In the dynamic world of cryptocurrency investments, leveraging advanced technologies like artificial intelligence (AI) can significantly enhance decision-making capabilities.

Recognizing the potential of AI in crafting strategic investment plans, Finbold sought the expertise of three leading AI models—OpenAI’s ChatGPT-4 Turbo, Anthropic’s Claude 3 Opus, and xAI’s Grok—to devise the optimal crypto portfolio for a $10,000 initial investment aimed at maximizing risk-reward outcomes for May 2024.

Despite each AI’s unique approach, there were notable similarities in their recommendations, particularly with the inclusion and significant allocation to foundational cryptocurrencies like Bitcoin (BTC), Ethereum (ETH). Both are considered essential holdings that provide a stable foundation and high growth potential, respectively.

Their consistent selection across different AI models reflects a general consensus on their importance and enduring value.

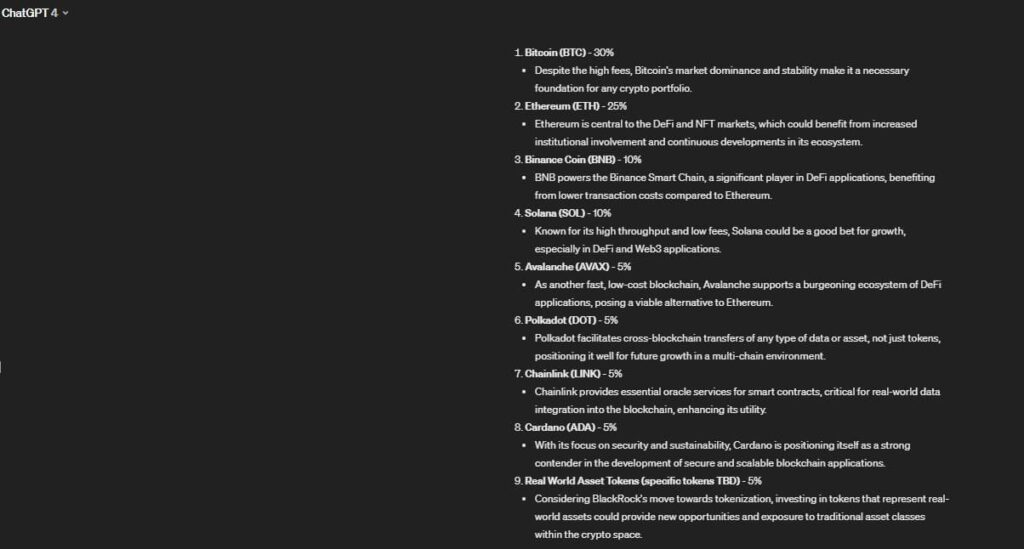

ChatGPT-4 ideal $10,000 crypto portfolio

ChatGPT-4 Turbo advocated for a diversified approach. The portfolio suggested including 30% Bitcoin and 25% Ethereum, highlighting their fundamental roles in any crypto strategy.

It also recommended smaller, yet strategic investments in other high-potential cryptocurrencies such as Binance Coin (BNB) and Solana (SOL) at 10% each, with 5% allocations in Avalanche (AVAX), Polkadot (DOT), Chainlink (LINK), Cardano (ADA), and Real-World Asset Tokens (RWA). This diverse mix aims to leverage both stability and growth across various segments of the cryptocurrency market.

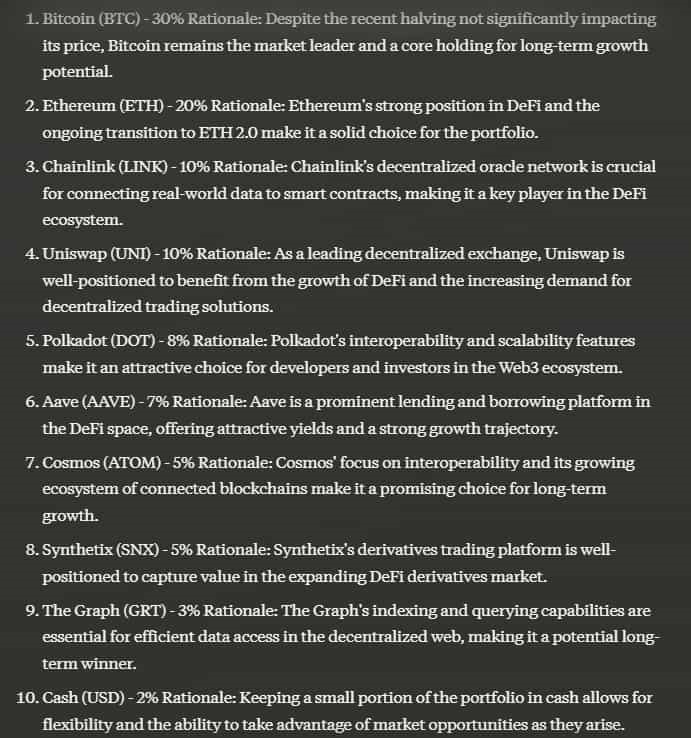

Claude 3 Opus’s best crypto portfolio

Claude 3 Opus’s portfolio strategy was slightly more concentrated but also included a broad range of cryptocurrencies, placing a strong emphasis on Bitcoin and Ethereum with allocations of 30% and 20%, respectively.

It uniquely incorporated tokens like Uniswap (UNI) and The Graph (GRT), dedicating 10% and 3% of the portfolio to these assets, highlighting their potential in decentralized finance and data indexing. Other selections included Chainlink and Polkadot at 10% and 8%, alongside allocations to AAVE, Cosmos (ATOM), and Synthetix (SNX), aiming to capture growth from various DeFi and cross-chain interaction developments.

Grok AI’s best crypto portfolio

Grok’s model placed a similar emphasis on Bitcoin and Ethereum with 30% and 25% allocations, underscoring their importance.

Additionally, it uniquely recommended a 10% allocation each to Dogecoin and BNB, alongside Cardano, tapping into both mainstream and cult-favorite assets.

The portfolio also included smaller stakes in meme-driven SHIB and high-performance Solana at 5% each, with minor allocations to LINK and DOT at 2.5%. This portfolio reflects a blend of traditional strengths with speculative plays that could yield high returns.

All three AI models reinforced the importance of Bitcoin and Ethereum as foundational elements of a robust cryptocurrency portfolio, attributing significant percentages to these two giants. The recurrent inclusion of Chainlink and Polkadot across two of the portfolios suggests a shared optimism in their capabilities to enhance blockchain functionality and interoperability.

Nevertheless, investors should not consider these recommendations as a final decision for building a crypto portfolio. The ideal investment allocation will depend on particular goals, risk tolerance, and knowledge moving forward.

Moreover, these AIs are prone to mistakes and could have based their decisions on outdated information, as disclosed by ChatGPT.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.