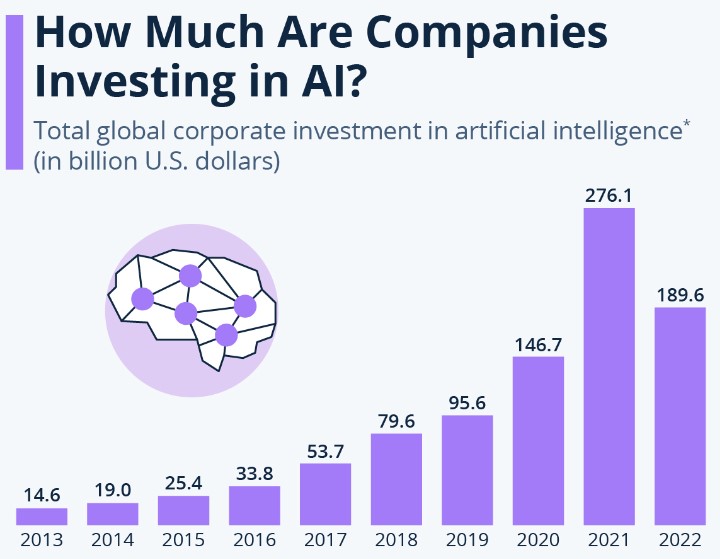

Throughout history, innovation has been pivotal in driving human progress, with different industries taking the lead. Currently, artificial intelligence (AI) stands out as a driving force in the industry.

Inspired by this trend, numerous startups have emerged, offering ingenious solutions to everyday challenges and building upon existing progress. This allows investors to enter these companies early, maximizing potential future profits.

Considering this, Finbold has curated a list of top startup stocks for investment, evaluating their prospects, growth potential, and broader implementation.

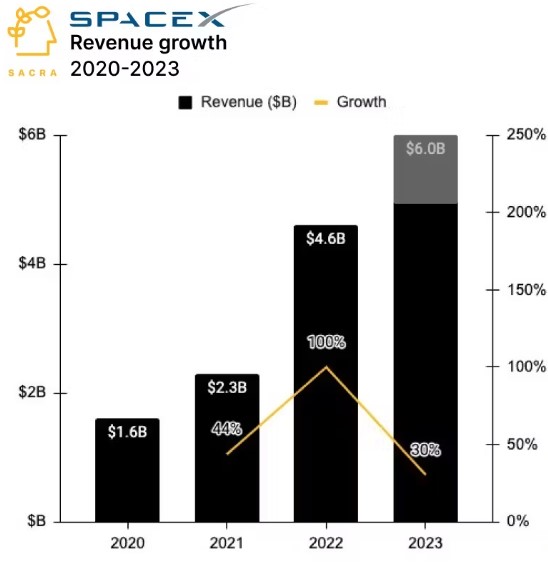

SpaceX

Elon Musk, the visionary entrepreneur, established Space Exploration Technologies Corp, commonly known as SpaceX, in 2002 to lower space transportation expenses, thus paving the way for humanity’s hopeful colonization of Mars.

Although Musk’s ambitious goal has yet to materialize, SpaceX has emerged as one of the world’s most valuable startups, boasting a valuation exceeding $180 billion as of early 2024. With its trajectory, SpaceX’s potential appears limitless.

SpaceX is not publicly traded on major stock exchanges such as the New York Stock Exchange (NYSE) or Nasdaq Stock Exchange. Consequently, retail investors cannot purchase shares of the space exploration company through their brokerage accounts.

As of late 2023, SpaceX had not scheduled an initial public offering (IPO), nor did it intend to go public.

Meanwhile, the company operates an internal trading program enabling employees and current investors to sell shares. In late 2023, SpaceX was in discussions with investors regarding an agreement permitting insiders to sell their shares at $97.

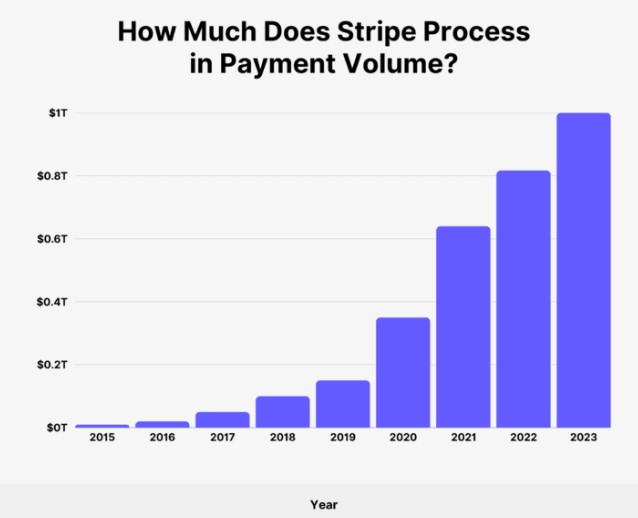

Stripe

Stripe stands out as a prominent entity within the startup landscape. Founded in 2010 by brothers Patrick and John Collison, the company specializes in internet payment processing. Its rapid ascension garnered significant attention from notable figures such as Elon Musk and Peter Thiel, both early co-founders of the precursor companies to the payments processor PayPal (NASDAQ: PYPL).

Stripe has emerged as a primary choice for merchants, particularly those engaged in online commerce, as a payment processing solution. Its advanced technology enables merchants to accept various forms of payment, including credit and debit cards, transactions from mobile wallets, and utilize buy now, pay later services.

As of February 2024, Stripe had not scheduled an IPO, though the company’s co-founders purportedly informed employees that a decision regarding going public would be made within this year.

Considering options include directly listing or enabling employees to sell shares on a secondary market. Stripe enlisted the guidance of investment banks Goldman Sachs and JPMorgan Chase to navigate this decision.

OpenAI

Few companies have made as significant an impact as OpenAI. Their ChatGPT chatbot has achieved viral status, captivating users worldwide. By late 2023, it had garnered a user base exceeding 180 million.

OpenAI has secured a cumulative funding of $11.3 billion across 8 funding rounds. Their most recent funding, obtained through a Secondary Market round, was finalized on December 14, 2023.

In June 2023, OpenAI CEO and co-founder Sam Altman announced that the company had no intentions of pursuing an IPO. This stance is expected to persist as long as he remains at the organization’s helm. Although Altman was briefly dismissed from his position in late 2023, he swiftly returned to OpenAI amid significant backlash.

Alternative ways to invest in startups

As these stocks are not publicly offered, investors might be looking for alternative ways to obtain shares of these companies. Fortunately, there are several alternatives.

One of the most common approaches is to purchase shares directly from existing shareholders, bypassing traditional market channels. This approach offers unique opportunities, allowing investors to access exclusive deals and negotiate favorable terms.

Traders can also indirectly invest by buying shares of public companies with investments in the startups, offering exposure to the industry’s growth potential.

Investing in a diversified fund exposed to related startups, such as aerospace, digital payments, and AI. These funds pool together investments from multiple investors and allocate them across various assets, including stocks, bonds, and other securities.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.