me, there’s a little too much uncertainty. But if I was a value or income investor (I’m more of a quality growth investor), I may consider buying them. With interest rates set to come down, a 5.1% dividend yield’s attractive.”

At press time, BP stock was changing hands at the price of $34.11, with no change on the day, down 0.52% across the week, in addition to declining 3.23% on its monthly chart, while this year BP shares have dropped 3.92%, as per the latest data on August 26.

Conclusion

In conclusion, investing in the above stocks might be one of the ways to boost Palantir’s growth, although the analyst stressed that he was not recommending them, just stating the “proof that Palantir is delivering a competitive edge is growing, and this is what I want to see as an investor.”

That said, investing in any asset in the stock market inherently comes with a risk, so doing one’s own research and keeping an eye out for any related news and developments is critical when spending a lot of money and devoting a significant part of one’s portfolio to any asset.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.