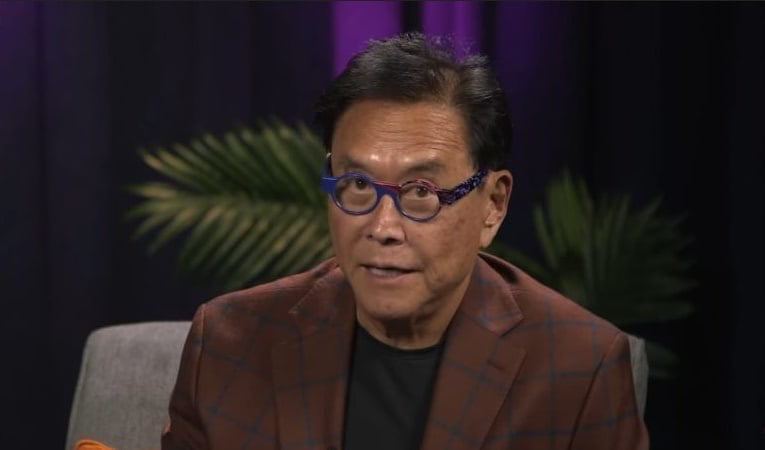

Renowned personal finance author Robert Kiyosaki, famous for his book “Rich Dad Poor Dad,” is well-known for sharing insights on the global economy.

At the heart of Kiyosaki’s perspective is a warning about a potential economic crash and advice on how investors can protect themselves. Finbold has, therefore, highlighted the following three key insights shared by Kiyosaki on the current market.

#1 Inflation is systemic

Firstly, Kiyosaki has cautioned about the inflation status in the United States, calling it “systemic” and not the temporary situation that the Federal Reserve has claimed.

In this case, Kiyosaki has urged citizens to brace themselves for continuously increasing prices in the coming years. Kiyosaki had also criticized the Fed Chair, Jerome Powell, stating that he had lied when he reassured the public about the temporary nature of inflation.

“Inflation is now systemic. You will pay more and more next year than we are after. When that guy Powell, who is the Fed chairman today, says inflation is transitory, he was lying through his teeth,” he said.

#2 Interest rate and dollar crash

The financial educator also cites rising inflation as a possible trigger for an economic crash, blaming the Fed for worsening the situation through constant interest rate hikes and the increased printing of money as a catalyst.

He criticized the Fed’s decision to raise interest rates, warning that it would result in the downfall of stocks, bonds, real estate, and the U.S. dollar. He predicts that the next financial crash will also stem from the derivatives market and alleges that U.S. financial sector leaders may not be acting in the best interests of Americans.

In this regard, Kiyosaki maintains that the dollar is destined to collapse to zero while referring to the currency as ‘fake money.’

#3 The Fed is a ‘Marxist’ organization that needs auditing

Following the Fed’s monetary policy, Kiyosaki has previously termed the institution as a Marxist entity that needs an alternative to challenge it. The author has therefore advocated for the importance of Bitcoin as an “auditor” needed to audit the Fed.

He believes that the blockchain technology underlying Bitcoin can provide the necessary transparency and accountability to fight back against central banks. The investor has suggested that Bitcoin’s ‘‘revolution will be bigger than the gunpowder revolution.”

Kiyosaki also sees the younger generation as being particularly drawn to blockchain technology because of the need for an auditor in the financial system.

In general, Kiyosaki maintains that investors should expect an imminent economic crash while calling for investment in safe assets for protection. Therefore, Kiyosaki is advocating for investment in Bitcoin, gold, and silver.