The Indian Rupee (INR) closed Friday, March 22, at an all-time low against the U.S. Dollar (USD). Investors and forex traders look for an explanation of what is going on with India’s local currency.

Notably, the Indian Rupee comes from one of its worst weeks in history, against the Dollar. INR opened Monday, March 18, at $0.01206, according to The Intercontinental Exchange (ICE) data plotted by TradingView.

From this point, it was a free-fall for India’s local currency, making new lows at every following daily closure. Finally, closing at an all-time low daily exchange rate of $0.01196 per INR, below historical resistance.

Interestingly, the Indian Rupee had traded at lower levels intraday, reaching $0.1195 on March 22. Previously, the INR saw an even lower price on September 20, 2023, at $0.01194, after opening at $0.01197. However, it closed the day above $0.012, which makes the current daily closure, India’s historically worst.

What is the current situation of the Indian currency?

This current fall happened amid an overall weakening of India’s Asian peers, like the Chinese Yuan (CNY) against the Dollar. Young Chinese investors have recently pivoted to accumulate gold beans, in a way to get exposure to gold amid finance uncertainties.

Yet, an unidentified foreign exchange trader at a private bank told Reuters the most significant dip occurred due to:

“Strong dollar bids close to the end of the session, (…) alongside the ‘surprising absence’ of the Reserve Bank of India’s intervention (RBI).”

— Reuters

Therefore, the Indian Rupee’s fall to record lows against the USD was mostly due to trading pressures and a lack of interference from India’s central bank. Interestingly, the International Monetary Fund (IMF) suggested in late 2023 that the RBI was excessively interfering in maintaining the INR exchange rate at higher levels, as reported by the Deccan Herald.

Indian Rupee historical supply inflation

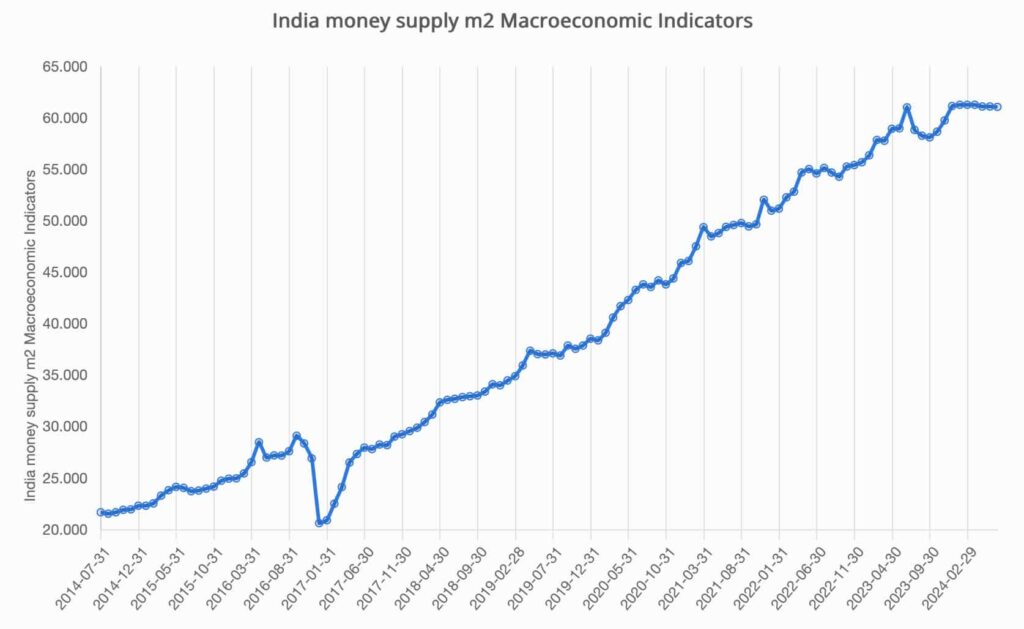

In particular, the need for central interference is partially explained by India’s historical supply inflation. According to data from Macrovar, the Indian Rupee money supply (m2) has increased by nearly three times in the past ten years.

On that note, there were 21 trillion INR in circulation in 2014, now registering over 61 trillion INR.

A loosened interference could now allow the forex market to freely set the pace for an economically weaker Indian Rupee. From a technical perspective, however, the INR has reached oversold levels in its daily Relative Strength Index (RSI), suggesting a possible correction upward before any further action.

Nevertheless, years of intervention from the Reserve Bank of India could have created imbalances that are now finally charging their price in dollars. If this trend continues, the INR could be on the edge of a crash due to the country’s past financial decisions and a massive issuance of money in the past decade.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.